Boeing is currently navigating a period of regulatory scrutiny and operational hurdles, primarily centered around its 737 MAX aircraft production. The Federal Aviation Administration (FAA) has imposed a cap on the production rate of the 737 MAX series, limiting it to 38 aircraft per month. This decision comes from ongoing quality control concerns, notably following a mid-air incident in January 2024 involving an Alaska Airlines 737 MAX 9, where a door plug detached during flight.

Boeing has launched a safety and quality improvement plan involving better employee training, tighter supplier oversight, and more rigorous inspections. However, the FAA will keep the production cap in place until Boeing consistently meets top safety and quality standards.

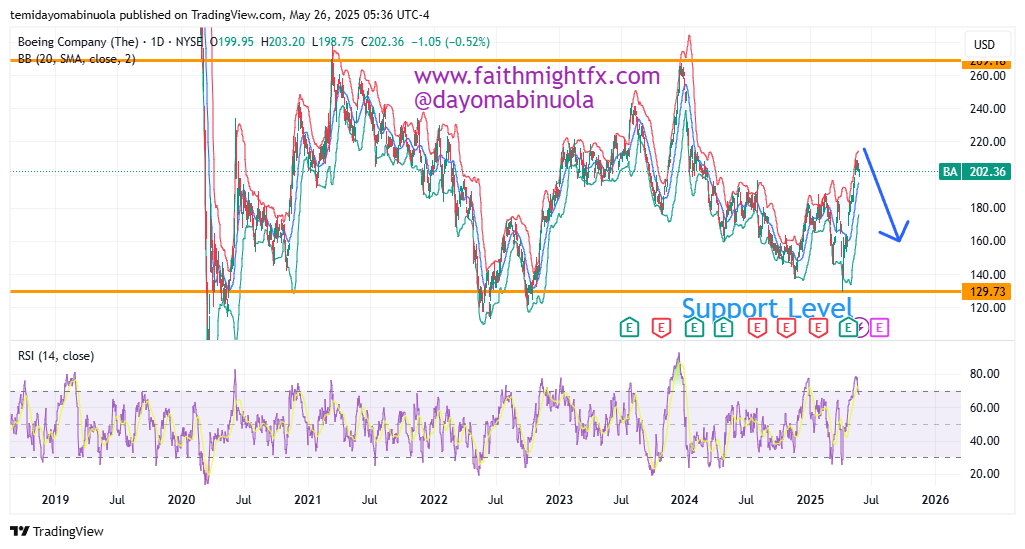

As of May 23, 2025, Boeing’s stock price closed at $202.36, down 0.52% from the previous day’s close of $203.41. The stock traded within a daily range of $198.75 to $203.20, with an opening price of $199.95. Over the past 52 weeks, the stock has ranged from a low of $128.88 to a high of $209.66. Boeing’s market capitalization is approximately $154.76 billion, with 754.01 million shares outstanding.

If regulatory scrutiny is fully enforced, Boeing’s stock price, currently at $202.36, could drop to $135 in the coming weeks. Price is overbought on the daily chart.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stock in your portfolio? Schedule a meeting with us here

Leave a Reply