This week is the best week so far for Apple since the beginning of the year. The share price appreciated on Wednesday by over 2.8%. It has been up 8% this week and about 6% this month. The supply chain shortages are getting worse though as Apple completely stops iPhone production in China for the first time in a decade.

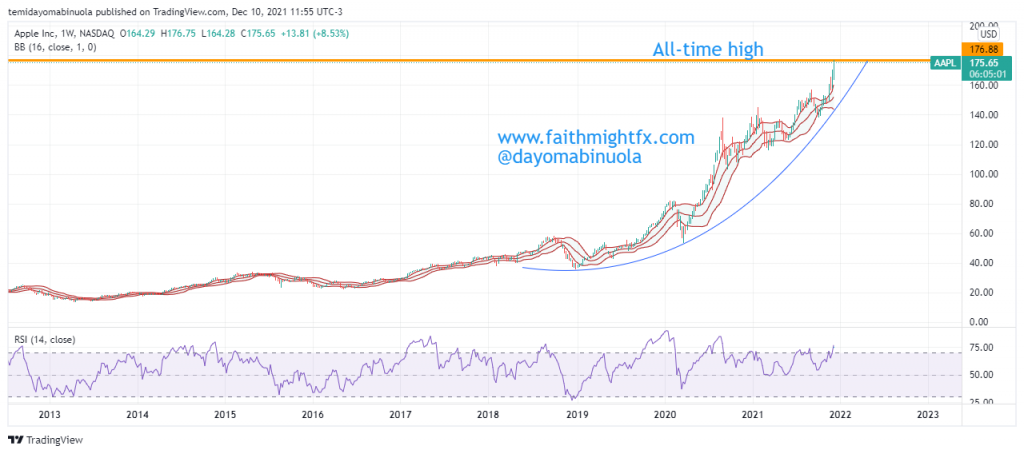

Just like many other stocks, Apple’s share price dipped during the lockdown from then $81.53 to $53.65, which was a 34% loss in value at that time. As the lockdown was eased last year, the price has continued to rally from the lowest price level at $53.65 to a new all-time high this month at $176.65. That is over 2X gain since the ease of lockdown. The last year has been the best year for the Apple investors as more gains are made. The current market cap for Apple is $2.86 trillion. Apple could be the first company to reach the $3trillion market cap.

Now that Apple has completely stopped the production of Iphones in China, this might lead to the share price taking a break from the rally. Apple has been sued over Apple watch defect that poses hazards to customers. RSI has shown that the price has been overbought twice between November and December. Price is currently in the upper region of the Bollinger bands, a correction might occur if the Omicron virus poses a major threat to the global populace.

Some of these ideas are in our clients’ portfolios. To understand which ones can work for you or for help to invest for your own wealth, talk to our advisors at FM Capital Group. Would you like more information on Investment Advisory, Portfolio Services, and VC? Schedule a meeting with us here.