With the entire world in full-blown pandemic, the Federal Reserve has gone above and beyond any other central bank in the world in response to COVID-19. To recap:

- On March 3rd, the Fed surprised markets with an emergency interest rate cut of 50 basis points

- On March 12th, the Fed restarted quantitative easing with QE5 injecting $1.5T into the repo markets

- On March 15th, just 3 days later, the Fed slashed interest rates to 0% (effectively but 0-0.25% technically) and cut the discount rate by 50 more basis points

- These aforementioned actions all occurred outside of the regularly scheduled FOMC meeting that was to be held on March 18th, which was cancelled

- On March 23rd, a week later, opened up QE even more to include ETFs, corporate bonds and an first-time ever lending facility to retail banks for Main Street lending

But what happened to the USD while the Fed was enacting massive unprecedented monetary easing? It strengthened! It may seem incredulous that a currency would rally in the midst of such large injections of liquidity but forex traders can’t ignore the interconnectedness of global markets.

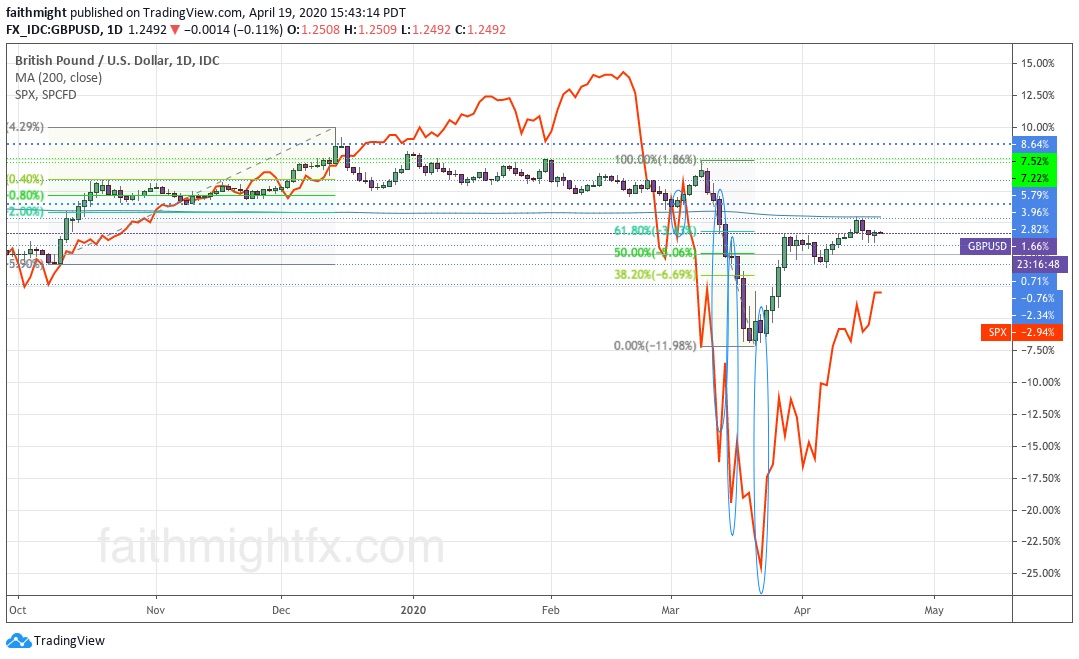

The real reason why the USD rallied in the face of massive monetary easing was due to the vicious selloff in U.S. equities that sparked a global demand for U.S. dollars. Looking at this $GBPUSD daily chart with the $SPX (orange line) overlaid, we can see that the surprise rate cut on March 3rd was met with the expected market response. Market participants sold the USD in the face of what was more aggressive easing action than expected (25bps cut), sooner than expected (at the scheduled March 18th meeting). But as the coronavirus ripped through Europe and reached America’s shores, investors become thoroughly spooked and began selling equities en masse. Therefore each subsequent Fed action only incited more fear thus making equities selloff harder and the USD rally all the more.

The only thing that finally comforted investors was the passage of the CARES Act, America’s multi-trillion dollar stimulus package. Since its passage, we have seen equity markets stabilize and find a (initial) bottom. And with that, the USD has finally got hip to the fact that the Fed has done what was previously unthinkable in America: 0% interest rates, trillions of dollars in liquidity, and the buying of corporate bonds and ETFs. Unbelievable.

The recent USD selloff has seen the $GBPUSD rally break the 61.8% Fibonacci level of cable’s recent descent. This signals a return to the 1.3212 resistance level. However, there a is significant resistance level that must be overcome at 1.2775. And we now are entering earnings season. I think the reaction in equities could be isolated to individual names but will still have an effect on USD demand. Watch for a correction lower in $GBPUSD but, ultimately, cable returns to the 1.3000 level.

Read more:

- The Federal Reserve just pledged asset purchases with no limit to support markets (CNBC)

- Traders Rev Up Bets on Who’s Next After Fed’s Emergency Cut (Bloomberg)

- How the CARES Act Impacts your 401k (FaithmightFX)

If you are interested in learning how I found these levels, please check out CHARTS101 or CHART201 course. Read the charts for your Self so you can invest what you see and not what I think.