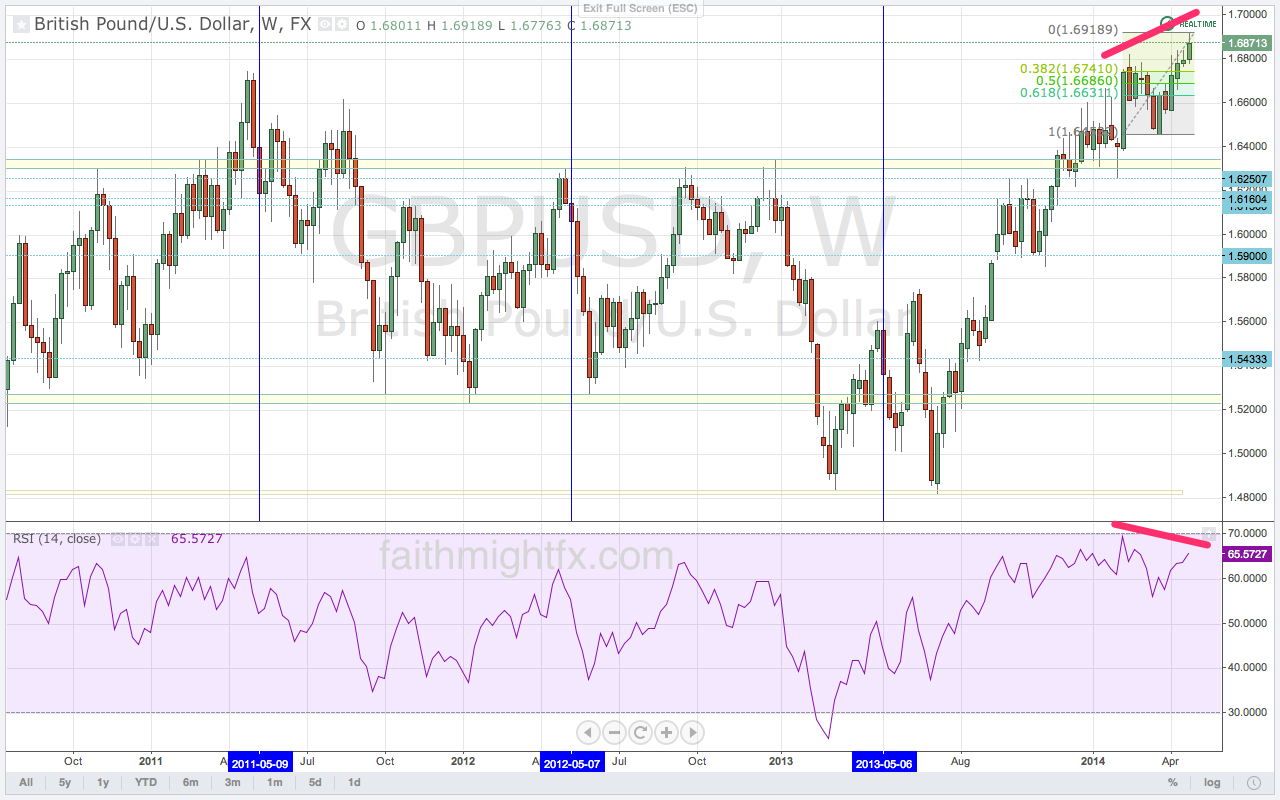

$GBPUSD has staged such an impressive rally in the month of April. The UK fundamentals have established a trend of a solid recovery. The “misses” this week are still good numbers. GDP and the PMIs showed growth so the UK economy continues to recover. This trend has given life to sterling especially versus the USD which hasn’t managed to strengthen on the taper. I don’t know if taper is tightening but I believe it is only a matter of time before we see 1.70 in $GBPUSD. However, there are 2 things that may put that target on hold: May seasonality and a still diverging RSI. Forget May flowers. It’s all about dumping May pounds.

The RSI on cable has been diverging for weeks now. As price manages to extend the rally to new highs, there just hasn’t been much in the way of strength. With so many bulls in the market perhaps cable is running out of buyers.

The timing of a correction couldn’t be sweeter. The market has a tendency to sell cable in May. The old trading adage, “Sell in May and go away”, couldn’t be more applicable here. I talk about it every year. So to be different this year, I give you a linkfest of this May seasonality trend in $GBPUSD. More traders are talking about it this year.

- May seasonality here on the blog (FaithMightFX)

- End of month thoughts: Im impressed! (Piptrain)

- ForexLive seasonal trades for May! (Forex Live)

Leave a Reply