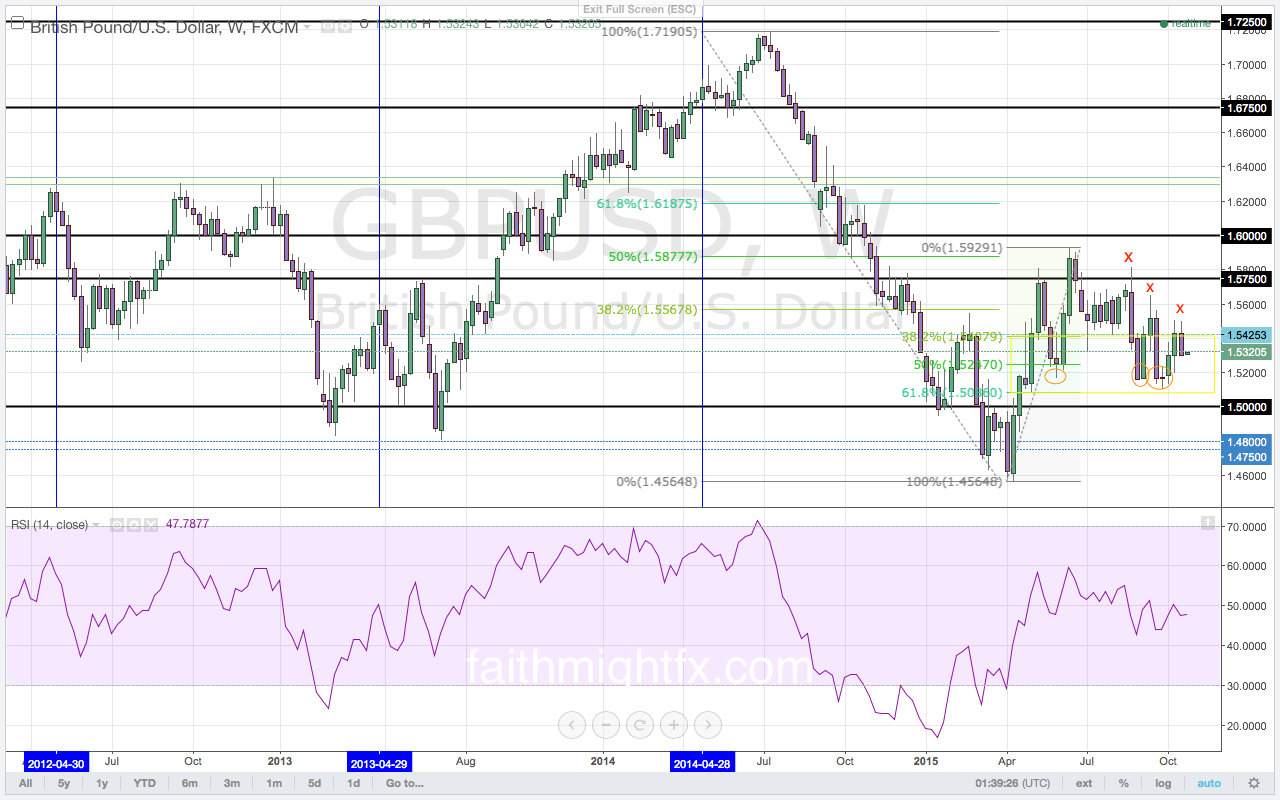

The USD found renewed strength last week as the ECB and PBoC ease monetary policy further. The new failed high on the breakout rally from 1.5109 to 1.5507 signaled a move back to the 1.5162 support level. A move to the downside is first met by the 1.5250, now turned, support level. A move lower in the $GBPUSD will be largely dictated by the moves in the S&P 500. If equities continue to advance, it is more likely that the USD weakens yet again sending the $GBPUSD to rally. Today’s release of the core PCE price index has markets back to expecting the first Federal Reserve interest rate hike to take place after June 2016. Risk appetite returning to markets on the back of S&P 500 strength has also added to USD woes. TWith risk appetite returning to markets on the back of S&P 500 strength, however, the USD strength has not been sustainable.

Outlook for the week:…

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.

Leave a Reply