Since the beginning of August 2023, many investors have begun to count their loses following the global market plunge. On Monday, August 5, stock prices crashed across several economies. Investors were worried about a potential recession and the knock-on effects from the unwind of the yen carry trade.

As of Monday, the 5th, West Texas Intermediate crude oil fell 0.97% to $72.81 a barrel. For Brent crude, the international benchmark, declined 0.90% to $76.12 a barrel. Gold was lower by 1.51% to $2,432.40 per ounce. The 10-year Treasury yield dropped 9 basis points to 3.70%. Bitcoin plunged 14.2% to $49,846.

FTSE 100 closed down to register its biggest drop in more than a year. Overnight, Japan’s stock market suffered its heaviest loss since 1987.

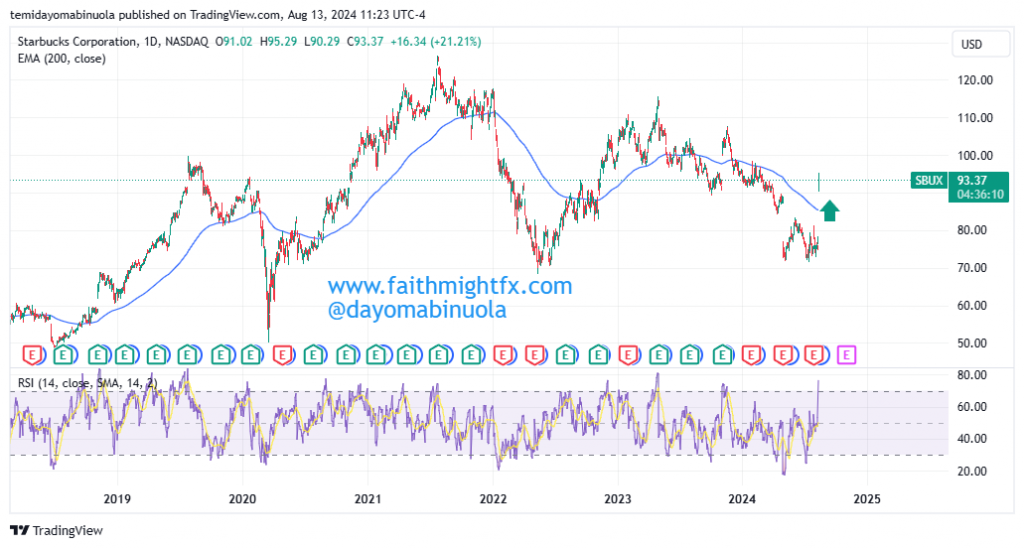

With all of these occurrences last week, the stock market is beginning to recover its losses. As of the time of this writing, Starbucks has gained 22% today, PACs Group has gained 14.50%, Tesla 3.85%, SPX 1.05% in just a single trading day. There is a possibility this rally will continue this quarter, i.e. we expect prices to maintain an upward trend for the rest of August and through September.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here

Leave a Reply