It seems the second half of this year will bring a lot of hope for investors as the monthly candlesticks for July and August ended in profits. Since Coinbase’s IPO in April 2021, Investors from the IPO day have had no cause to smile to the bank. All monthly candlesticks have closed below the IPO price at $380. The 2021 lowest price was at $201, which was in May 2021. Each time the share price tried to rally, it was counteracted by the efforts of the bears.

The opening price for this year was at $258. Price went lower to reach an all-time low at $42 in May 2022. Coinbase is the second largest Crypto exchange company in the world with over $1.4million worth of transactions done daily. On the 9th of September, the coinbase shares opened with a gap up at $78 from the previous day of $72. After that gap up, the market closed at $80.87.

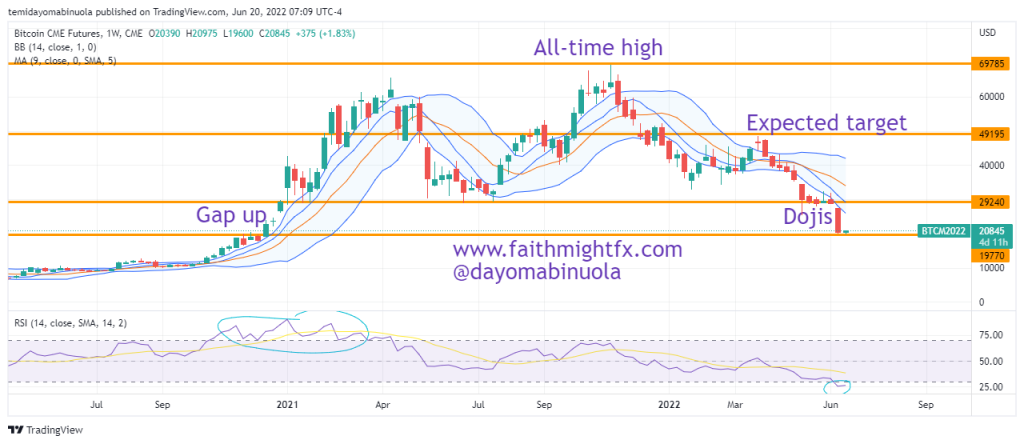

On the monthly chart, there is an inverted hammer and a doji towards the support level around $42. As investors are hopeful for an appreciation in the price of $COIN due to increased acceptability of crypto assets in the world, we should be seeing a rally in the share price of Coinbase in the coming months. The psychological level of $100 might be reached before the end of this year. The RSI shows that the weekly and monthly charts have been oversold, an indication for a possible rally.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here