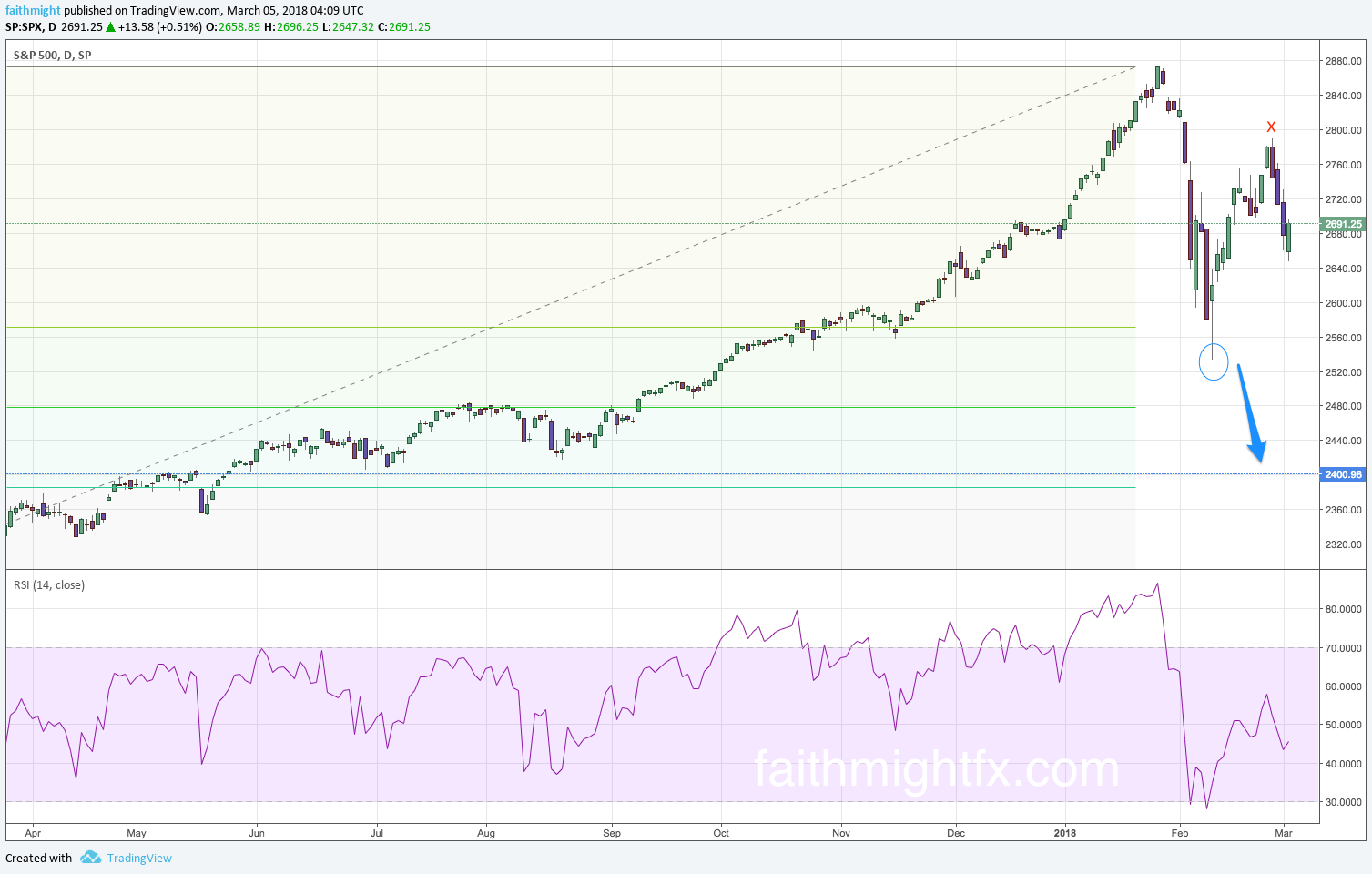

The stock market finally took a hit. The S&P 500 ($SPX) was down as low as 32% from the recent highs this year. A dip that finally really mattered still found buyers and equities attempted to move higher last week. However, 2 weeks ago it the first time that a buying frenzy after a big dip did not result in a new high (a price higher than the previous high price). This is a technical signal that may foretell a move much lower can occur for the U.S. stock market ($SPX).

Now before you starting getting hysterical about lower stock prices, your long-term perspective becomes so critical when assessing whether current price action should actually prompt a response in your portfolio. If you positioned in this blue area, then this recent dip probably doesn’t bother you. However, if you have new money to put to work, it is important to pay attention to where equities make their next move.

As the Federal Reserve welcomes a new chairman and the markets grapple with possible trade wars and a ballooning fiscal deficit, make a plan for what to do with a $SPX chart at much lower levels. Many fund managers and traders alike, myself included, have been waiting patiently for equities to get healthy again. But trying to catch a bottom in a correction this deep will feel scary. However, at the right levels, swing traders will be right back in these markets again. The buyers will return. Be healthy, and smart, enough to see the opportunities.

There are ebbs and flows to every market. Trade what you see. Invest with a pro. [sponsored]