The new trading week has been very busy out of the UK this week. Inflation may be heating up in both regular pay wages and consumer prices. Perhaps the accelerated weakness in the Great British pound may start to feed inflation as the increasing price of imports may be passed on to consumers. Additionally, the low exchange rate may also forces companies to raise wages to keep up with this rising price of goods and services. The PMI numbers that had trended below the 50.0-threshold level earlier in the year have started to recover. The October releases revealed robust PMI numbers in all sectors of the economy. It will be interesting if this recovery in the PMI numbers this month will persist. If so, building strength may allow the Great British pound downtrend to finally correct in the short-term. Any strength in sterling, however, is expected to be temporary.

After weeks of decline and new, multi-year lows, the Great British pound has staged a correction. Depending on your chart, it has been impressive and not so impressive all at the same time. But it has been a correction nonetheless. And it has allowed swing traders to reset short positions as currency pairs like the $GBPNZD and $GBPUSD trade at essentially all-time, low levels.

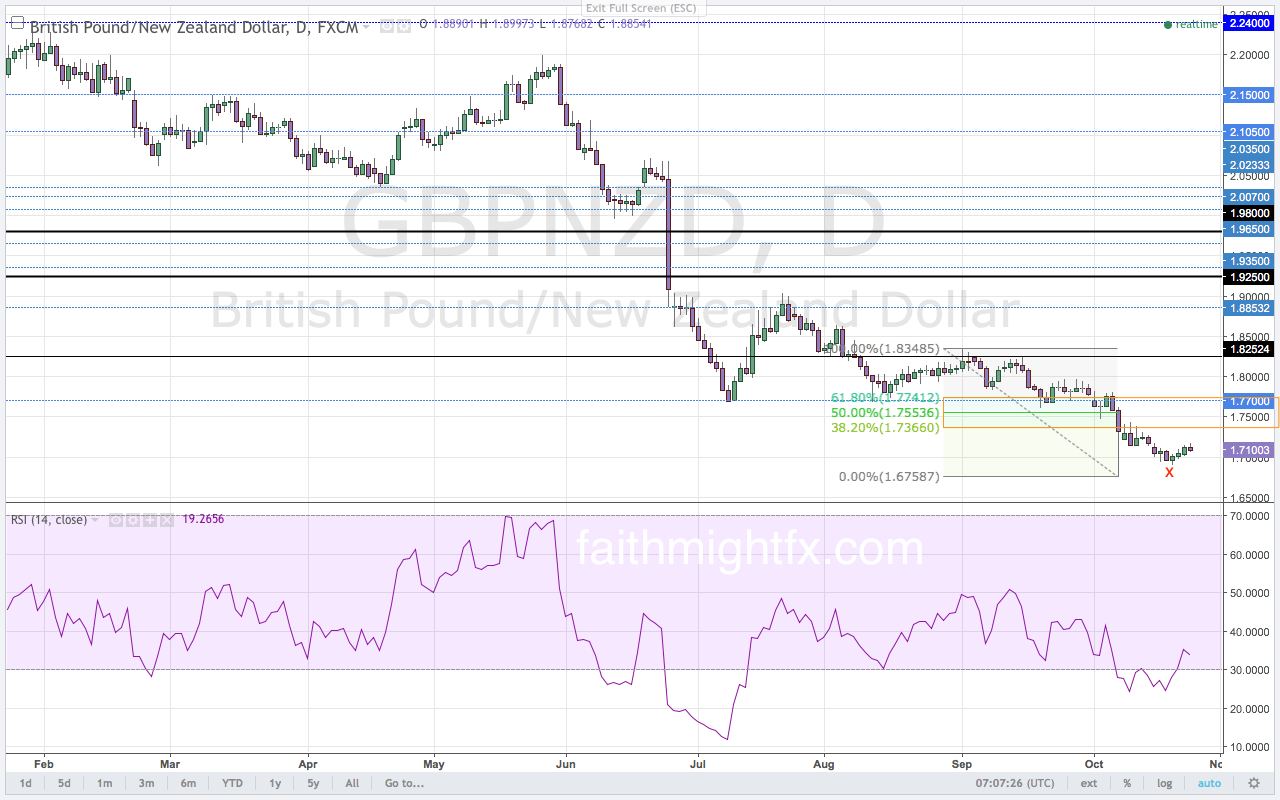

This Friday close is the third consecutive weekly close below the major 1.7702-support level. This is the first time there have been consecutive bearish closes below the 1.7702-level on any timeframe (Volume 79). However, with building bullish momentum on the RSI of the daily chart, the $GBPNZD may stage a correction off the lows. The failed low of last week also signals a bullish move higher.

The highs this week have not been able to get quite as high at the Fibonacci levels. And that failure is actually evidence of the strong bear trend in the $GBPNZD.

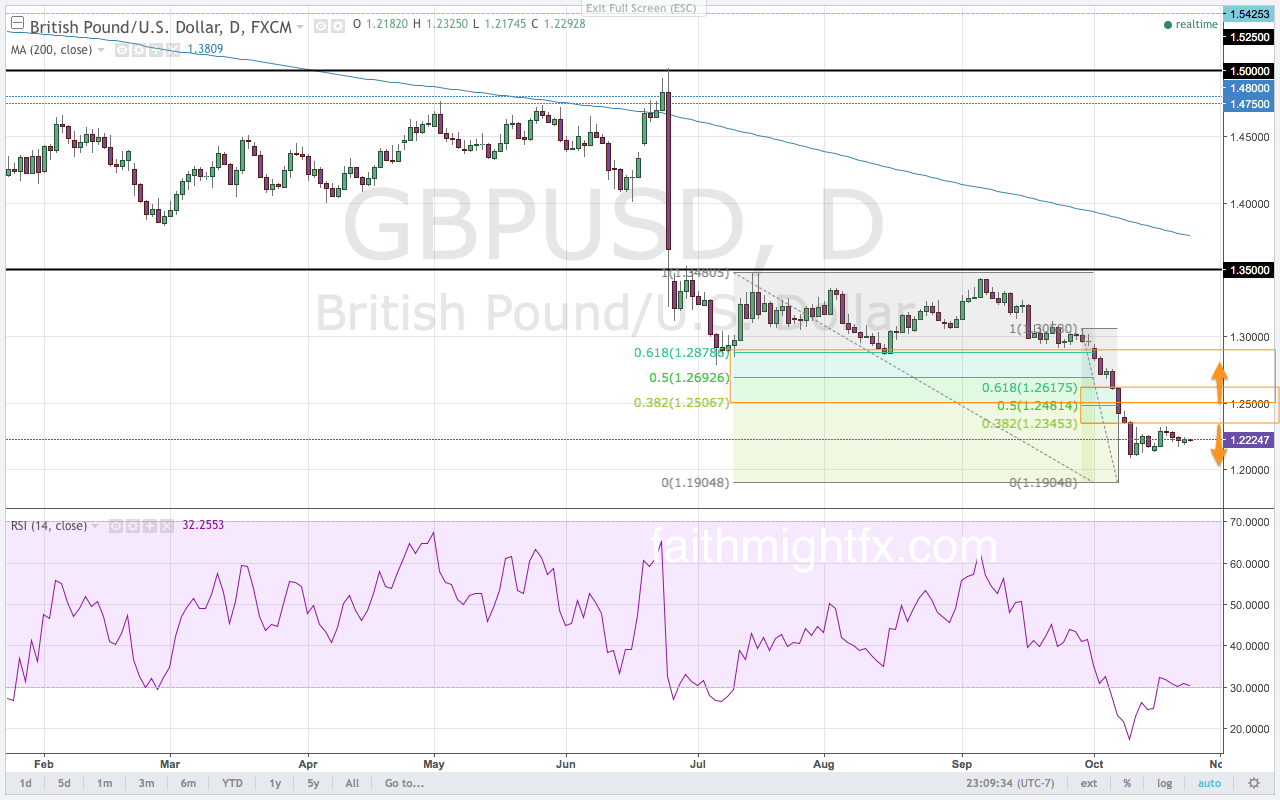

The $GBPUSD currently trades at levels not seen since 1985. As such, there is very little technical support at these price levels. However, the $GBPUSD has started to forge out minor support at the 1.2160, 1.2154 and 1.2132 levels. This support zone seems to have stalled selling in cable for the time being. Without a close below the 1.2000-psychological level, the $GBPUSD begins to build bullish sentiment in the very short-term.

Cable has been coiling between the 1.2350 and 1.2100 levels since the flash crash. While the defense of those 1.2089 lows this week emboldened bulls, it has not been enough to spark a rally to the psychological level at 1.2500. This failure keeps the $GBPUSD bearish despite the rally off the new lows this week.

All in all, sellers continue to show up at the highs. The rally has totally underwhelmed. Only against the JPY has the correction moved as high as expected. While there could be an argument that Brexit woes and implications are already priced into the market, price action seems to indicate otherwise. With these currency pairs trading at these low levels, the GBP has the certain potential to move lower still…until it doesn’t. Be careful out there. Don’t chase the price action!

All quotes and charts taken from this week’s Quid Report, Volume 82. Full report has trade setups and includes more currency pairs.