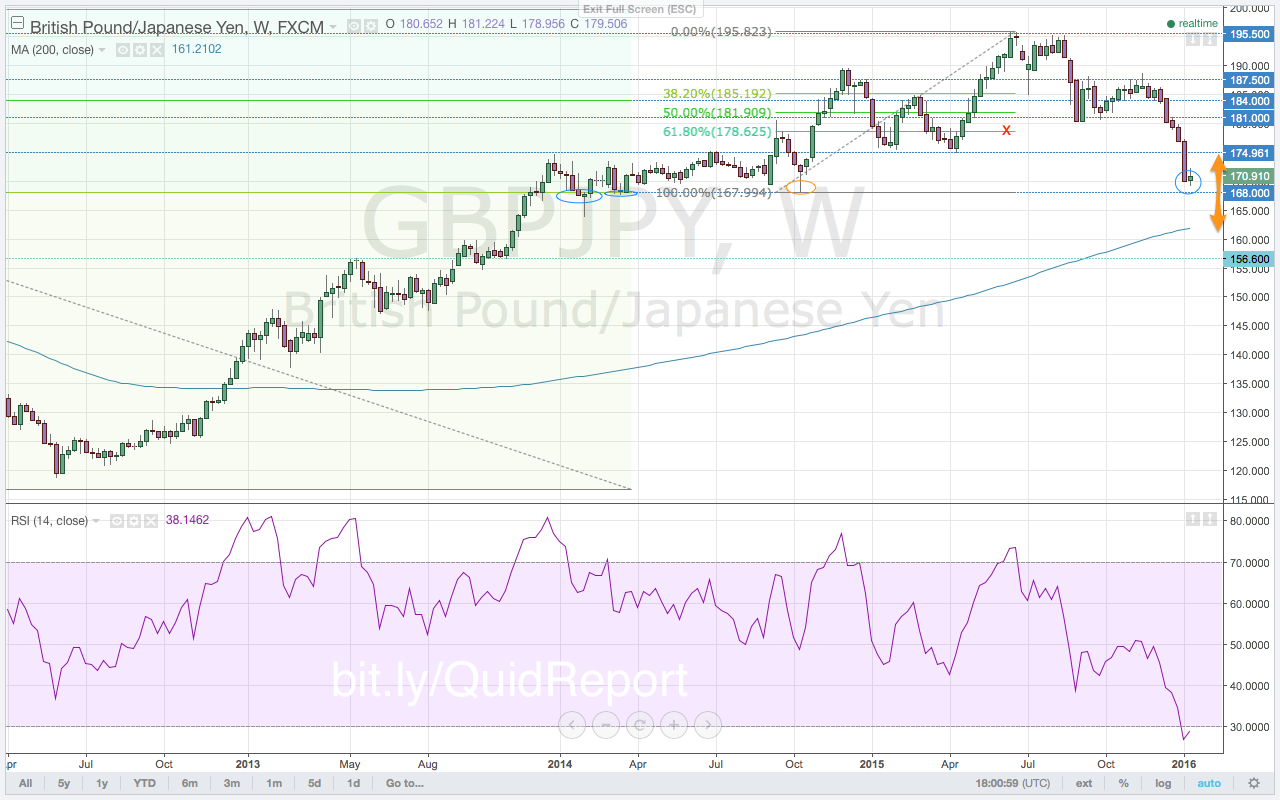

The $GBPJPY continues to slide. The Japanese yen rally has become sustainable as the Bank of Japan (BoJ) continues to give indications that it is considering a shift away from its quantitative and qualitative easing (QQE) program. This is a very subtle shift in BoJ sentiment that is not getting much media attention. Less QQE means that the BoJ erodes at the divergence gap in monetary policy that it has had with other major central banks for several years. Manufacturing PMI released last week was higher than expected, helping to confirm the BoJ’s optimistic economic outlooks for Japan. This hawkish tone is helping to strengthen the Japanese yen now at a time when risk aversion flows may be re-entering capital markets. The geopolitical wars and diplomacy tensions around the globe are starting to wear on investor sentiment. As U.S. equities weaken, the Japanese yen continues to be the largest beneficiary of increases in risk aversion flows. The new trading week opens with the $GBPJPY trading at extremely oversold levels. Despite its bearish sentiment in the medium term, the $GBPJPY may consolidate the new lows below the major 170.00 psychological level.

The $GBPJPY has not staged a correction since breaking below the 184.00 support level back in early December. The break below the 175.00 support level with the extremely shallow rallies is a major signal of bear strength as the $GBPJPY continues to grind lower. The $GBPJPY breaks nominally below the 170.00 psychological level as the new trading week begins, subtly indicating that the staunch support level is being met with more bearish psychology than last year. Perhaps with the RSI at extremely oversold levels, the $GBPJPY will bounce higher as sellers exhaust. A “healthy” correction off the new 169.30 lows moves the $GBPJPY back toward the 175.00 level to the sell zone starting at the 173.45, 38.2% Fibonacci level. Sellers are lined up to the 176.00 resistance level. Given the importance of the 170.00 support level on a bearish move that has seen very little retracement, a strong bounce is highly likely. More aggressive traders will look to take advantage of any move higher to establish a short position in the $GBPJPY. Continued strength in the Japanese yen is likely especially as crude oil prices remain so low, which is an aide to the Japanese economy.

Premium trade setups with targets and stops are published in the $GBPJPY Outlook for the Week in Volume 45, this week’s Quid Report.