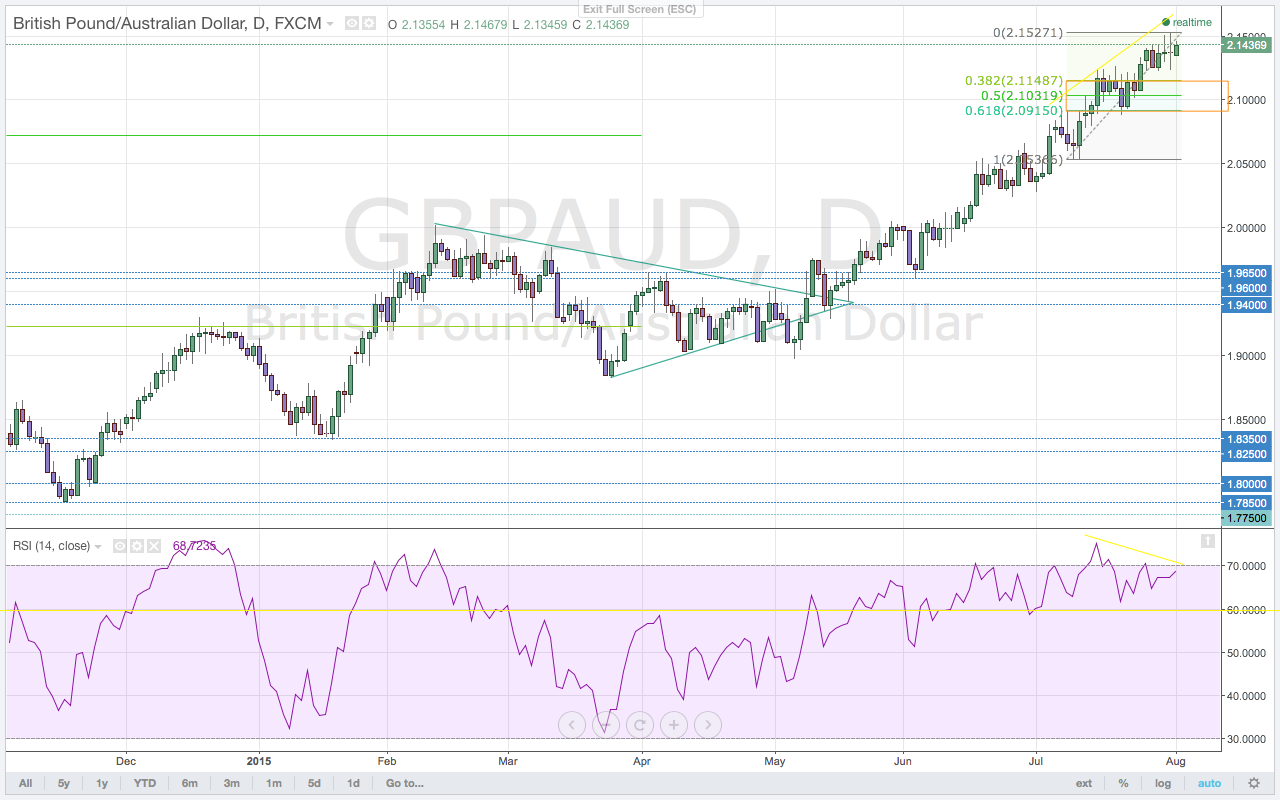

The $GBPAUD daily chart posted this week is the clear winner.

I like the Reserve Bank of Australia (RBA). They have actually been neutral for weeks. It’s not their fault that their stance against any more accomdative easing this year fell on deaf ears. Blame commodities. Buyers have been fixated on commodity markets. As commodities, including copper and iron ore, crashed into bear markets, forex traders sold AUD in like manner. The $GBPAUD rallied over 20,000 pips. Since MAY. That’s an incredible bull rally, by an measure. Markets simply ignored the RBA. Until this week. Monetary policy action and the statement this week showed an adamant central bank in their stand to allow the interest rate cuts this year to do their work. The RBA even appreciates the weak AUD. It bolsters domestic demand in the face of slowing exports. So no complaints there. Unlike their counterparts in Switzerland, the RBA is happy to have traders do their dirty work. Smart.

The price action and close this week do serious technical damage to this chart right here.

This chart is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.

Leave a Reply