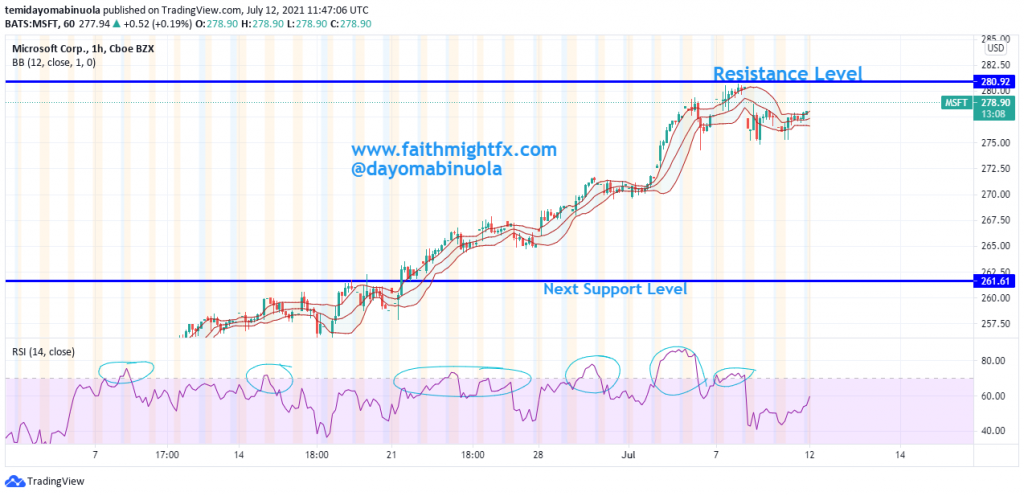

The first half of 2020 started so well for Netflix investors as the price remained bullish. The lockdown must have aided the bull run as many countries were on lockdown, getting on Netflix was one of the ways to maximize the lockdown. Before the lockdown, between January 2018 and January 2020, the price of $NFLX was ranging between $228.51 and $421.60. But in May 2020, a breakout to the upside occurred as price brokeout the then $421.60 resistance level. The highest price level $NFLX reached this year was at $591.89, resulting in major resistance. The resistance level at $591.89 was last reached in July 2015 when $NFLX had a stock split at 7 for 1, as the price moved from $662.25 to $110.69.

A head and shoulder pattern is being formed as price retraces back to $569.19. RSI has indicated at two different times of price being overbought between July and August 2021. A reversal might occur, which might result in a sell-off. $NFLX might lose about 160points from the current price at $569.19. Price is currently maintaining the upper region of the Bollinger bands. This year’s support stands at $479.57. As sell-off begins to occur, the year’s gain might be wiped out, as the price might reverse to $409.96.