The market seems to be turning higher for the commodity dollars (comm dolls), which is inline with the recent price action in commodities. Commodities, like copper, oil, and gold, have been generally rangebound in 2017 following the significant downtrends that started in 2011. During that downtrend in commodities, markets have been operating on loose monetary policy based on the flow of funds from central bank balance sheets and ultra-low interest rates. Now these fundamentals are shifting with balance sheet reductions, interest rate hikes and increasing hawkish central bank sentiment around the globe. With the fundamentals transitioning from one psychological paradigm to another one, increased volatility and choppy price action may start to creep back into the markets.

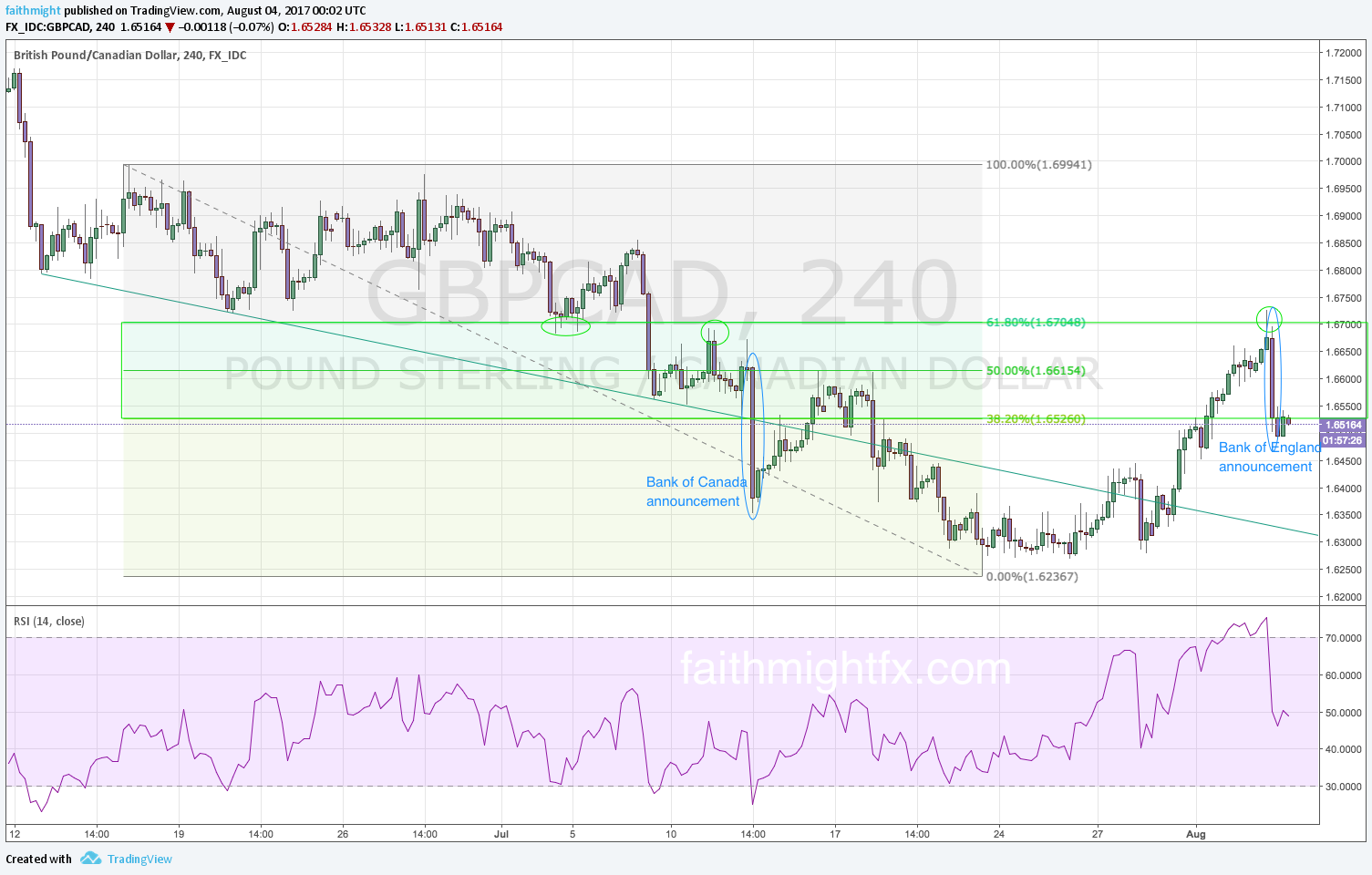

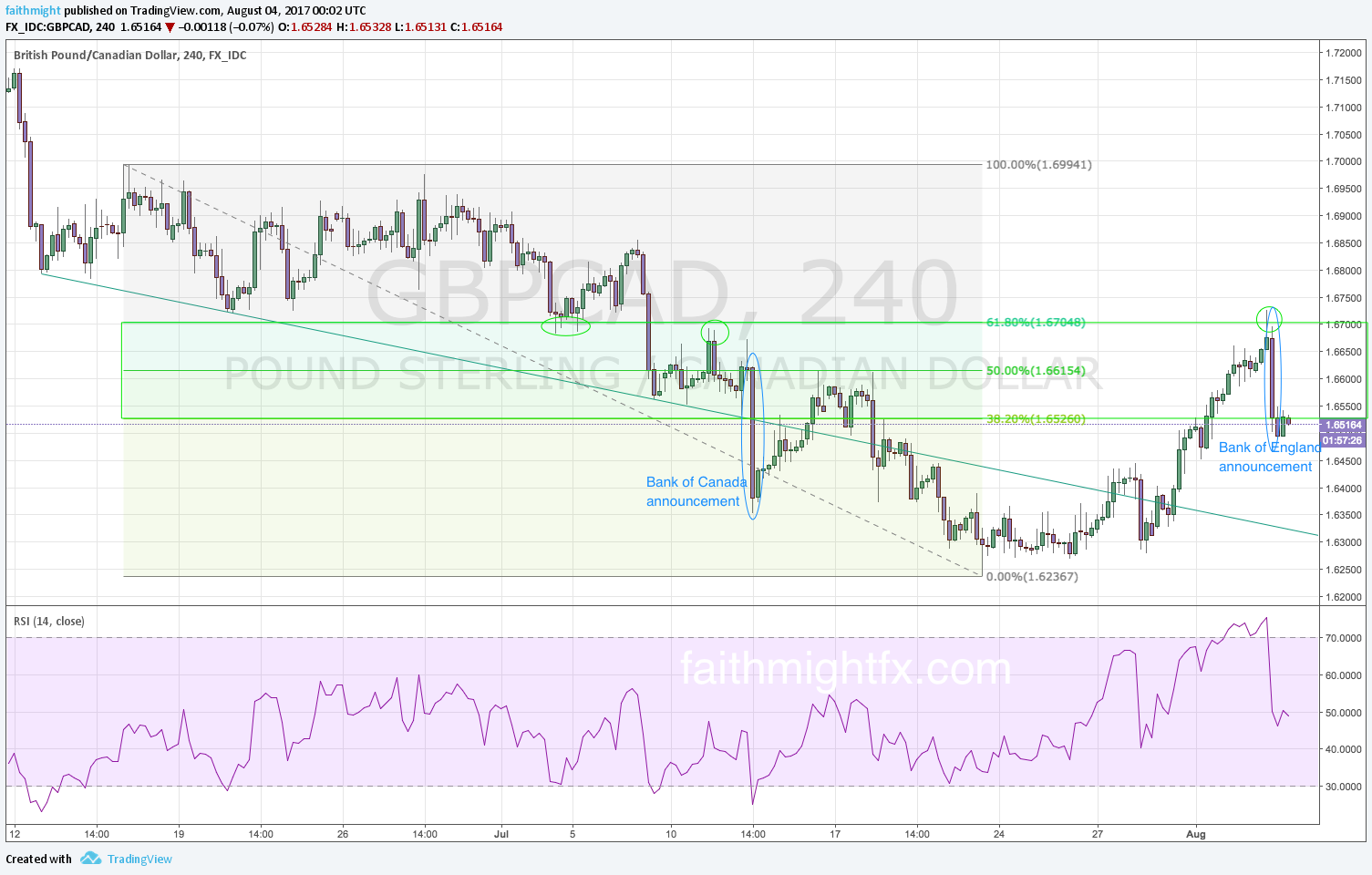

There have been no summer doldrums in the forex markets. Starting with the Canadian dollar, the Bank of Canada (BoC) completely surprised markets last month with an interest rate hike. The start of monetary tightening in Canada now gives the CAD fundamental support for the rally that has taken place for much of this year already. So the correction this week just ahead of the Bank of England (BoE) interest rate announcement this Thursday, was a fantastic opportunity to buy Canadian dollars versus the Great British pound. The corrective rally moved right into the 61.8% Fibonacci level giving a level of risk reward that worked well for sellers ahead of the UK Super Thursday news event. The BoE was more dovish than the market expected as it cut its inflation and economic growth forecasts amongst calls for gradual rate increases. This divergence in monetary policy between Canada and Great Britain may see the $GBPCAD move to new lows.

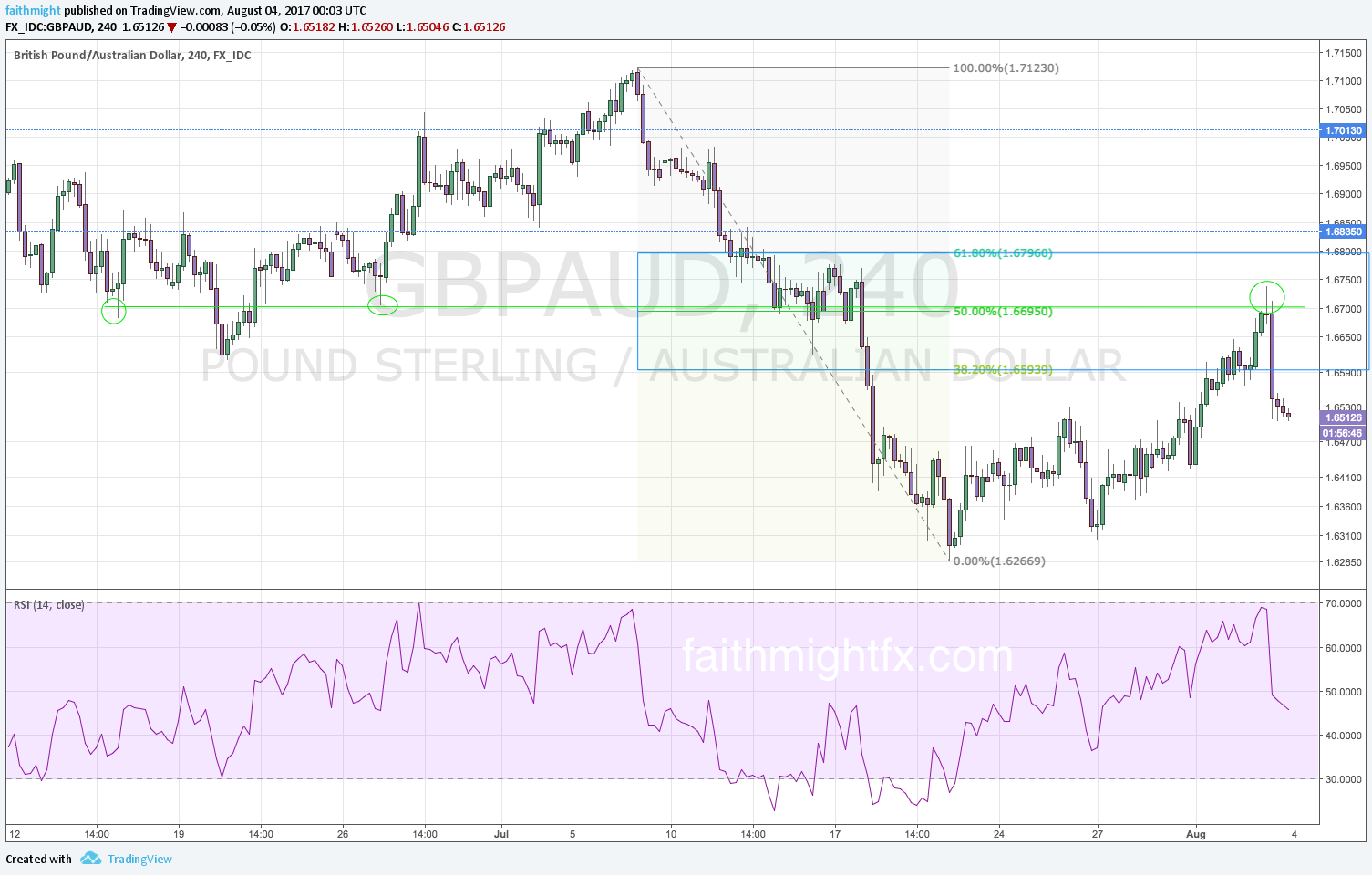

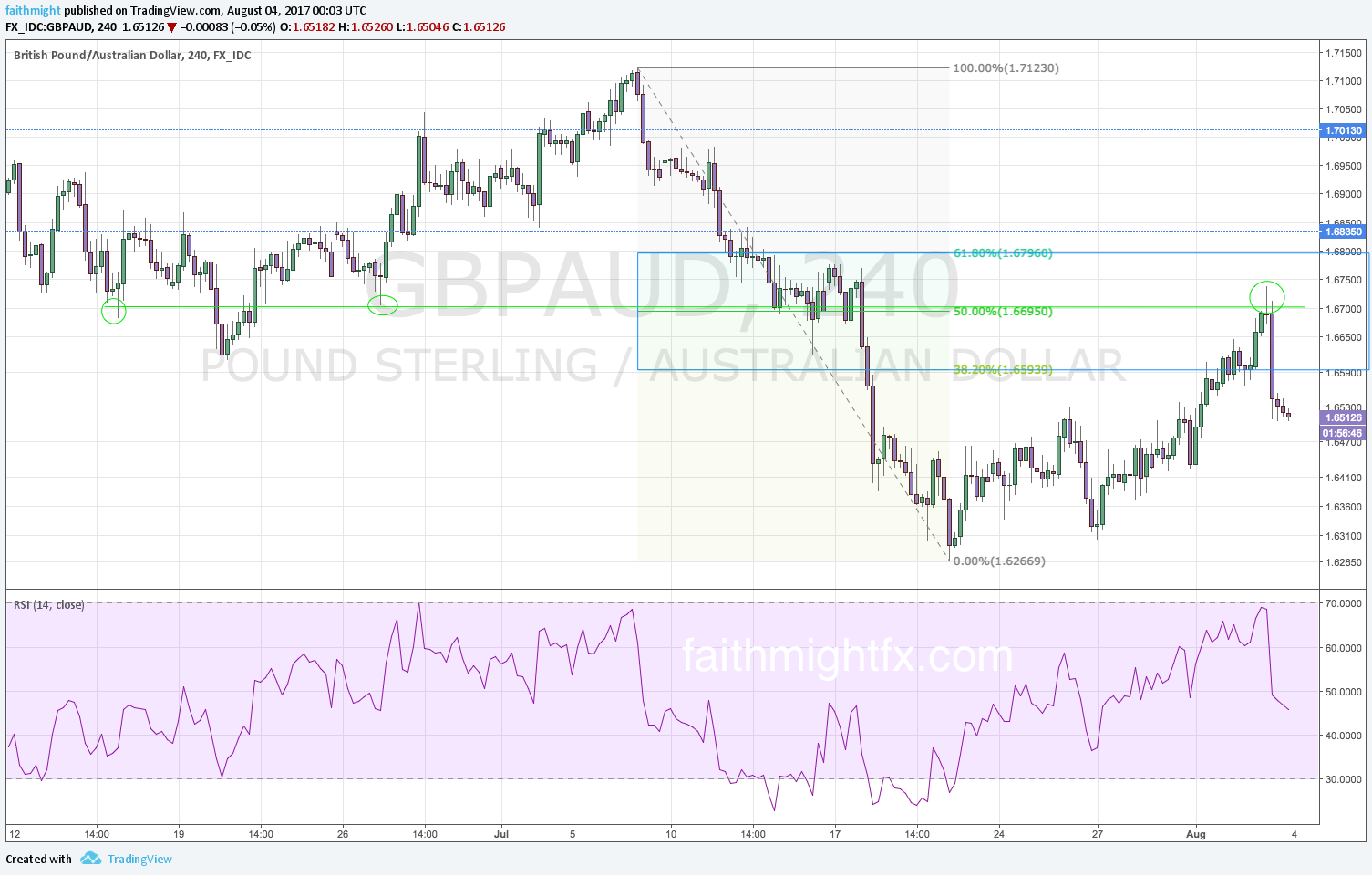

The Reserve Bank of Australia (RBA) released their monetary policy statement this week too. While the RBA is hawkish on the Australian economy, they remain adamant that accommodative monetary policy must remain for that growth to continue. As such, the RBA will likely not move on interest rates at all this year. But neither will the BoE. If this remains the case, the interest rate differential and the divergence in economies should continue to underpin the Australian dollar against the Great British pound.

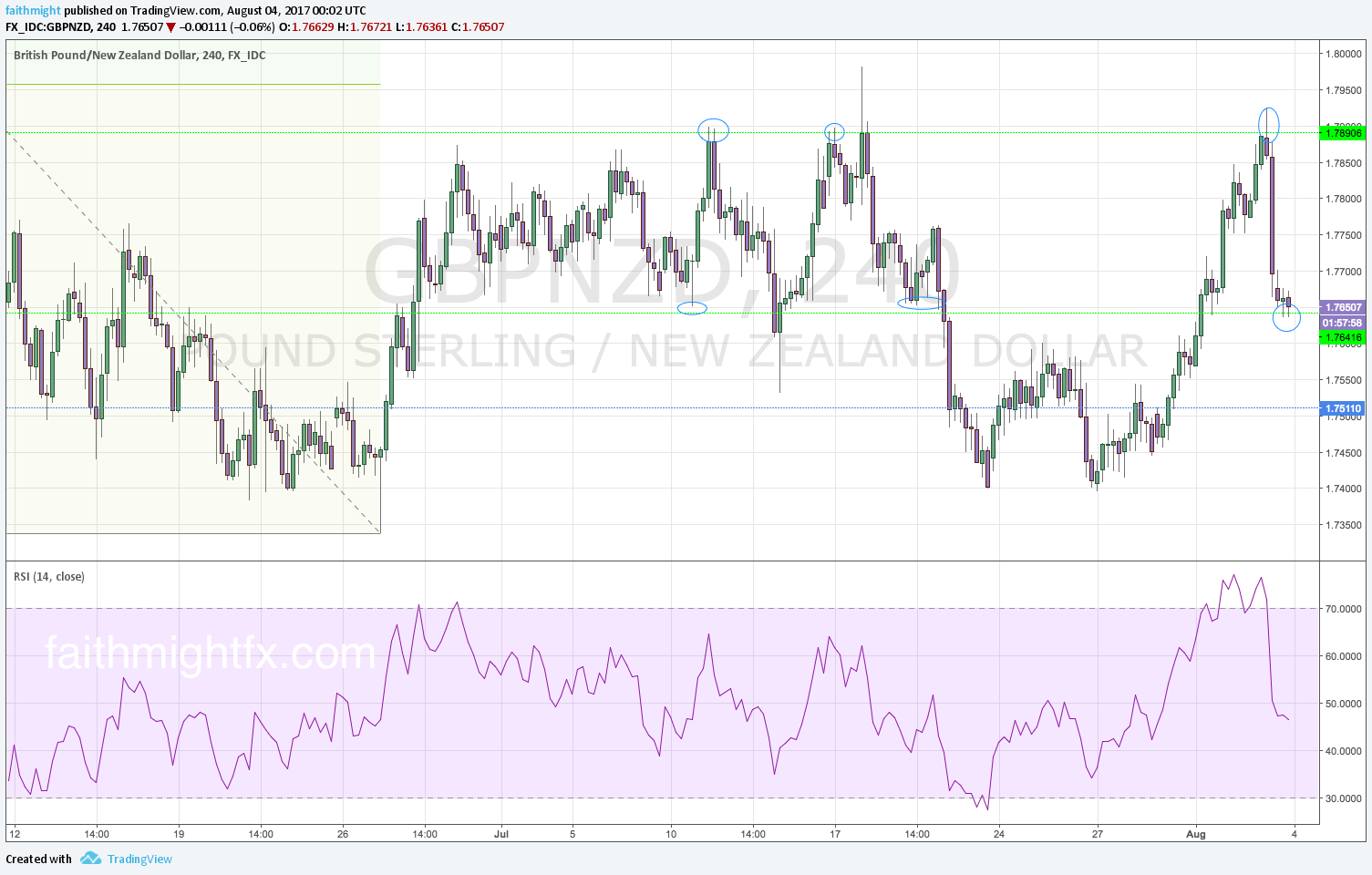

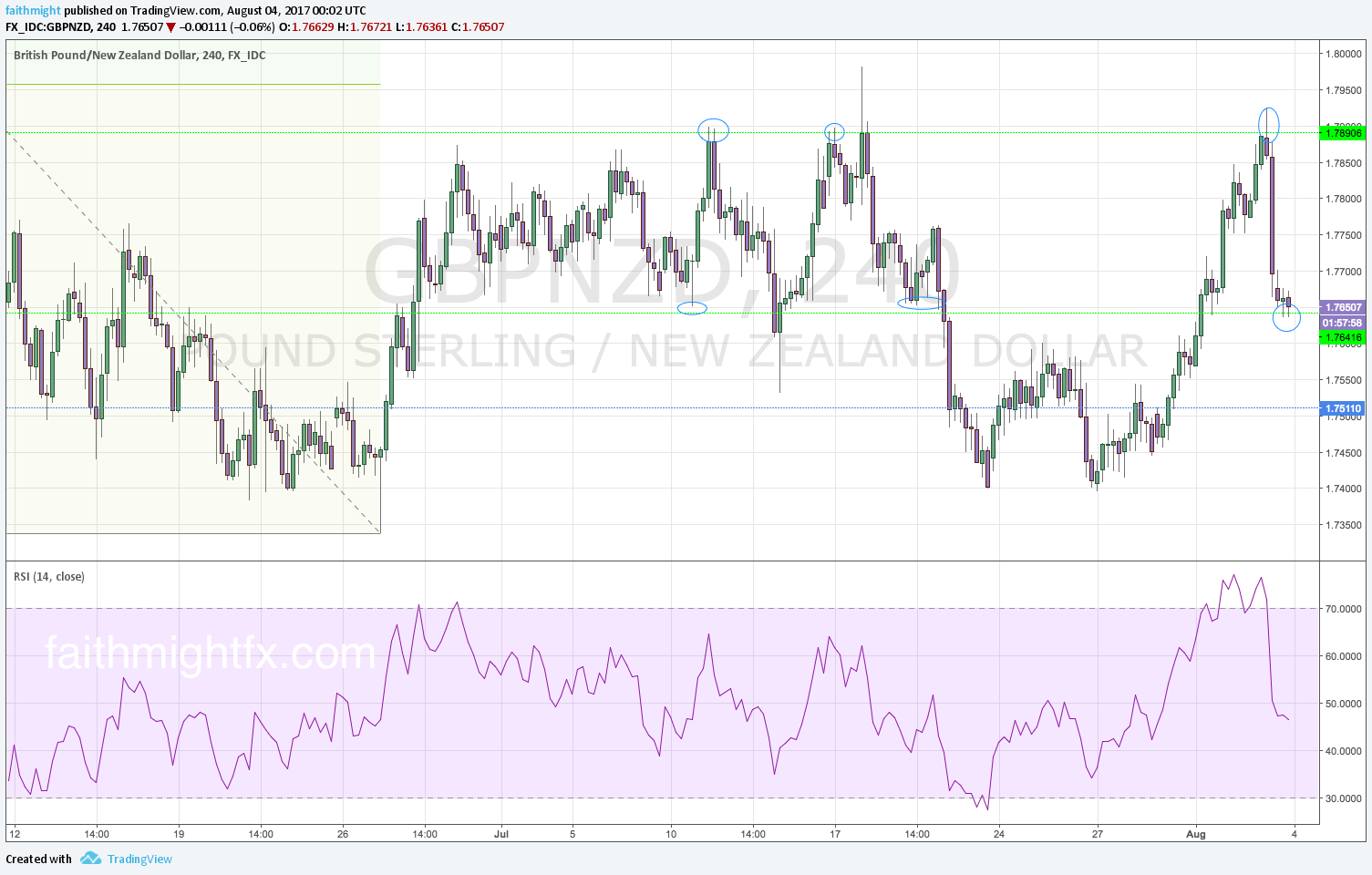

The $GBPNZD was trading in a wide range while we saw the aforementioned breakdowns in the $GBPCAD and $GBPAUD. The $GBPNZD finally joined suit and fell to new lows at the 1.7400 support level. But the $GBPNZD staged a major correction this week that actually saw price move back to the top of the former trading range above the 1.7900 level just before the BoE announcement. While this complete reversal higher seems like bullish price action, hindsight reveals another fantastic sell opportunity post BoE.

So now that the selling opportunities have presented themselves, can the commodity dollars continue to strengthen against the pound? There is another factor at play here that we have not yet touched upon – the weakening U.S. dollar. A weak dollar boosts most commodities since they are priced in U.S. dollars. Higher commodity prices should bolster the commodity dollars higher as well. But this is no guarantee. So take care with your trades. It’s going to be a choppy month with the occasional bursts of volatility as markets ready for full throttle trading come September. Be patient and take advantage of the setups, like these, when they come.