The Walt Disney Company is an American Multinational mass media and entertainment conglomerate. Disney was founded in 1923, which is about a century ago. Disney is traded on NYSE as $DIS. As of February 2023, Disney’s market cap stood at about $197Billion. As of 2020, its total number of employees was over 200,000. After the share price of Disney reached an all-time high at $203.13 in March 2021, the value of Disney depreciated all through 2022 as price reached $84.13, which was the lowest price since March 2020.

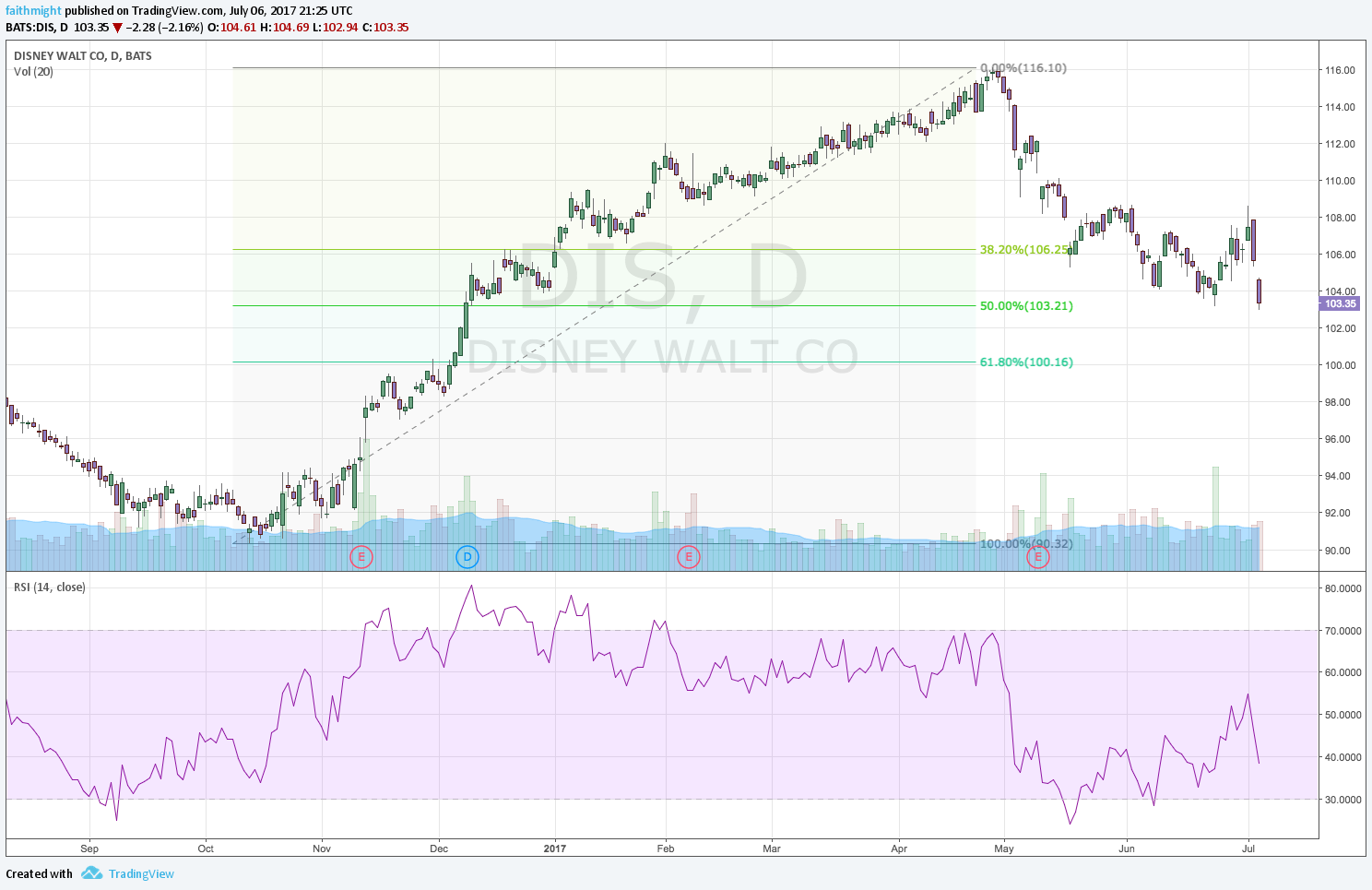

The year 2023 seems to be bringing a bit of hope as January closed on a bullish note. The price has continued to rally in February as price reach a new high this year at $118.10, which occurred on the 9th of February. The $DIS bulls might push price higher in the coming weeks. Our analysts think the $DIS price could reach a resistance level at $140 if the rally continues. On the weekly chart, RSI indicates that price has been oversold. This could be good news for $DIS investors.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here