Nvidia Corporation is one of the largest developers of graphics processors and chipsets for personal computers and game consoles. The head office is in Santa Clara, California. NVIDIA Corporation does not have its own manufacturing facilities and therefore works according to the fabless principle.

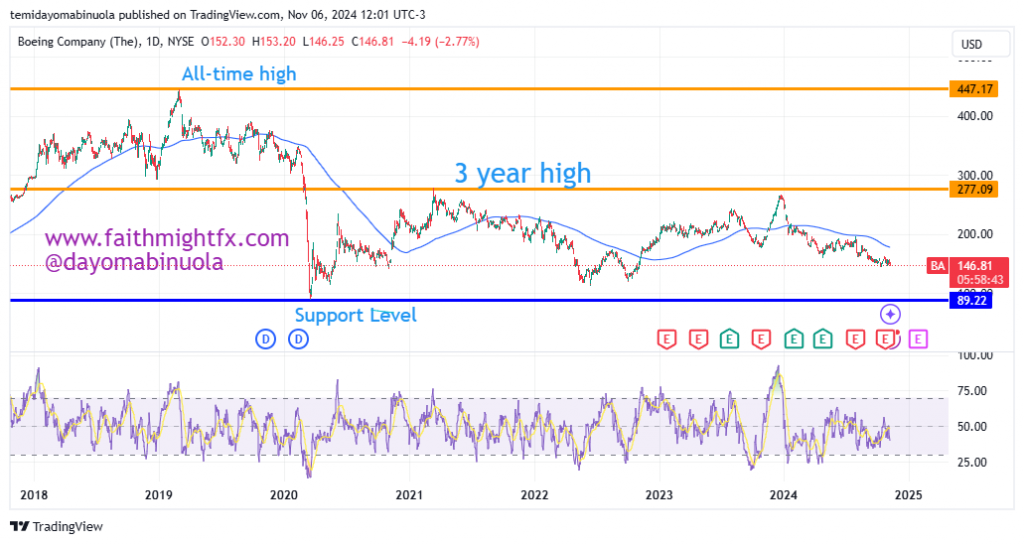

Nvidia is the second most valuable company after Apple as of today, with a market cap at $3.497 trillion. In the last one year, Nvidia has gained with 167.96%. Before the close of market yesterday, Nvidia reached an all-time high of $153.13 but subsequently declined by 6.2%, closing at $140.14. This fluctuation followed CEO Jensen Huang’s keynote at CES 2025, where he introduced the GeForce RTX 50-series gaming chips. Despite these advancements, some investors were disappointed by the lack of immediate AI and robotics innovations, contributing to the stock’s decline.

Many analysts rate NVIDIA as a “Buy”, with ambitious price targets due to its innovation and growth trajectory. Price might fall to $133 in the coming weeks, which could be an indication of a buying level for Nvidia Investors. RSI on the four-hour chart shows price has been overbought, this could be an indication for a continued temporary fall in price.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here