In an unexpected move yesterday, the $FED began the taper by reducing quantitative easing by $10 billion dollars. It was Bernanke’s last meeting and he couldn’t go out a liar. He said he would taper and he did. The caveat, however, is that forward guidance got stronger by upping the ante on unemployment. Conveniently, it set the unemployment threshold at 6.5% which is the level Janet Yellen stated during her confirmation hearing a couple months ago.

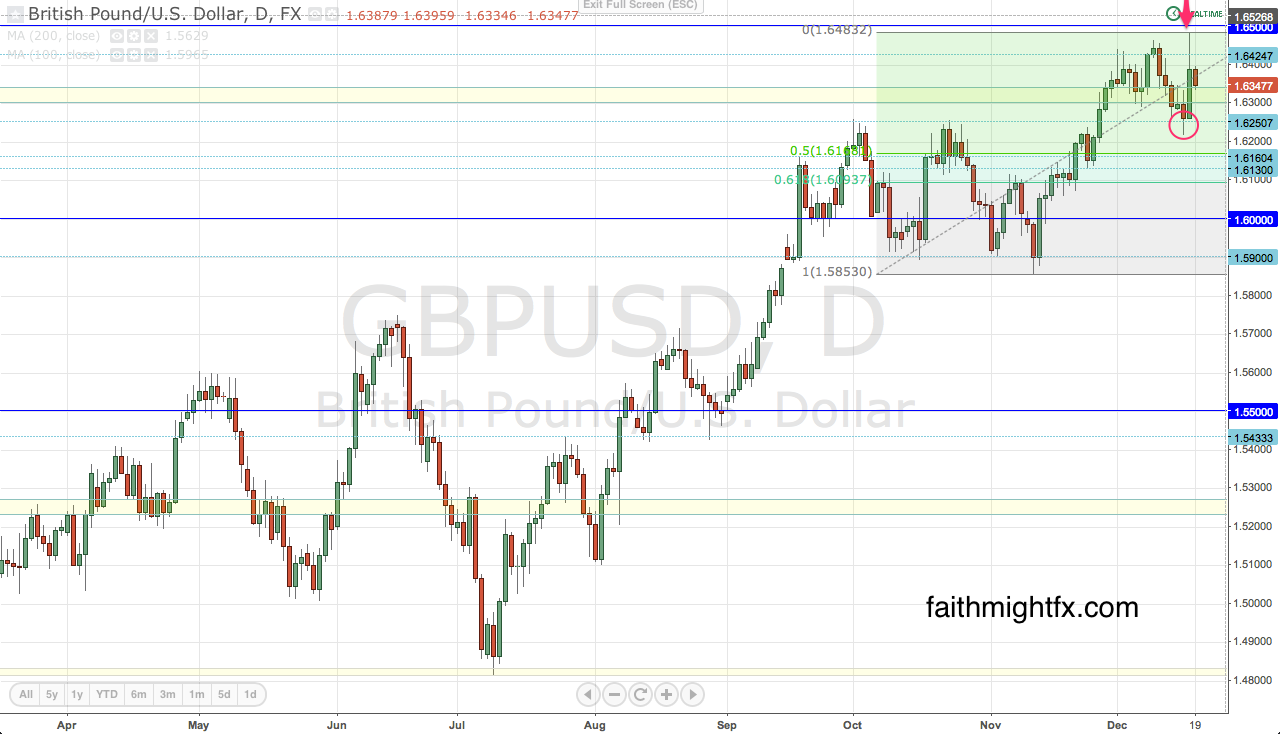

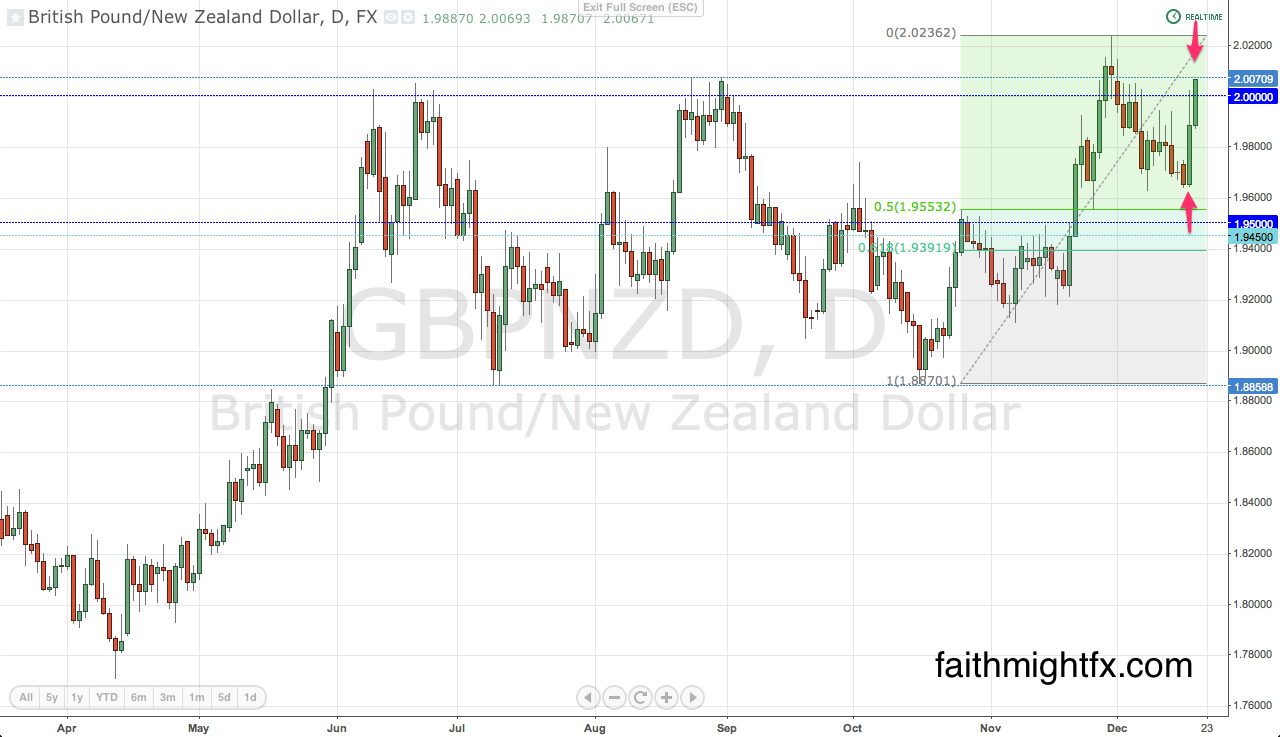

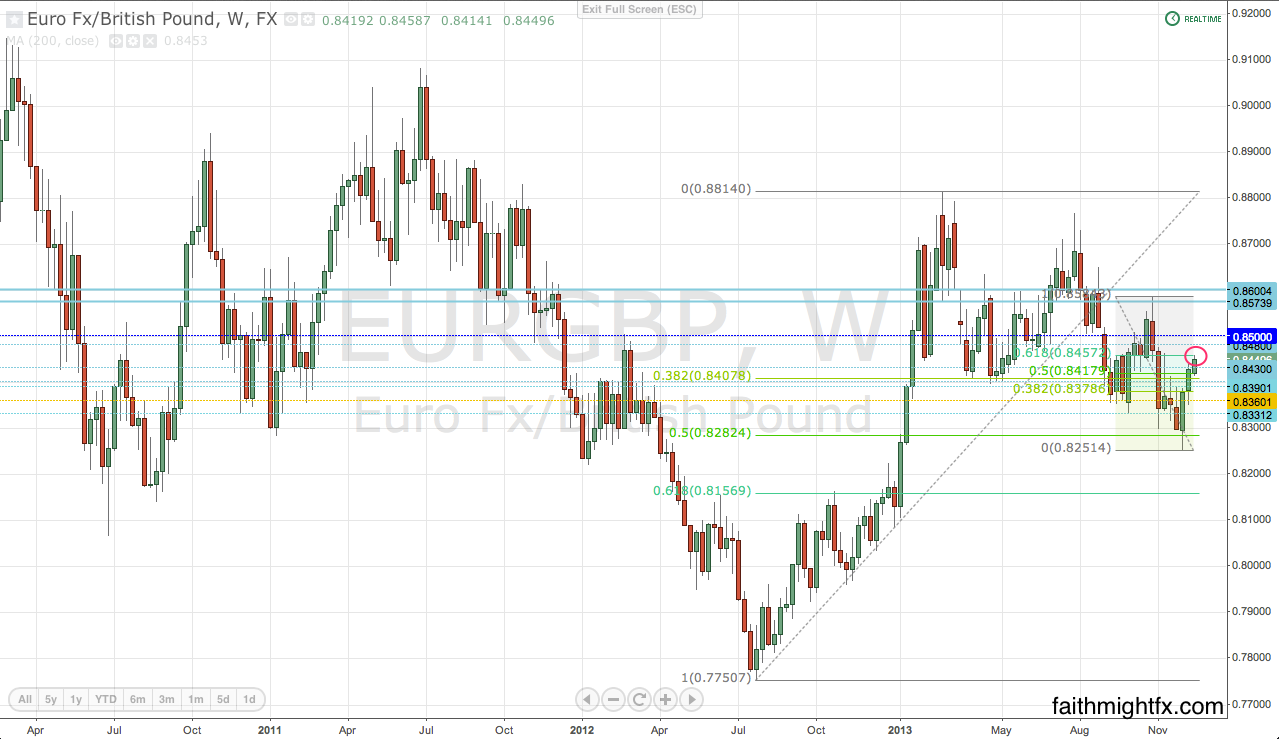

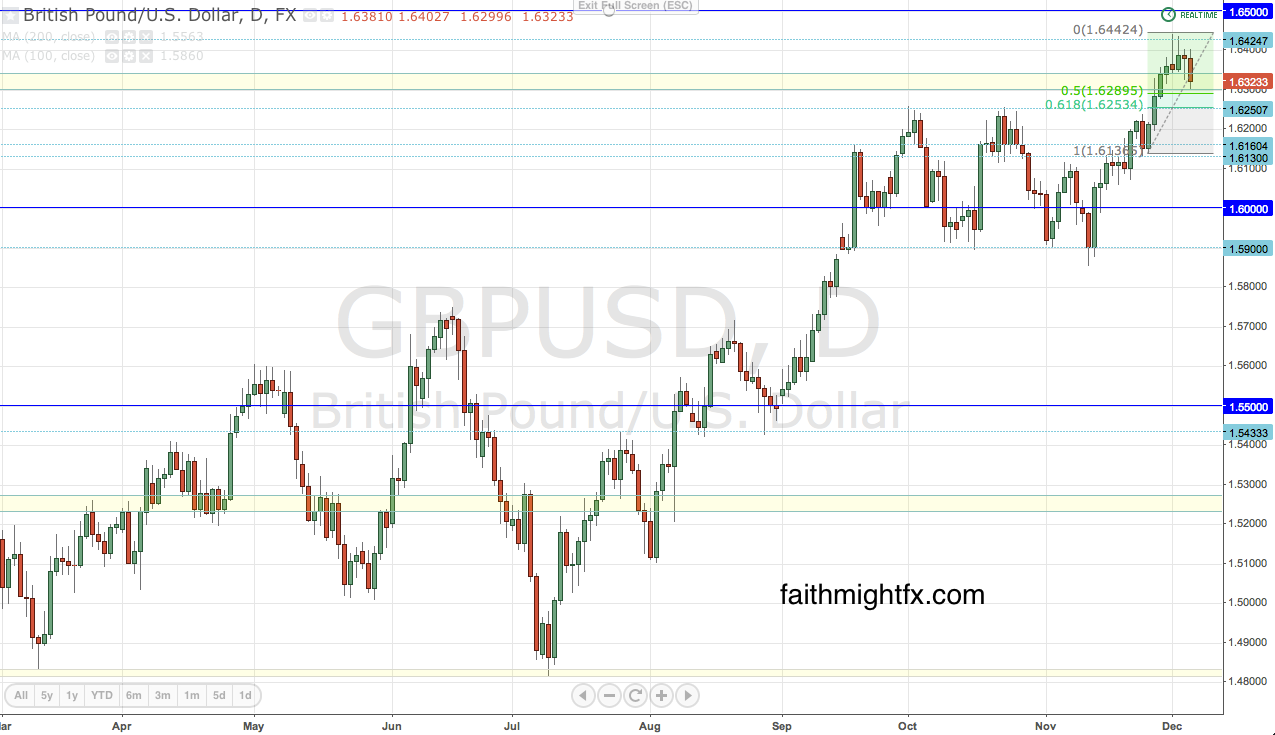

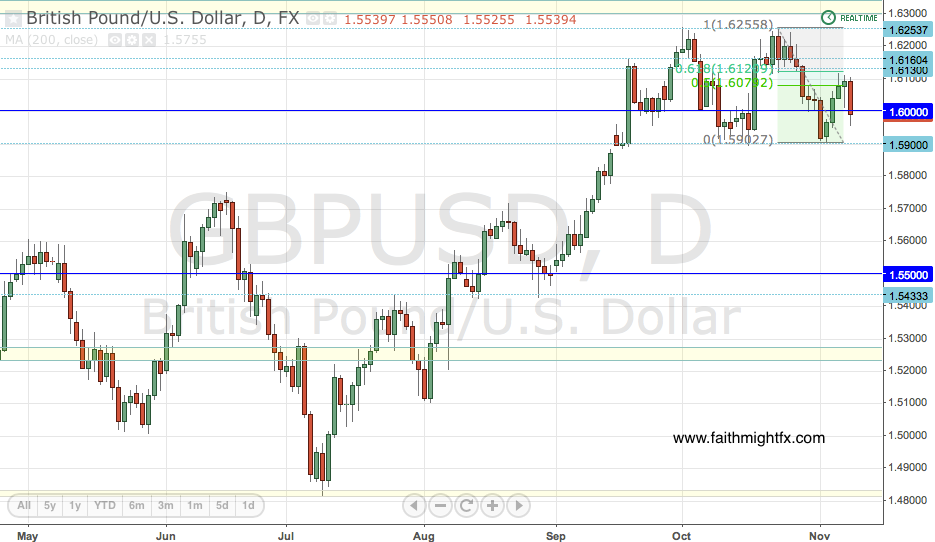

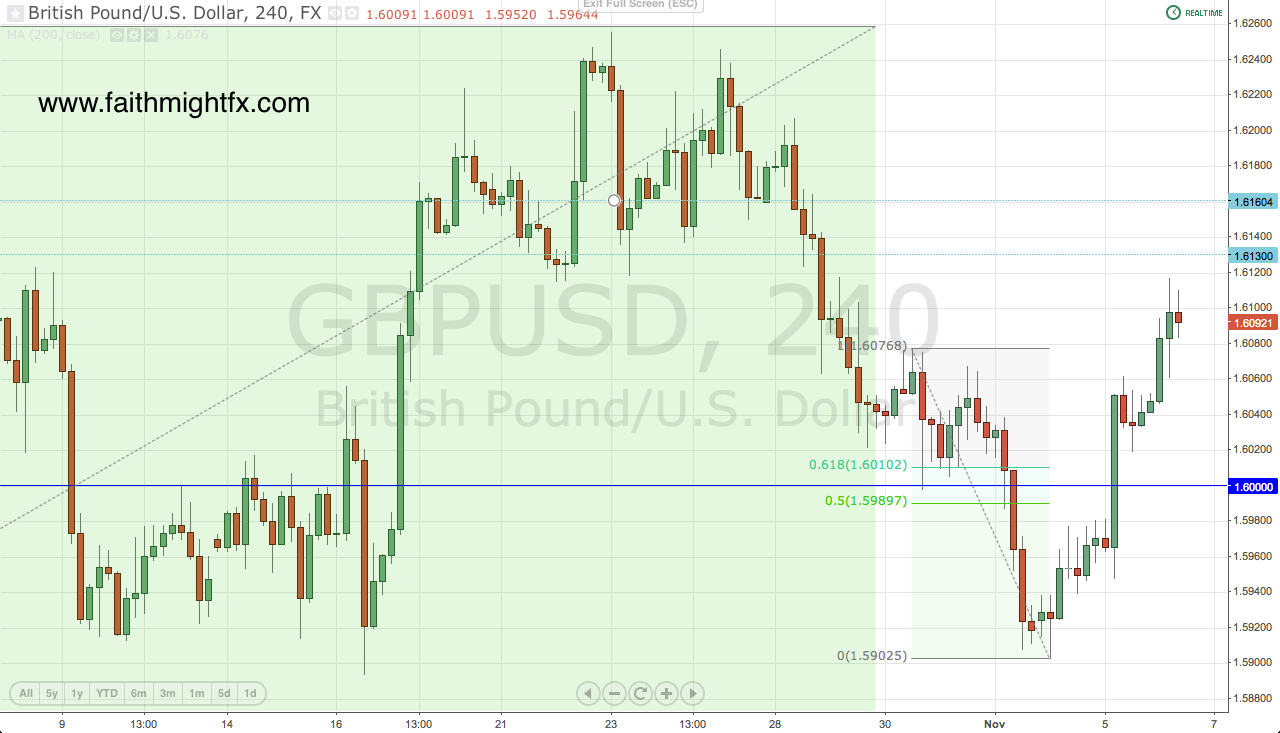

Prior to the $FED’s announcement, the GBP was seeing a pullback pretty much across the board. That dynamic has changed. USD strength can now build as the $FED is the 1st QE-wielding central bank to reduce such operations. We see this central bank divergence playing out already in the $EURUSD and the $GBPUSD. Additionally, this USD strength will weaken commodities and we can see that playing out as $GBPNZD resumes its rally.

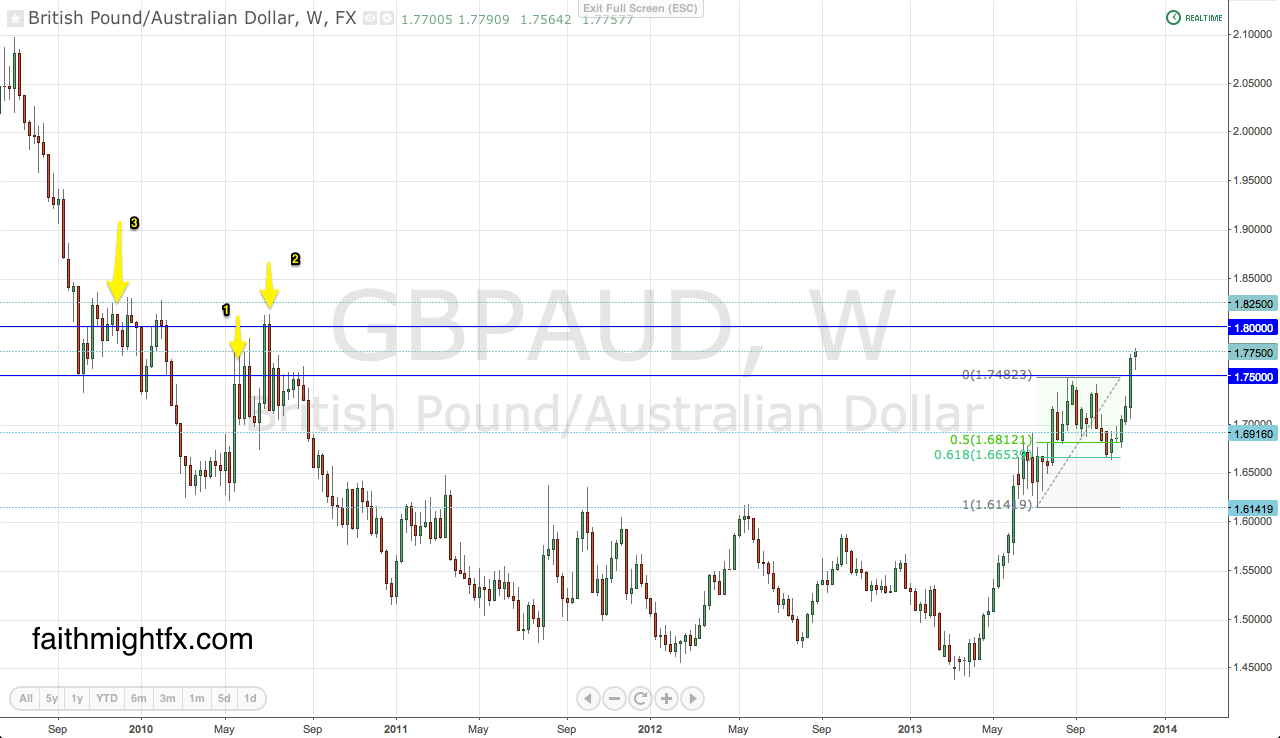

As such my outlook has changed in the $GBPNZD while I still remain bearish GBP near term in the $GBPUSD and $EURGBP. Yesterday’s pop in sterling has allowed for good opportunity to short GBP while hovering around the 2.00 level remains a great buy opportunity in $GBPNZD. $GBPAUD remains on my no-trade list (see why).

$GBPUSD

$EURGBP

$GBPNZD

Read also:

- Central Bank Tailspin (FaithMightFX)

- Stocks soar to record highs after Fed taper move (CBS Money Watch)