The resumption in oil weakness has kept the $GBPCAD supported on the back of CAD weakness. Weakness in oil markets may also resume the dovish sentiment out of the Bank of Canada (BoC). While the BoC welcomed the weaker CAD that resulted from the slide in oil prices, the return of weak oil could also mark the return of the doves to the BoC. Recently, however, oil markets have stopped crashing and started consolidating. This stabilization may mean another push lower in oil is eventually coming. As long as the crude oil futures market are unable to rally further beyond the $60 level, the $GBPCAD will find traction to move higher.

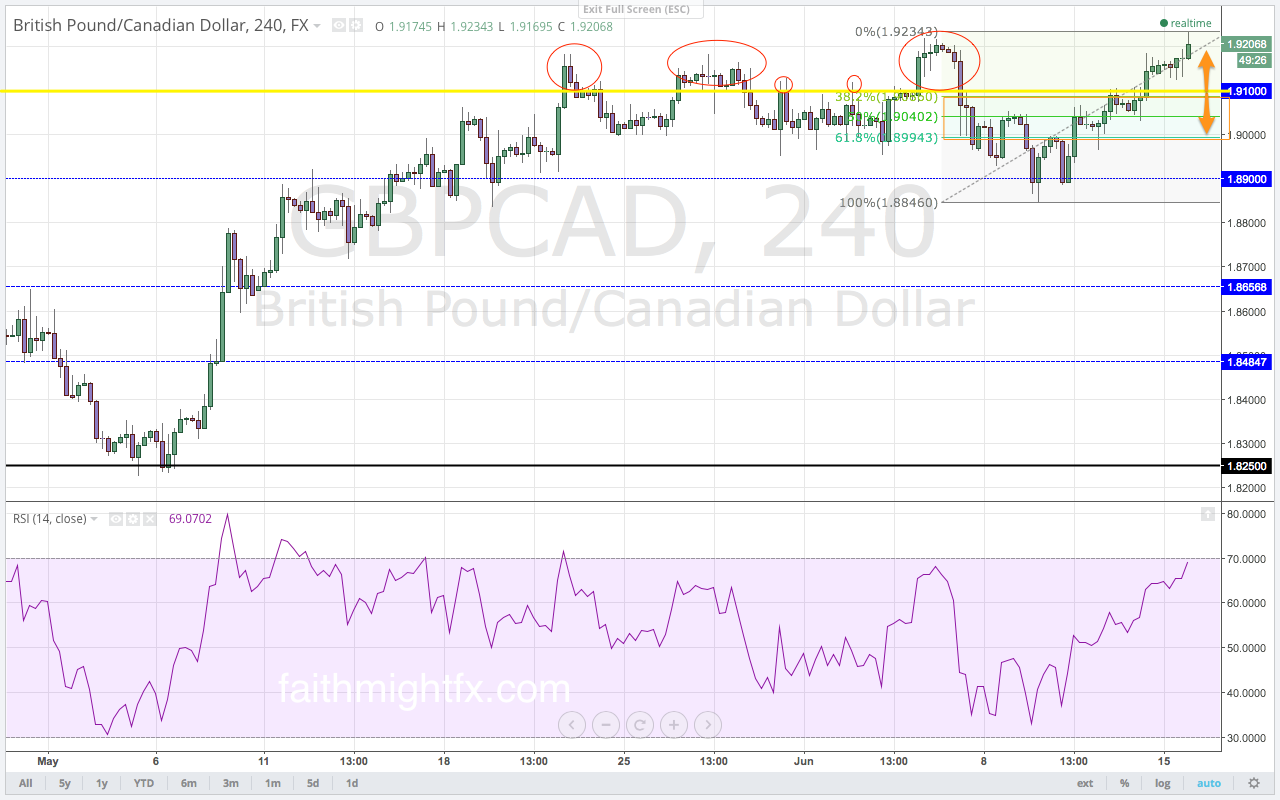

The $GBPCAD had been range bound between 1.8900 and 1.9100 as oil markets consolidated. Thus, it has been Canadian economic data dictating direction in the $GBPCAD in recent weeks. Despite a good housing starts number released last week, it was the poor capacity utilization number that weakened the CAD. The $GBPCAD moved back above the 1.9100 resistance level to close the week. The new trading week has already seen a weak Canadian manufacturing sales report rally the $GBPCAD to new highs at 1.9234. These new highs complete the Fibonacci move after last week’s correction. With wholesale sales, retail sales and inflation numbers to be released this week, any weak data will see the $GBPCAD continue its rally back toward the highs at 1.9555. However, strong data will cause the $GBPCAD to retrace the current rally.

With the close of last trading week above the 1.9100 level, the $GBPCAD had its first bullish close above the range between 1.9100 and 1.8900. Manufacturing data is such a market mover for the CAD because of Canada’s export-dependent economy. In fact, last week BoC Governor Poloz warned of weak economic effects due to bad weather extending into the second quarter of economic activity. The weak data seems to confirm this BoC warning issued just last week. Therefore the CAD will be on the back foot in trading this week. This CAD weakness will only be amplified on any weakness in the crude oil markets.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.