It’s been an incredible month. Our first trading month of 2015 is in the books and it did not lack for surprises and drama. Crashing oil prices kicked off volatile trading as the new year began. The Swiss National Bank got things going with their surprise abandonment of their currency peg to the euro and interest rate cut into negative territory. The Bank of Canada surprised markets too with its interest rate cut much sooner than markets expected. The European Central Bank also managed to surprise with a larger than expected quantitative easing package. The Federal Reserve surprised markets too but in the other direction. While it did not make any changes to monetary policy, the $FED remains hawkish following Yellen’s hawkish signals in December. Finally, the Bank of England turned seemingly dovish with its hawks relinquishing their call for interest rate hikes. The incredible drama series that was January certainly sets the stage for a new normal to emerge in 2015.

- The Swiss currency bombshell – cause and effect (Financial Times)

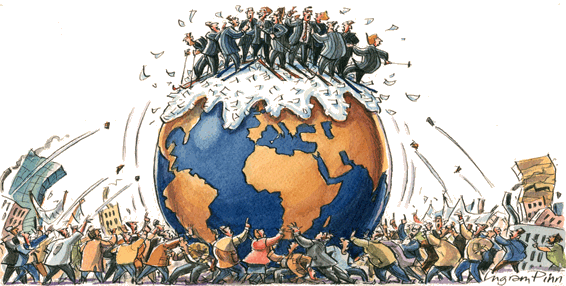

- 2015: The global economy’s ‘sink or swim’ moment (CNN Money)

- Carney-Yellen Neck-and-Neck on Being First to Raise Rates (Bloomberg)

- Fed Waits, RBNZ Shifts (AshrafLaidi.com)

- The Forlorn British Pound: The ‘Schedule’ For Rate Hikes Pushes Out To 2016 (Seeking Alpha)

- Don’t Lose the Forest for the Trees: Dollar Rally Still in Early Days (Traders Log)

Leave a Reply