Due to the holiday shortened week and it being the very last week of 2015, no Quid Report was published this week. Instead, I am doing a video update to last week’s written report. While I have been on many forex shows, this is my first time hosting a live broadcast. This should be a quick update and review for the week in progress. Enjoy! And please leave your feedback in the comments. Perhaps this will be a new thing for me in 2016.

Ode to Canada

Break the 61.8

This trade could be great.

With the fundies aligned

Long term action divine.

Be patient. The targets

Are a long ways away!

Premium trade setups with targets and stops are published in the $GBPCAD Outlook for the Week in Volume 42, this week’s Quid Report.

Is This The Bottom?

Last week, I was on the air live with Dale Pinkert, host of FXStreet’s Live Analysis Room. My episode is down below. It’s always fun talking GBP with Dale because he always has insights to share with me as I do with him. His experience in futures on top of the forex always leads to a good conversation. The interview never feels like an interview. Just good trading talk between friends.

The interview took place the day before the September non-farm payrolls dropped. You’ll hear us talk equities quite a bit. With the weakness in the $SPX, I explain why the $GBPJPY was actually looking to fall further to 174.86 and possibly even as low as 167.99. But the weakness in the NFP report may change everything. Apparently, Yellen and the $FED did know something we all didn’t know. The recent global malaise in China, Syria and Brazil are, in fact, starting to show ripple effects in the U.S. economy. And if this economic weakness becomes a trend, interest rate hikes out of the Federal Reserve are off the table. Probably completely. Definitely for 2015. The lack of wage growth and the less-than-expected jobs growth has finally convinced markets that the $FED is not moving on interest rates. In fact, whispers of QE4 are back. Expect that drum to beat louder if the U.S. economy starts to show more weakness in the months ahead.

Looking at the $GBPJPY as our equities proxy, the Friday close above the 181.00 support level is a bullish signal in light of the strong close in the S&P 500. Watch here:

Bank of Canada no longer spooked by oil

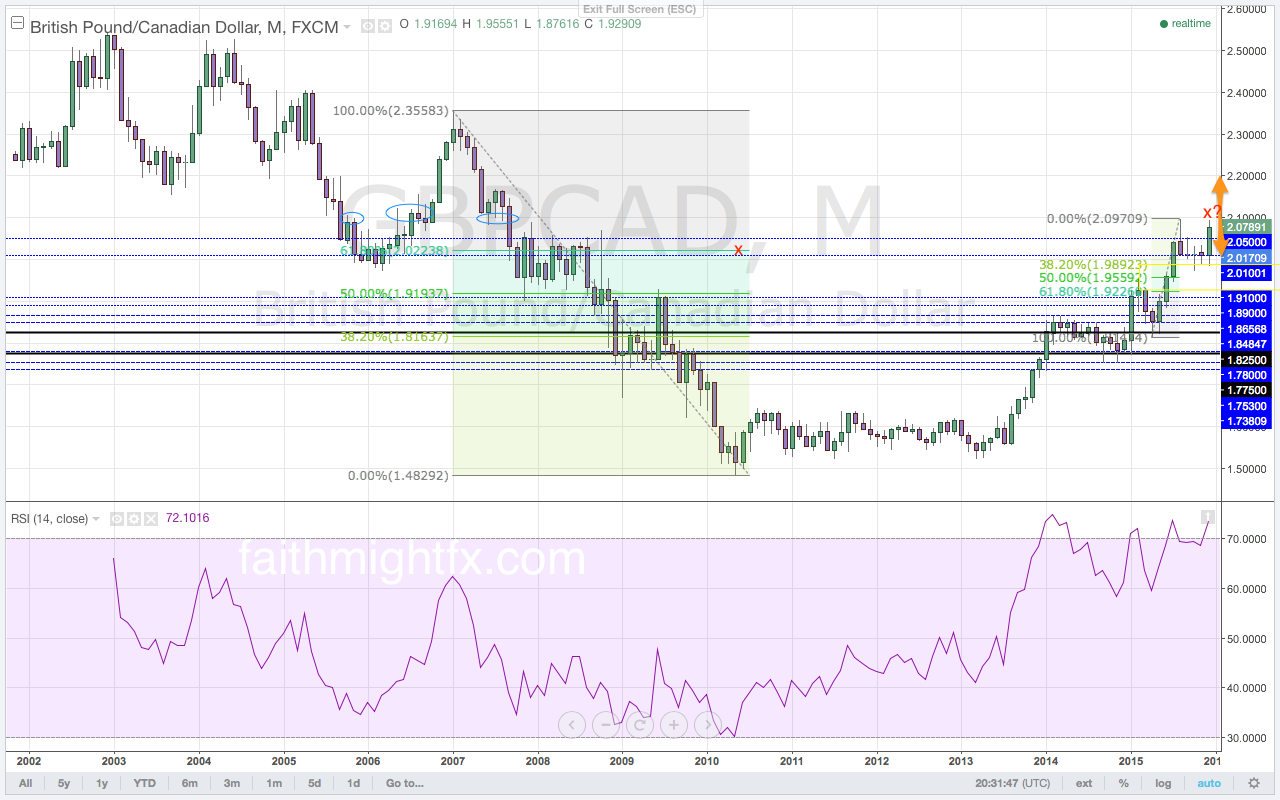

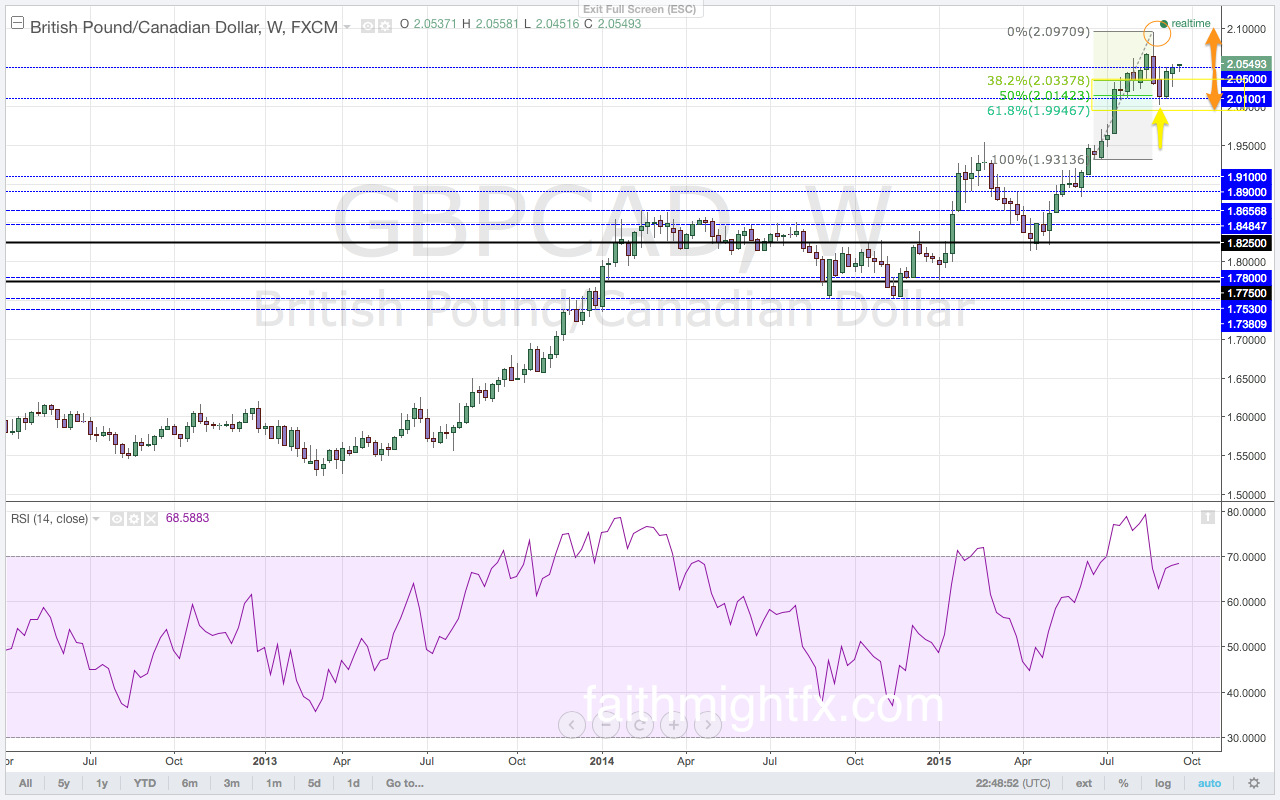

Oil markets rallied last week on the back of the weaker USD in light of no change in U.S. interest rates. The close on Friday is the first close above the 2.0500 resistance level since the week before Black Monday. The $GBPCAD opens the new trading week extending the rally further as risk appetite wanes in the general capital markets. If this week also ends above the 2.0500 resistance level, it confirms this tentatively bullish bias in the GBP/CAD.

The Bank of Canada (BoC) surprised markets this month with no change in monetary policy. While the crude oil markets have plunged to new lows, the recent weeks have seen prices consolidate. The BoC feels that inflation remains inline with its outlook for the year. Though exports remain uncertain, the lower value in the Canadian dollar has helped to absorb the impact of low commodities by bolstering domestic demand. After already cutting interest rates twice this year, the BoC remains at ease with allowing those cuts to continue to work through the economy. Despite the cheerier disposition this month, the BoC remains a very dovish central bank as long as oil markets remain weak. There have even been whispers that the BoC may implement quantitative easing in 2016. With a less dovish stance in this month’s monetary policy statement, the Canadian dollar met with buying strength. This CAD strength pushed the $GBPCAD below the key 2.0100 support level. The $GBPCAD made new lows at 2.0028 before finding support and moving higher above the 2.0500 resistance level. The key 2.0100 support level remains the important level on a sustained move to the downside (Volume 22). However, last week price closed just above the 2.0500 resistance level. This resistance is the level to watch in the new trading week.

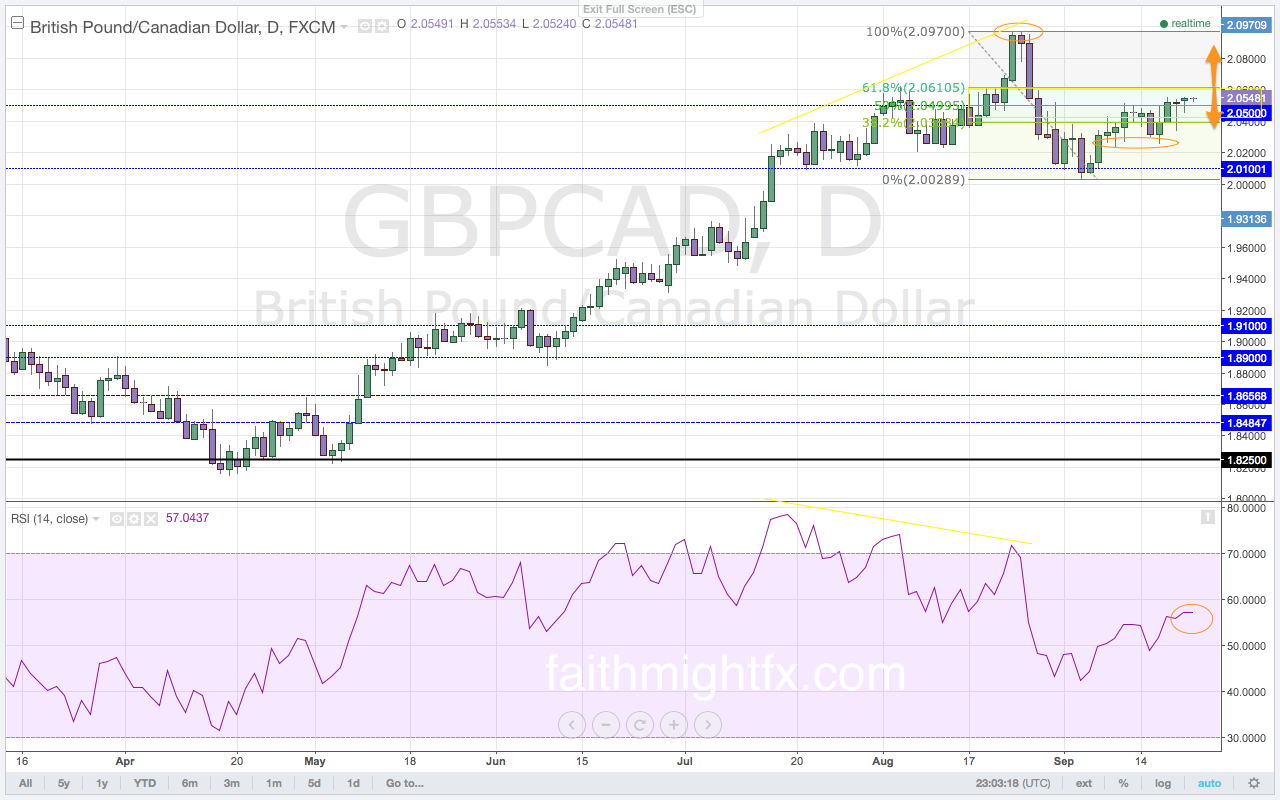

The $GBPCAD finally succumbed to the bearish divergence that had been building on the daily chart since mid-July. With a new low in momentum and a breach below the RSI 60.0 level, the $GBPCAD corrected lower to the 2.0028 lows before rallying higher off the lows. The follow through lower from the bearish divergence pushed momentum into selling territory last week. However, price was unable to close below the important 2.0100 support level with confirmation even with selling momentum behind it. The rally met profit-taking flows ahead of the weekend with the close at 2.0516. With confluence between the resistance level and the 50% Fibonacci level, there is staunch resistance at the 2.0500 level. As the rally extends higher in the open of the new trading week, momentum remains out of bearish territory. With a confirmed close above the resistance level, $GBPCAD looks to move higher. A break of the 61.8% Fibonacci level sees the $GBPCAD rally higher for a reversal back to the 2.0970 multi-year highs.

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.

How Much More Loonie Weakness?

The resumption in oil weakness has kept the $GBPCAD supported on the back of CAD weakness. Weakness in oil markets may also resume the dovish sentiment out of the Bank of Canada (BoC). While the BoC welcomed the weaker CAD that resulted from the slide in oil prices, the return of weak oil could also mark the return of the doves to the BoC. Recently, however, oil markets have stopped crashing and started consolidating. This stabilization may mean another push lower in oil is eventually coming. As long as the crude oil futures market are unable to rally further beyond the $60 level, the $GBPCAD will find traction to move higher.

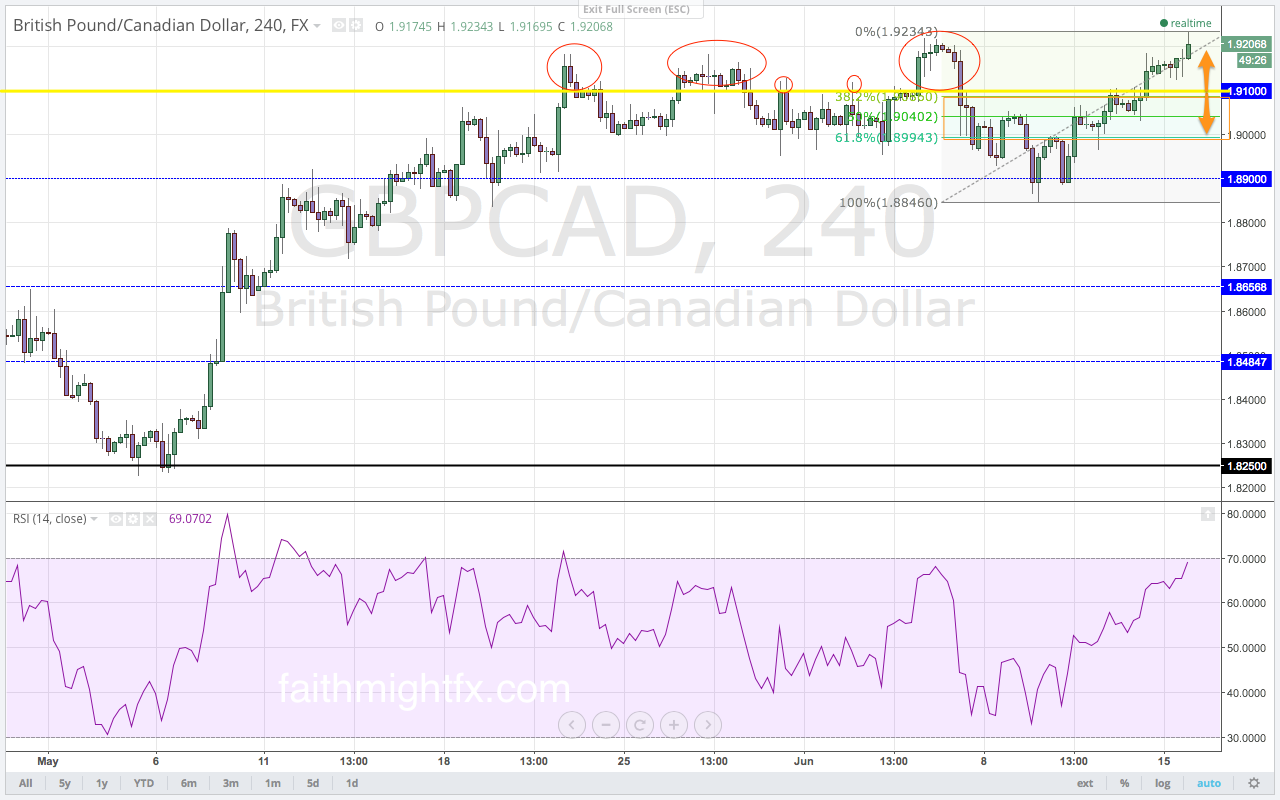

The $GBPCAD had been range bound between 1.8900 and 1.9100 as oil markets consolidated. Thus, it has been Canadian economic data dictating direction in the $GBPCAD in recent weeks. Despite a good housing starts number released last week, it was the poor capacity utilization number that weakened the CAD. The $GBPCAD moved back above the 1.9100 resistance level to close the week. The new trading week has already seen a weak Canadian manufacturing sales report rally the $GBPCAD to new highs at 1.9234. These new highs complete the Fibonacci move after last week’s correction. With wholesale sales, retail sales and inflation numbers to be released this week, any weak data will see the $GBPCAD continue its rally back toward the highs at 1.9555. However, strong data will cause the $GBPCAD to retrace the current rally.

With the close of last trading week above the 1.9100 level, the $GBPCAD had its first bullish close above the range between 1.9100 and 1.8900. Manufacturing data is such a market mover for the CAD because of Canada’s export-dependent economy. In fact, last week BoC Governor Poloz warned of weak economic effects due to bad weather extending into the second quarter of economic activity. The weak data seems to confirm this BoC warning issued just last week. Therefore the CAD will be on the back foot in trading this week. This CAD weakness will only be amplified on any weakness in the crude oil markets.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.

QUID REPORT – NOW AVAILABLE

Election jitters played out in trading last week as the GBP weakened across the board. Economists and financial media took to extreme headlines about sterling volatility spiking due to the uncertainty surrounding this particular general election cycle. The GBP did slide but election jitters did not take the GBP under siege. Rather, the Bank of England (BoE) hold on monetary policy last week gave the GBP a bit of reprieve from the election selling. Without a statement from the BoE after its policy announcement, the market is left to trade on its own expectations for a series of interest rate increases out of Great Britain to begin in early 2016. However, in the past few weeks, BoE members have taken to jawboning to temper those hawkish expectations.

In addition to hawkish expectations and election jitters, trading this month is already fraught with seasonality themes….

Read the full report: Quid Report, Volume 7 (subscribers only).

The Sterling Digest, 28 February 2015: en fuego

This #Merkel vs #Tsipras float strides across streets of Cologne during today’s carnival. #Greece crisis everywhere. pic.twitter.com/G1uYSuLai3

— Maxime Sbaihi (@MxSba) February 16, 2015

Sterling has staged big rallies across the board. Much of this new strength comes on the back of heightened expectations that the Bank of England (BoE) will increase interest rates even sooner than previously expected. As the market fully digests this new timeline in interest rate hikes, sterling has caught bid as traders buy in anticipation of tighter monetary policy.

While a big reason for the rally in sterling, monetary policy is not the only reason. Global deflation, due to the crash in oil prices, has caused other currencies to weaken considerably. As such, sterling has been able to rally to multi-year highs versus currencies like the Canadian dollar, the euro and the Australian dollar. Lastly, the sterling is catching bid as a safe haven currency. The discord between the the new Greek government and the rest of the European Union and continued manipulation by the Swiss National Bank in the francs markets, has traders piling into sterling as the only desirable European currency available. As long as these conditions continue to persist, expect sterling to continue to benefit on the long side in the medium term.

- Unemployment Down, Wages Up in U.K. (Bloomberg)

- U.K. Inflation Slows More Than Forecast to Record-Low: Economy (Bloomberg)

- Great Graphic: US and UK Unemployment (Traders Log)

- UK jobs reports, strong earnings fire up sterling (City Index)

- Does It Count as ‘Real’ Deflation When Prices Hit an Oil Slick? (Wall Street Journal)

- Bank of England increasingly divided on path for interest rates (Telegraph)

- ECB braces for QE as others shift rates (Yahoo! Finance)

My Appearance on FXStreet’s Live Analysis Room

I was thrilled to be back in the #FXRoom with Dale Pinkert yesterday. He brought me in to talk all things GBP covering $GBPUSD, $GBPJPY, $GBPAUD, $GBPCAD. But he also gave me some nuggets of wisdom on the EUR via the $EURUSD giving some confirmation on the $EURGBP. The show unexpectedly became a golden example of how traders come together with different perspectives and expertises to edify one another.

I also give a sneak peek to a new service I am launching very soon. Watch out for it!

My Appearance on Benzinga’s #PreMarket Prep Show

I had the pleasure of joining Joel Elconin and Brianna Valleskey as a guest on Benzinga’s #PreMarket Prep Show yesterday and talk with them about central banks, interest rates, oil and, of course, currencies!

Double Whammy

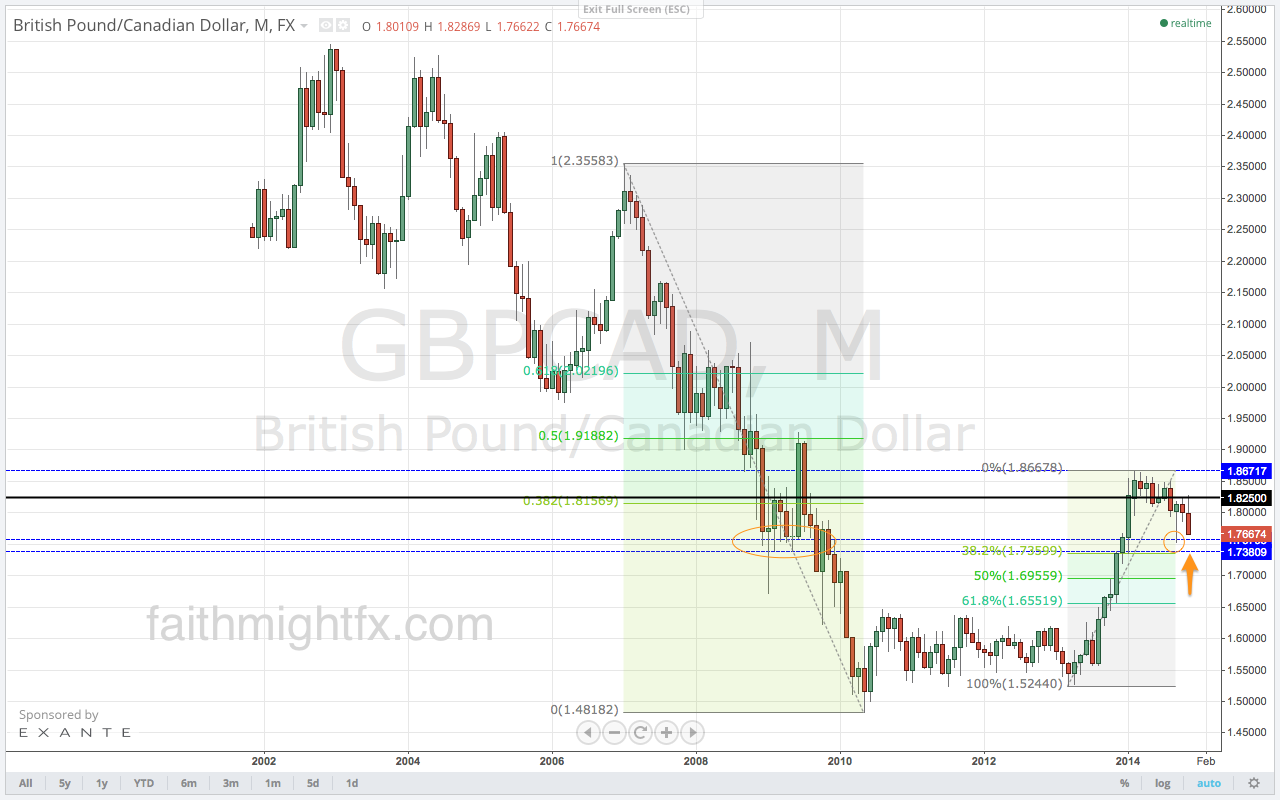

The CAD has enjoyed considerable strength as the Canadian economy strengthens on the back of its robust trading partner, the United States. As a result, we have seen a huge move lower in the $GBPCAD as sellers enjoy the double whammy of a strong CAD and a weak GBP.

As $GBPCAD moves lower, we see that there is a significant support zone ahead that dates back to 2009. Price found support at the top of the zone at 1.7580 back in September so this is the level to watch. Until we get to the previous low at 1.7580, the $GBPCAD can continue to benefit from the double whammy. However, watch price action in this support zone. Profit-taking is sure to take place given the move lower. However, it remains to be seen if a corrective rally on profit-taking turn into a reversal higher or if the $GBPCAD can break this long-term support zone and continue even lower.