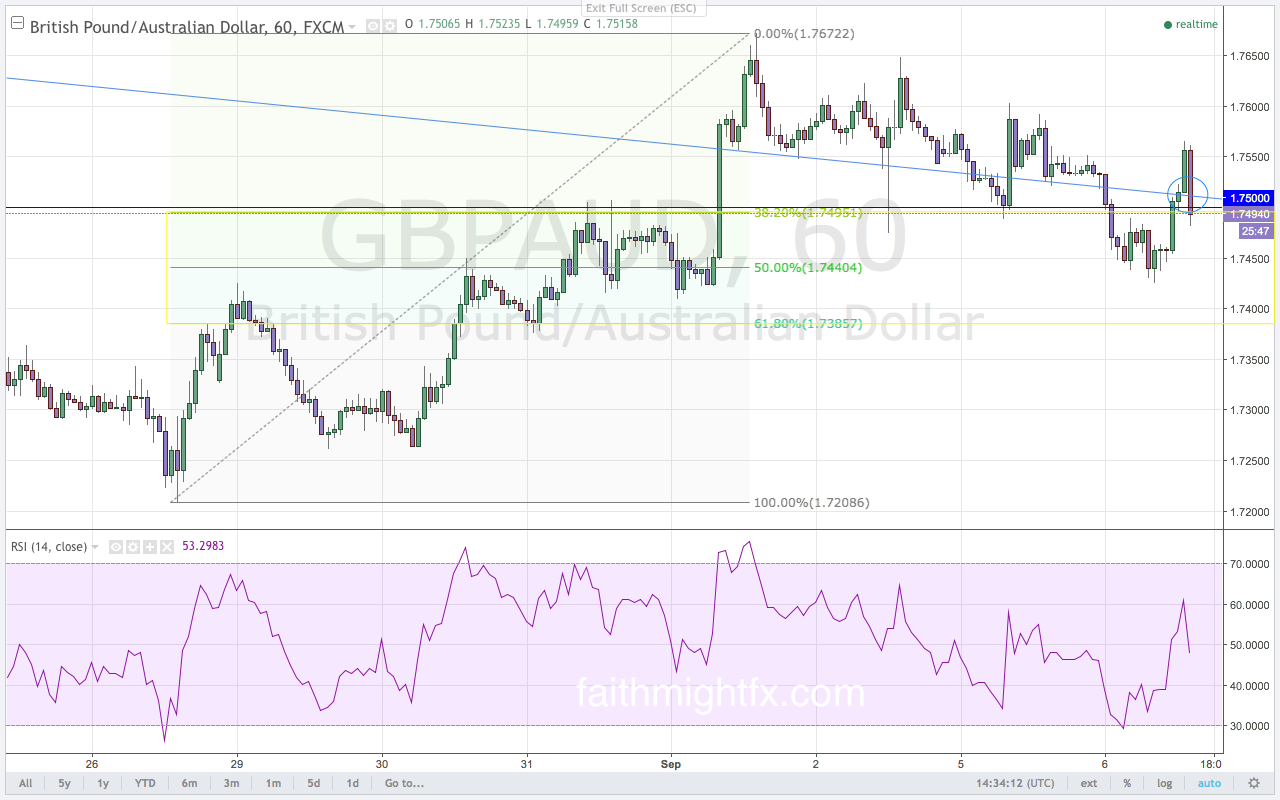

The Australian dollar continues to rip higher with little regard for the Reserve Bank of Australia dovish sentiment. Though the RBA has cut interest rates and will likely cut again in 2017, the market is not blind to the fact that the Australian economy continues to remain robust. The RBA is bullish on the economy too. Australia survived the crash in commodity prices. Now that they are recovering, the GBP/AUD remains biased lower for a continuation of the large Fibonacci move (see Quid Report, Volume 58). The inability of the GBP/AUD to close above the 1.7500-level also signaled bearish price action. While the GBP/AUD now has the room to move lower on a continuation of the bear trend, the bullish divergence remains on the weekly chart. The bullish divergence signaled the rally higher back above the 1.7000-level. The rally this week saw the $GBPAUD move back to the top of the channel.

The event risk of the week for the Australian dollar was the RBA interest rate announcement. The RBA did not move on interest rates this week after surprisingly cutting interest rates in August. The $GBPAUD moved slightly higher on Australian dollar weakness after the announcement with no new highs printed. If the lower highs lead to a break of the 61.8% Fibonacci level on the 1-hour chart, this break lower signals a reversal back to the long-term lows at 1.6720. The interim target for sellers, however, is the lows at 1.7208. Only a move back above the trendline invalidate the current bearish bias.