The Bank of Japan has its massive QE program well underway after announcing it almost 4 weeks ago. The central bank has committed to massively supporting its economy and markets to the decline of the JPY. With little reprieve in sight, many expect the short JPY trade to work for weeks to come.

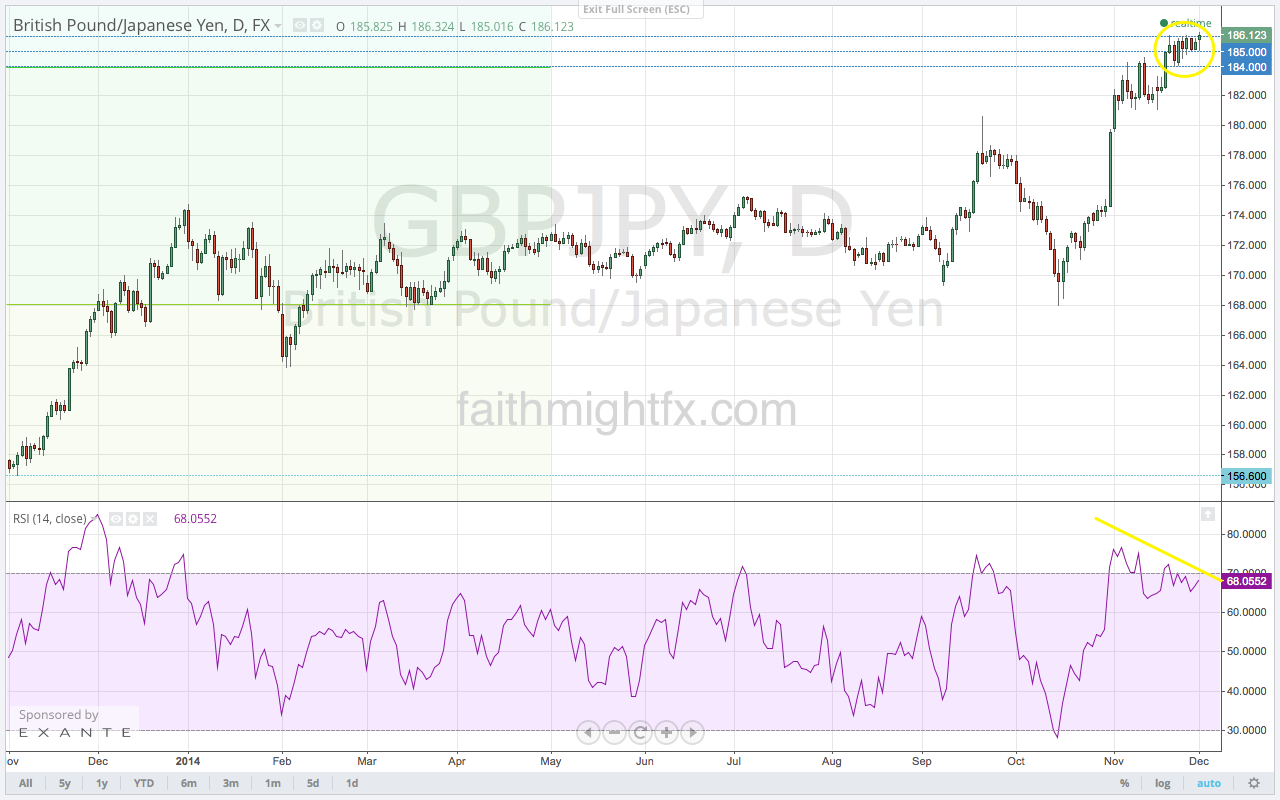

While it looks like the beginnings of a breakout as price break the top of the range at 186, the RSI is telling quite another story. This bearish divergence in the RSI relative to price gives the bull in me pause. Perhaps there is another correction lower still left in the GBP/JPY. The timing for such a correction couldn’t be better with an expected dovish outcome from the BoE this week.

Given the highs and the bearish diverging RSI readings, no new buys should be initiated at these price levels. While it is a tempting short at these resistance levels, we will not trade against the Bank of Japan regardless of the charts. Instead, the higher probability play is to set up to go long on a pullback. A close above 186.00, however, is also a signal to initiate long positions if we don’t get a move into support from here.