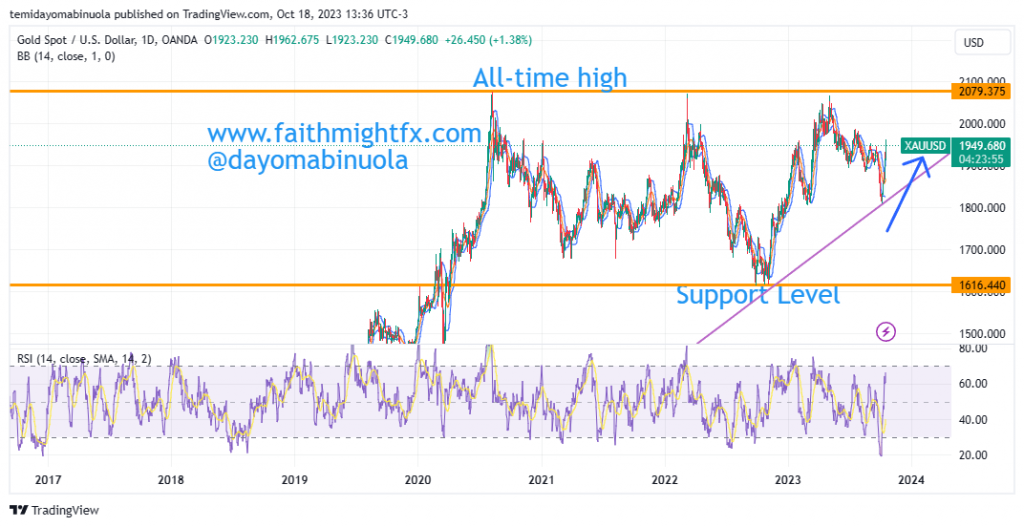

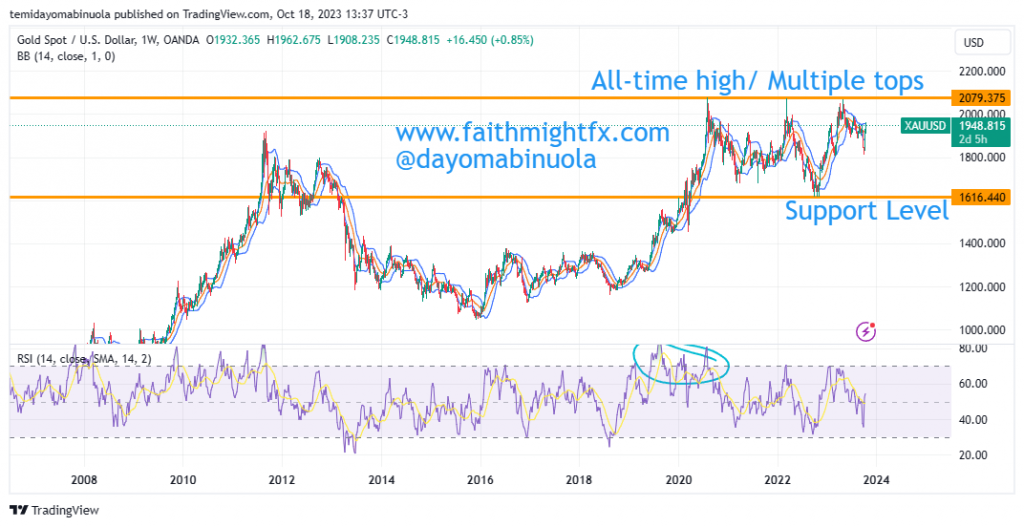

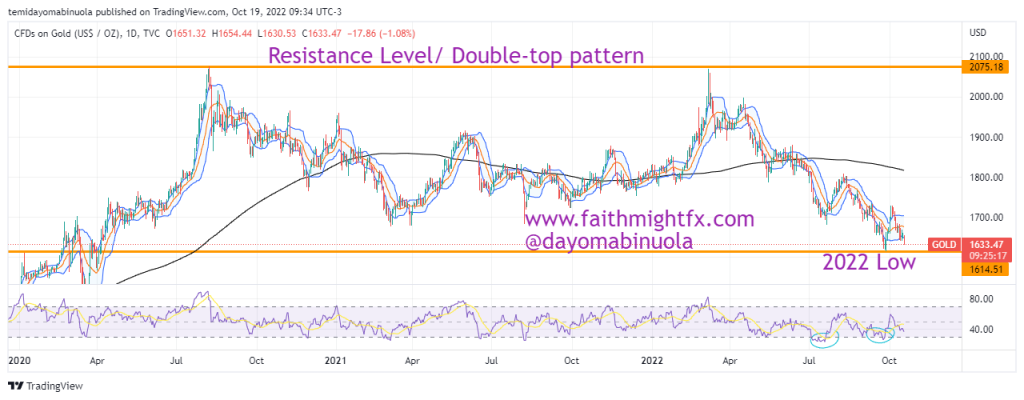

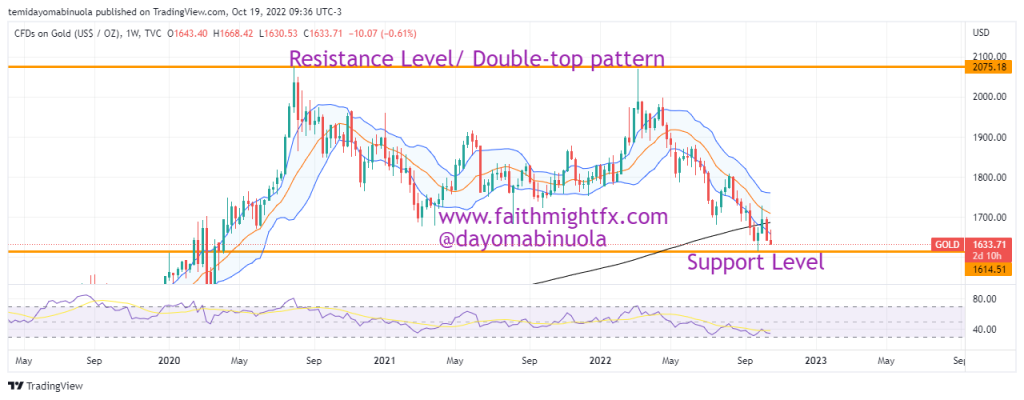

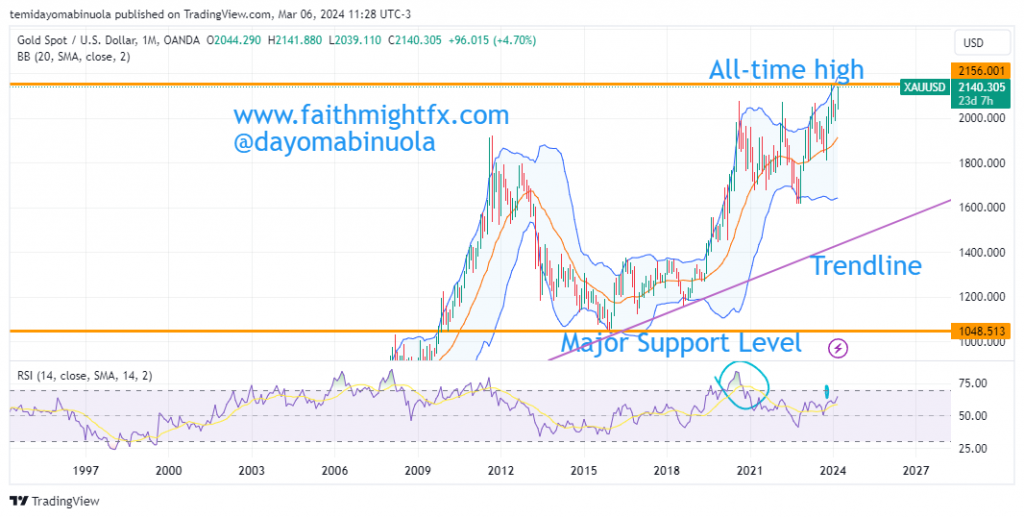

The commodity price has been increasing for about a decade despite the uncertainties in the financial market. The lowest price of XAUUSD was $1048 in December 2015. The price has rallied to $2141 per ounce in December 2023. Unlike many other asset classes during the lockdown, the price of gold rose to $2074 per ounce in September 2020. The bears took over as price fell to $1622 in September 2022, which stands as the lowest price since April 2020.

At the time price of XAUUSD was at $2074, RSI was at an overbought position. The price of Gold broke out of the previous resistance level to reach $2141, which currently is the all-time high of gold. There was a price retracement in January and February 2024 that made price fall to $1985 before price rallied again above $2000 in the last week of February. As a result of the bullish momentum, the price of gold might break a new all-time high at $2150 in the coming days or weeks.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get commodities in your portfolio? Schedule a meeting with us here