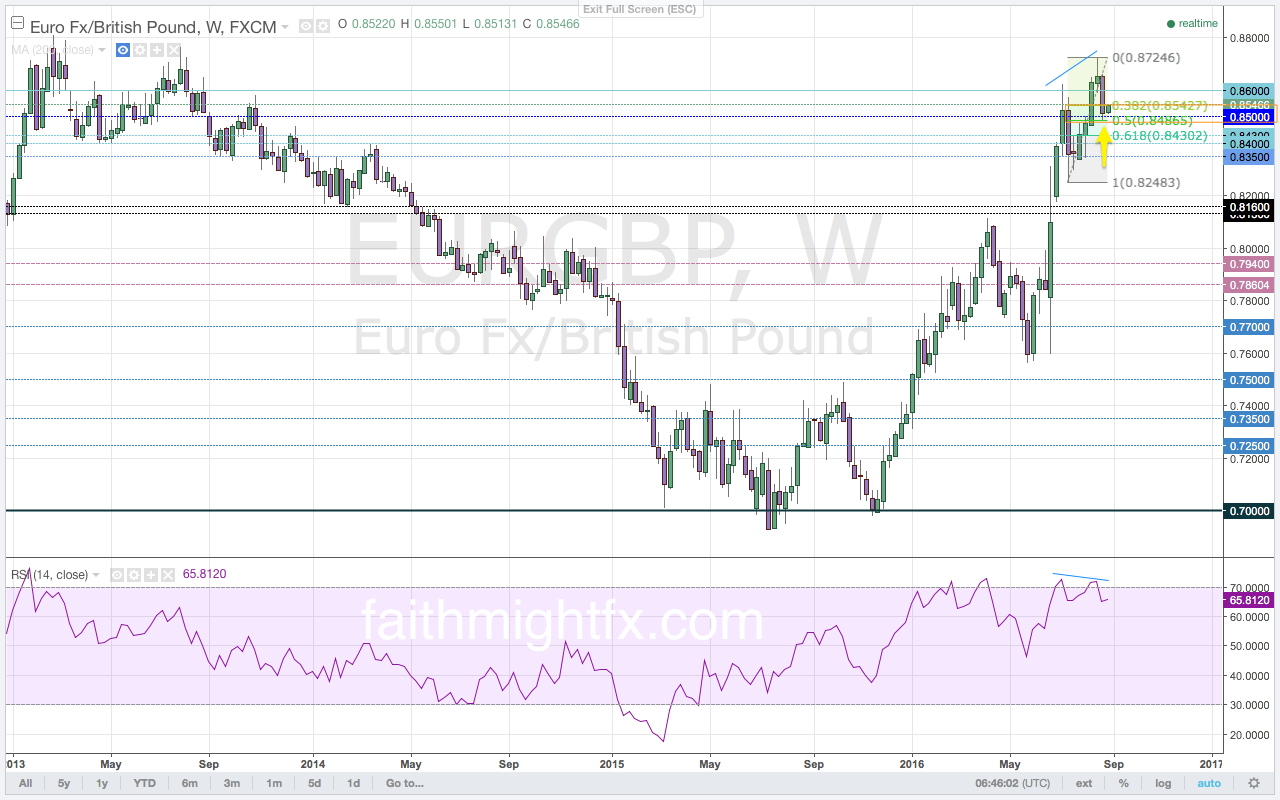

Despite breaking to new highs now at 0.8724, momentum is still unable to match the new highs in price with new highs on the RSI. The $EURGBP moved lower off the highs last week but found support at the 50% Fibonacci level at 0.8486. With price moving lower off the new highs, the $EURGBP is biased to move lower as the new trading week gets underway. Despite the close above the key 0.8500-psychological level, the $EURGBP remains biased to the downside to start the new trading week. If the $EURGBP is unable to move above the 0.8600-resistance level, then it can be expected to move to new lows. A Friday close below the 0.8500-support level may invalidate the current bullish bias in the short-term and supports a deeper correction of the summer rally.

The European Central Bank (ECB) Governor Mario Draghi has made it clear that the path for future monetary policy action is further easing and accommodation. This dovish bias includes cutting interest rates again, as soon as September. However, contrary to these euro fundamentals, markets continue to buy euro. It is likely that September will be no different. In fact, the euro may accelerate its rally higher if the ECB fails to deliver this highly anticipated move to further accommodate monetary policy. The economic calendar is very busy out of the Eurozone this week. A slew of PMI data from the core European economies are due for release this week. The event risk of the week for the euro is the release of the German jobs data. As the strongest economy in the Eurozone, a weak jobs report may accelerate $EURGBP weakness.

OUTLOOK FOR THE WEEK: After breaking back below the channel last week, the $EURGBP has been unable to move higher. The trendline of the channel has acted as resistance capping the rally out of the Fibonacci buy zone on the weekly chart. Sellers step in on rallies back to the trendline… [subscribe]