On March 31, 2025, the Dow Jones Industrial Average rose by 417.86 points, 1% to close at 42,001.76. This uptick occurred despite global market apprehensions regarding impending tariffs set to be implemented on April 2, referred to as “Liberation Day” by President Trump.

President Trump announced sweeping tariffs, including a 10% baseline tariff on all imports, with additional reciprocal tariffs targeting specific countries—34% on Chinese imports and 20% on European Union imports. These measures were scheduled to take effect on April 9.

In reaction to the tariff announcement, the Dow Jones fell about 1,700 points which was 3.98%. The S&P 500 and Nasdaq Composite also experienced significant declines, with losses of 6.65% and 5.8%, respectively. This marked one of the most substantial selloffs since the onset of the COVID-19 pandemic. On April 4, The DJI experienced its third-largest one-day point decline on record, shedding 2,231 points which is about 5.5%.

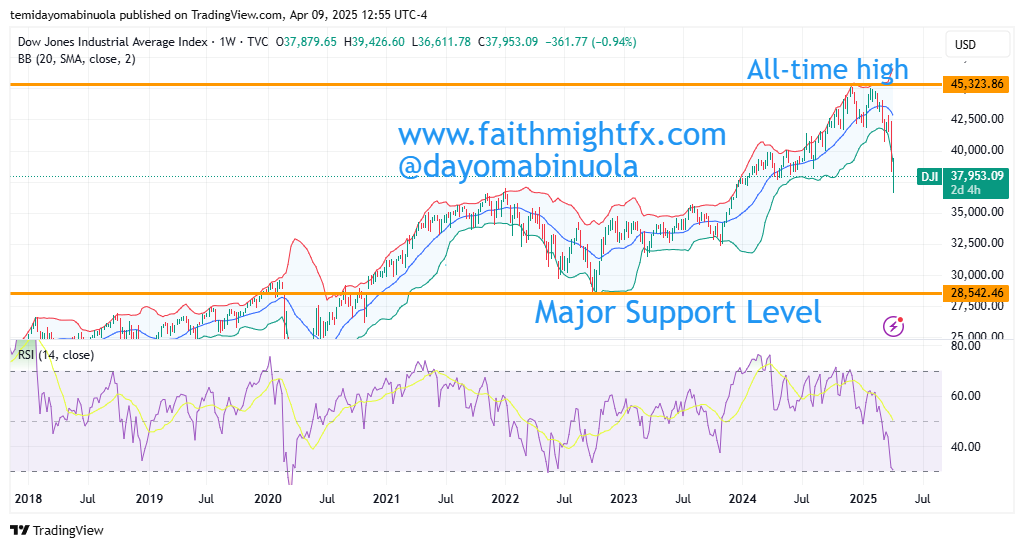

On the weekly chart, RSI has been overbought since the first week in December. As the price keeps falling, RSI could reach the oversold region. The current price of Dow Jones is 37,859 as at the time of this writing. Price might continue to fall in the next few weeks as price could hit 36,000.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stock indices in your portfolio? Schedule a meeting with us here