GameStop ($GME) is an American video game, consumer electronics, and gaming merchandise retailer. The company is headquartered in Texas, USA. GameStop is the largest video game retailer in the world. GameStop was founded 39 years ago. As of January 2023, GameStop had 4,413 locations. The revenue as of 2022 was at $5.93billion. In 2022, $GME had a full-time employee strength of 11,000; and 14,000-27,000 part time employees as of January 2023.

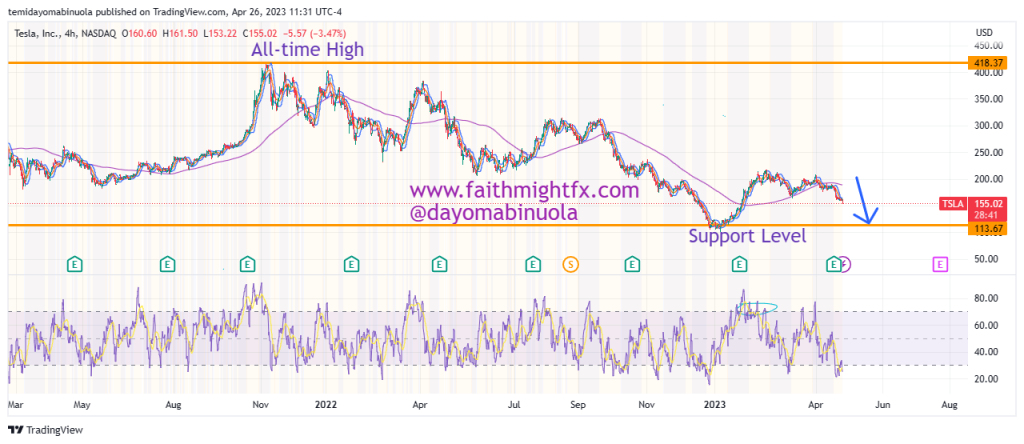

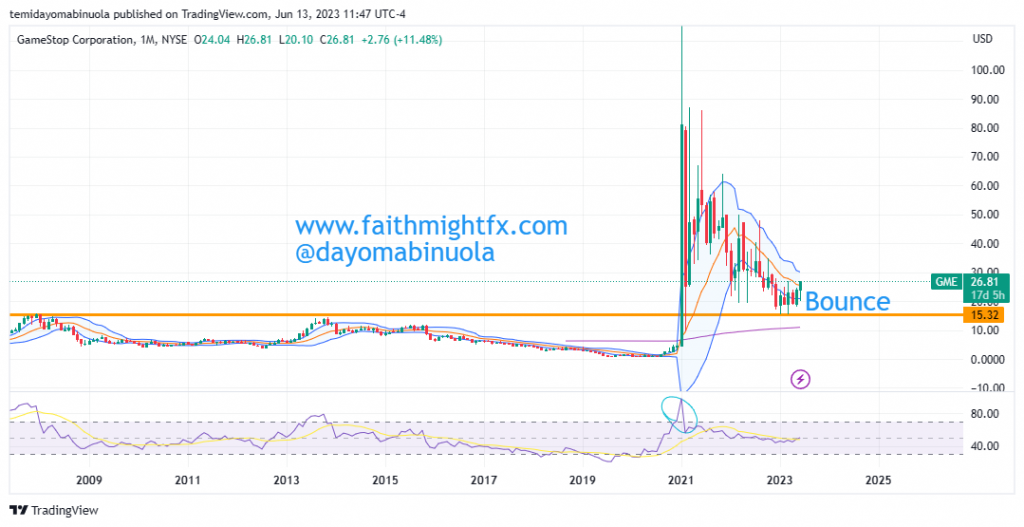

On the 8th of June, a gap-down occurred but as of the 12th of June 2023, a rally occurred to close up the gap-down. On that day, $GME opened at $22.85 and closed at $24.30 i.e. $GME gained 7.14% in a single trading day. However, our analysis forecasts that $GME bears will take control of the price movement regardless of the recent rally. The price of GameStop might fall from the current price of $25.80 to $17.62 in the coming weeks.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.