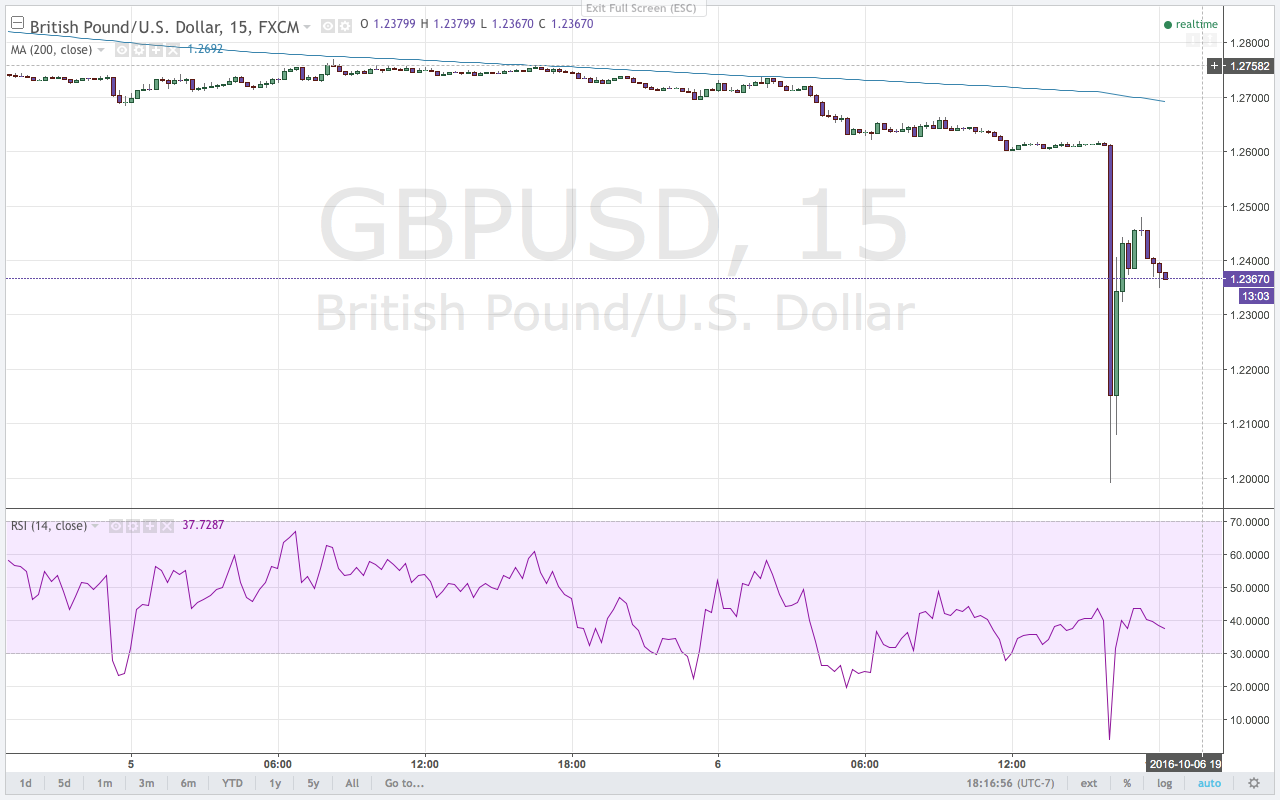

Last month, I had the pleasure of speaking with a new traders community. Led by Carl Burgette, The Trader’s Vibe is a new weekly video podcast series where Carl interviews notable and prominent traders every week. To be considered notable and prominent in this business is truly an honor so I was happy to join him on the show. As with any new community, we spent much of the time talking about my background and how I entered into finance (which is a very unorthodox path, to say the least). Of course, we talked markets and what I was seeing at that time in the GBP. However, this was the first time that I was asked about how I’ve been treated as a woman in the business and my thoughts on bringing more women and people of color into finance.

Catch my episode of The Trader’s Vibe below. Enjoy!

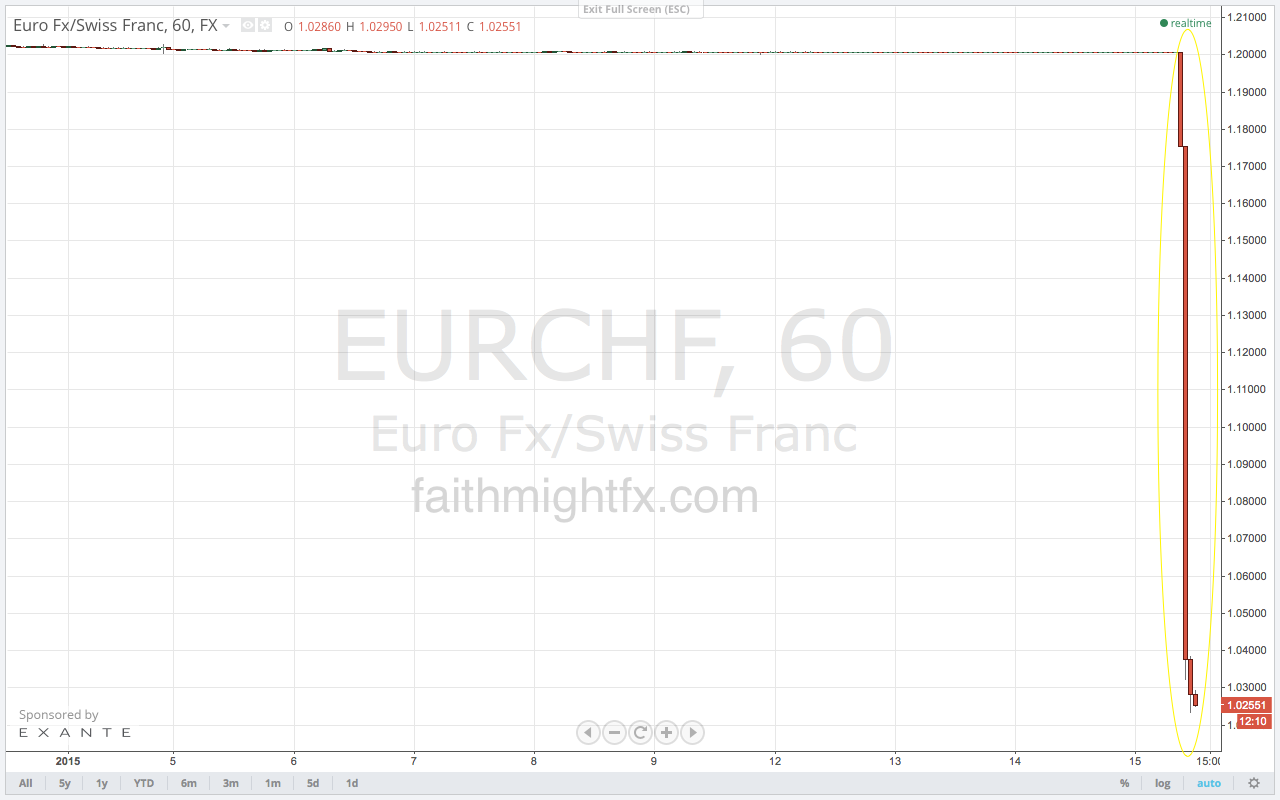

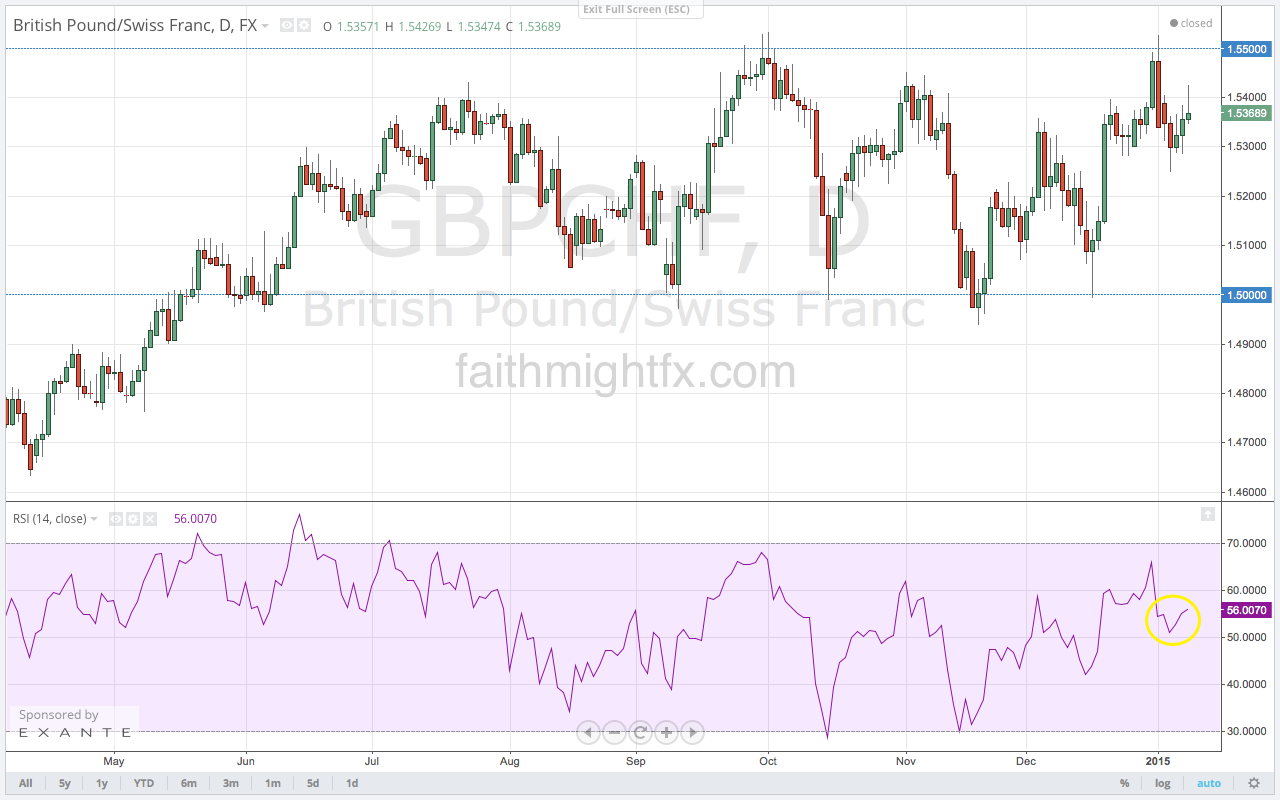

If you are interested in learning how to read and analyze stock & forex charts on your own, please check out the CHARTS101 course. Read the charts for yourself so you can trade what you see and not what I think.