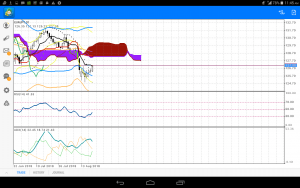

$EURJPY’s price at the beginning of the year was 126.046 and the price was able to reach the highest level at 134.083 in June 2021. A double bottom has been formed between the months of August and September of this year. This double bottom activated the rally of $EURJPY with the current price at 132.618, 350 pips less of the previous major resistance level at 137.545, which was last seen in February 2018. The highest price of $EURJPY in the last decade was at 149.838. The Euro seems to appreciate more against the yen since the lockdown. Nevertheless, Japan and many countries have vaccinated more than 50% of their population.

In recent times, there has been an increase in the demand for labour and skill in Europe. This was as a result of the lockdown, as many foreign skilled people are relocating to Europe. Before the dip in August and September of this year, which resulted in a double bottom, RSI showed that the price has been overbought in May 2021. At the moment, the price is already overbought on the daily chart. This could lead to a possible reversal in price as a Doji was formed yesterday and today’s candlestick shows a bearish one. If the price closes with a bearish candlestick and the next few days close on a bearish note, the price might fall to 129.261.