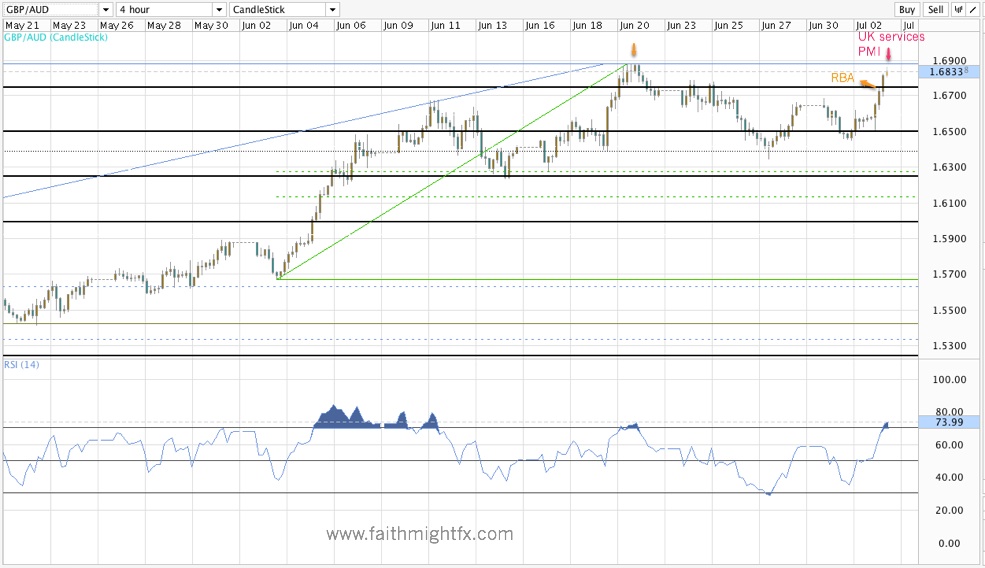

$GBPAUD ripped higher on the back of a AUD weakness-GBP strength double whammy. During the Asian session overnight, the Reserve Bank of Australia Governor Glenn Stevens jawboned the Aussie off a cliff. In fact, the market is now pricing in an increased 60% chance of a RBA rate cut in August. As a result, the AUD was throttled across the board allowing the $GBPAUD to rally to 1.6750. Then UK services PMI surprised to the upside and further carried the $GBPAUD to new highs at 1.6858.

With this news-induced rally, one would anticipate that the $GBPAUD would have broken to new highs on the daily chart. After all, the fundamentals just laid out should support such a breakout. The $AUDUSD certainly did break down to lows not seen in 3 years. The $GBPUSD found a bottom at new lows to break above 1.6250 resistance that had capped price all week. And yet we find the $GBPAUD struggling to take out the top at 1.6877. Perhaps the market awaits the BoE decision tomorrow. Perhaps the market will wait for the 4th of July holiday to pass. Whatever the reason, bulls should be cautious. This rally is looking exhausted with the weekly chart is still working out overbought conditions. All of which makes the $GBPAUD very toppish at these levels.

Mentioned above:

- Chances of an RBA rate cut at the August meeting now at 57% (Forex Live)

- Reserve Bank of Australia head Stevens: Australian dollar was ‘somewhat too high for a period’ (Forex Live) [full speech]

- GBP/AUD Finds A Top (FMFX)

Leave a Reply