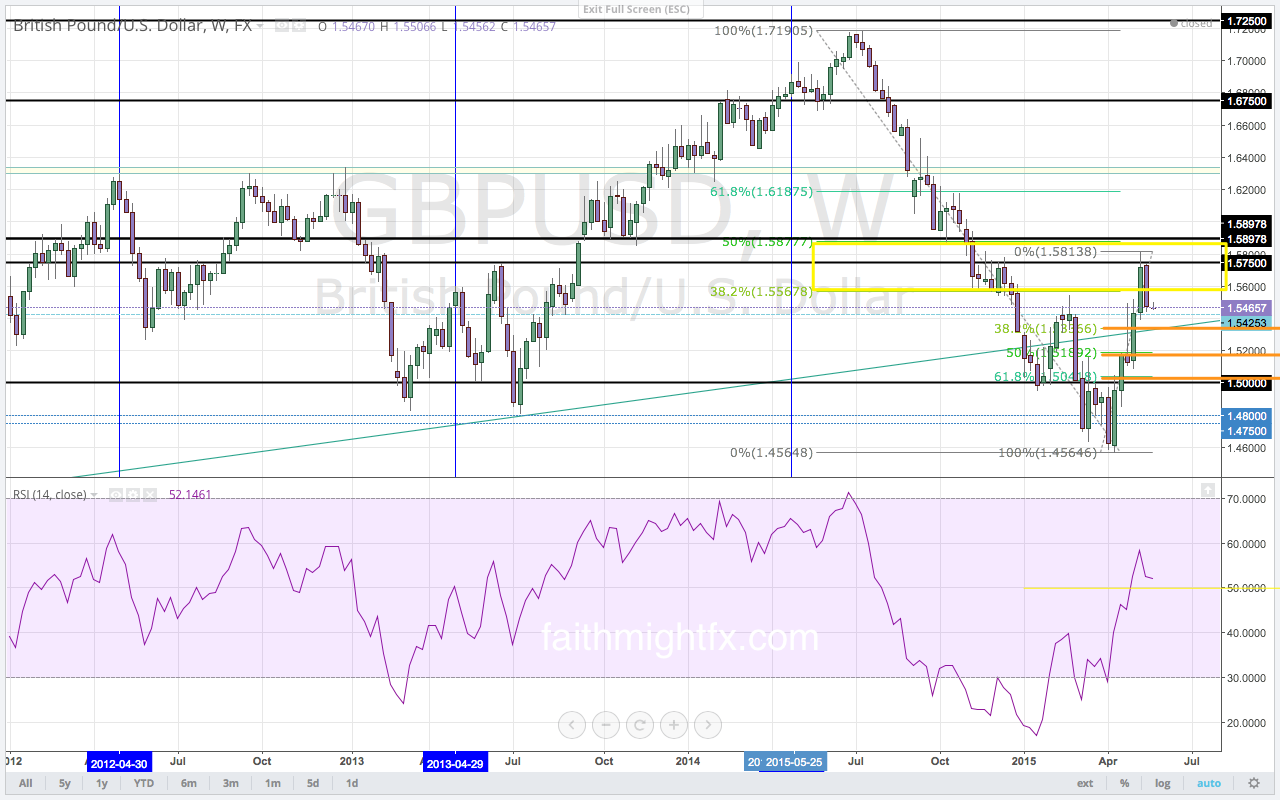

Each week, I highlight a chart out of the Quid Report.

While the timing still may be unknown, the Federal Reserve remains on track to raise interest rates this year. This makes the $FED the most hawkish central bank in the world. Despite the recent bout of weakness, the USD should rise due to the contrast in monetary policy between the Federal Reserve and the rest of the world. The reason that USD weakness may persist is that the U.S. economy is not strong enough to justify aggressive monetary tightening. While the $FED may be considering a schedule of interest rate hikes, it cannot commit to it with the U.S. economy still so fragile. So even if the $FED surprises markets with an interest rate hike in June, it is unlikely it will spark a change in trend. While there will be a knee jerk reaction when the $FED raises interest rates, the USD could continue to weaken if markets price in a delay in subsequent interest rate hikes for as long as the U.S. economy remains soft.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time calls and adjustments to the weekly report. AVAILABLE NOW.