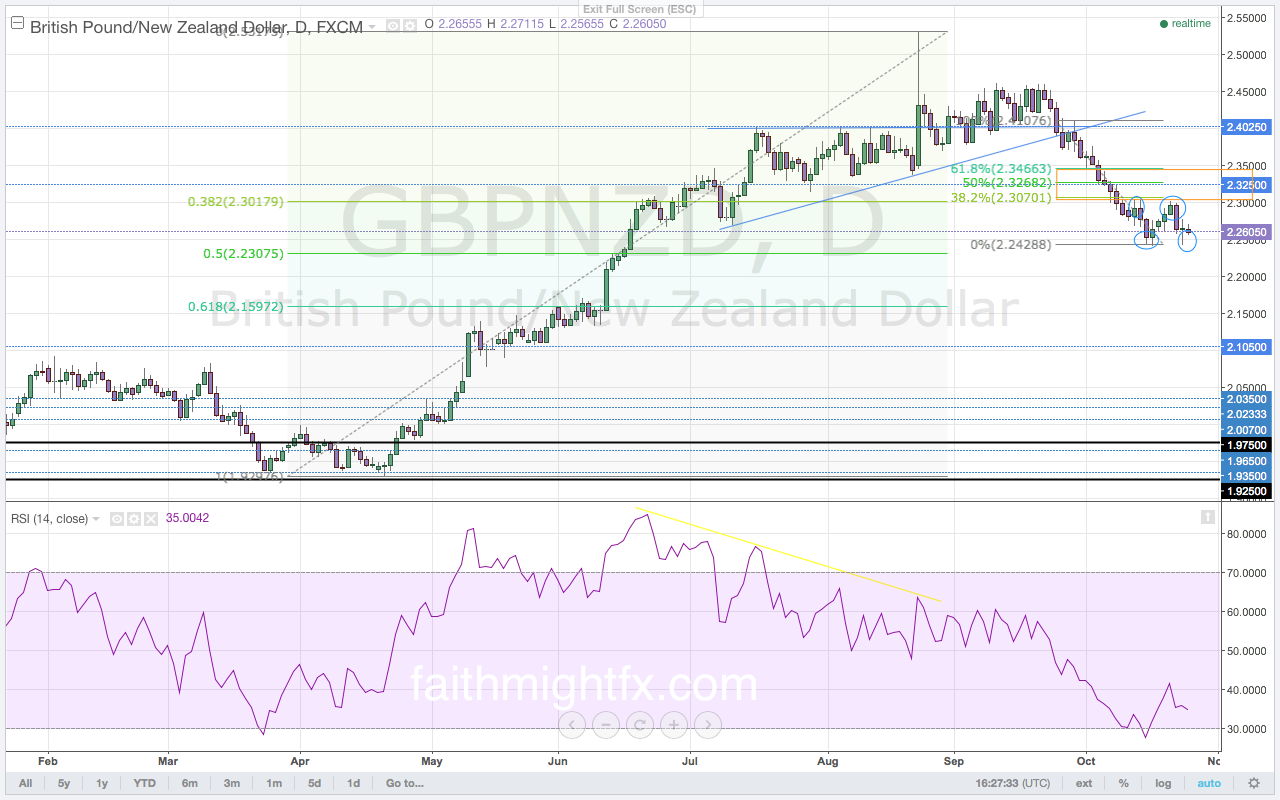

In light of the substantial dip lower in dairy prices last week, this week’s interest rate announcement from the Reserve Bank of New Zealand (RBNZ) should be given attention. If the RBNZ expresses caution about dairy and commodity prices, the New Zealand dollar will weaken. Dairy prices led other commodities with a bottom over five weeks ago. This consequently exhausted buying momentum in the $GBPNZD due to NZD strength. The decreasing momentum allowed the $GBPNZD to break lower in the past four weeks of trading. The new lows find support ahead of the large 50% Fibonacci level at 2.2307. The correction higher into the sell zone also finds resistance against the 2.3000 psychological level. The confluence here makes a break above the 2.3000 level a significant technical development. However, this may not be likely if the RBNZ remains neutral in sentiment and monetary policy. Rather, the $GBPNZD is carving out a range for itself between the 2.3000 level to the upside and the 2.2400 level to the downside. A break to the downside could potentially be a false break with the 50% Fibonacci level just below the support level at 2.2307. Therefore, the $GBPNZD may continue range bound for the week depending on how the market reacts to the RBNZ and Federal Reserve interest rate announcements.

OUTLOOK FOR THE WEEK….

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.