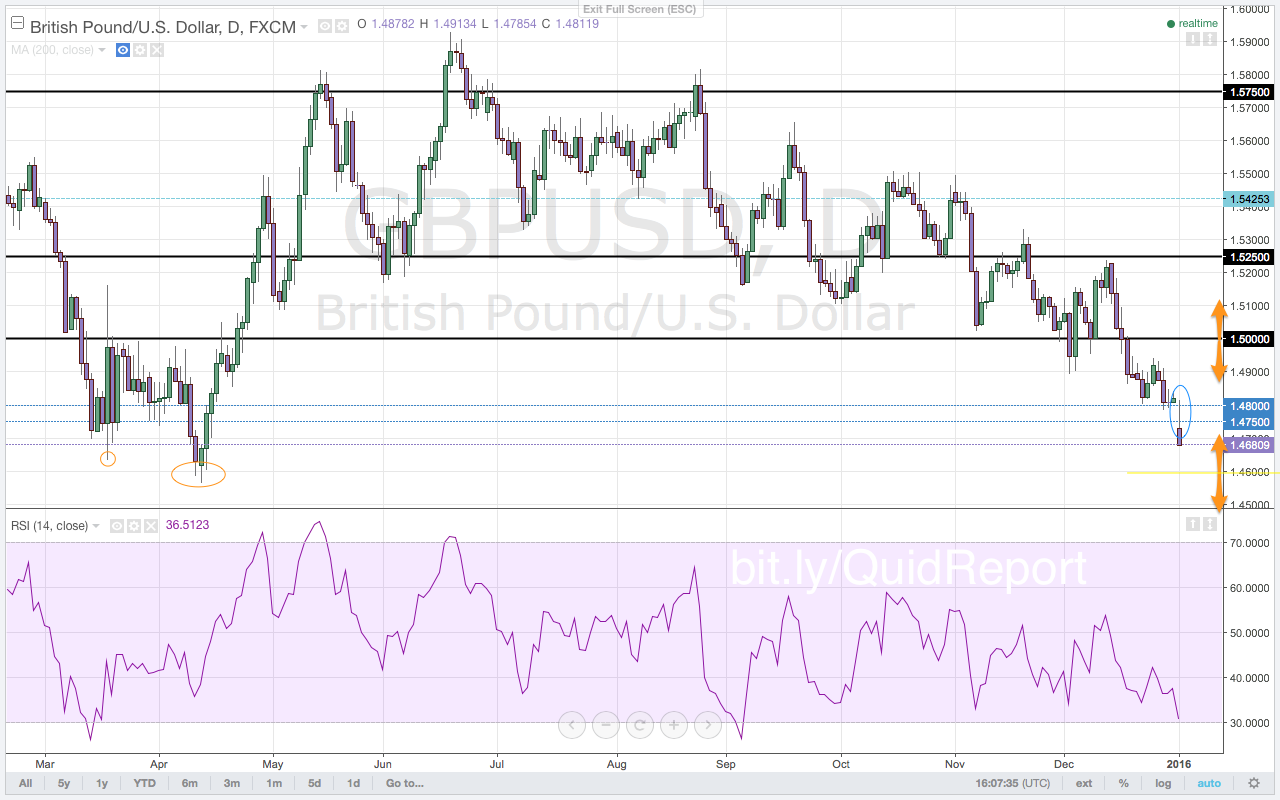

The new year opens with a very significant start for the pound against the U.S. dollar. The only other time in recent history that the $GBPUSD opened the new year at lows was back in January 2002. At that time, the $GBPUSD bottomed as buying momentum picked up with the RSI finding support at the 40.0 level on the monthly chart. This time, however, is actually a bit different. Momentum is sliding to lows on the RSI. The $GBPUSD has gapped lower as the first trading week of 2016 gets underway. This gap down has cleared the zone of support between the 1.4750 level and the 1.4800 level. This zone has been an area of supply for the $GBPUSD eight times in the past sixteen years. It supported price last week as sellers took profits and established new positions against the support zone. Now this gap and subsequent move lower is a strong indication of further selling in the $GBPUSD. Strong economic reports from the UK may give sellers a reprieve. But the calendar is dominated by economic news out of the United States this week. Risk aversion is already entering markets as U.S. equities open 2016 with pronounced weakness. Any strong news about the U.S. economy is likely to rally the U.S. dollar further. Having broken below the 1.4680 level, the $GBPUSD is poised to test lows at 1.4565.

Premium trade setups with targets and stops are published in the $GBPUSD Outlook for the Week in Volume 44, this week’s Quid Report.