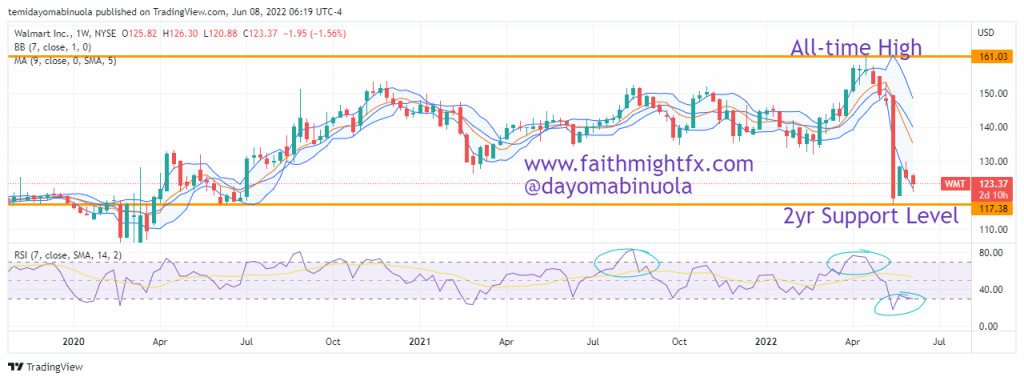

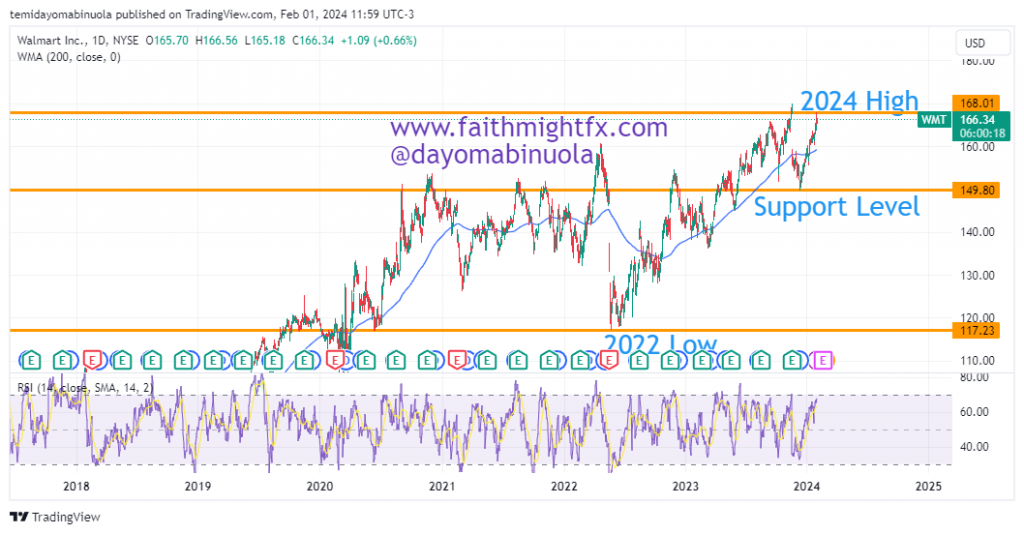

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets (also called supercenters), discount department stores, and grocery stores in the United States. Walmart reached an all-time high at $170 per share on 15 November 2023. After the all-time high, there was a gap down, which made the price of $WMT reach $158.69. The price continued to fall to $149.55 on 11 December 2023, which is currently a support level.

From the support level in December 2023, price rallied to the 2024 high at $167.95. On the 30th of January, Walmart announced that it will conduct a split of its outstanding shares of common stock at a ratio of 3:1. That same day, the price of $WMT closed at $165.64. The opening price the following day was $167.95 which indicated that a gap-up had occurred. The stock split is part of Walmart’s ongoing review of optimal trading and spread levels and its desire for its associates to feel that purchasing shares is easily within reach. We might see the price of $WMT at $150 in the coming weeks.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stock in your portfolio? Schedule a meeting with us here