A fellow trader asked:

what do u mean by style long term short term swing trade scalping ? 🙂

For me, trading style ultimately refers to preferred timeframes. Swing traders look at bigger timeframes, typically no less than a 4hour timeframe. A day trader will look at minute timeframes, typically no more than 60 minutes. Of course, the details vary from trader to trader.

A swing trader is comfortable holding a trade overnight and doesn’t want or need to be active in the markets every single day. A swing trader is looking to capture much larger profits on a given position. A day trader couldn’t conceive that. A scalper is very satisfied with smaller profit targets and only wants to be in a position for a few minutes/hours.

Position sizing becomes interesting when you start to look at the 2 distinct styles. Swing traders will typically scale into (and out of) a position to take advantage of the best price the market is giving. Because we are in a position for several days, swing traders take advantage of a market action that provides multiple optimal price points. Scalpers tend to trade their entire position size because they expect to exit the position relatively quickly. So in order to get their desired reward, they are willing to put on their entire position. It seems risky to a swing trader but holding a position for several days seems very risky to a day trader. It’s all about style.

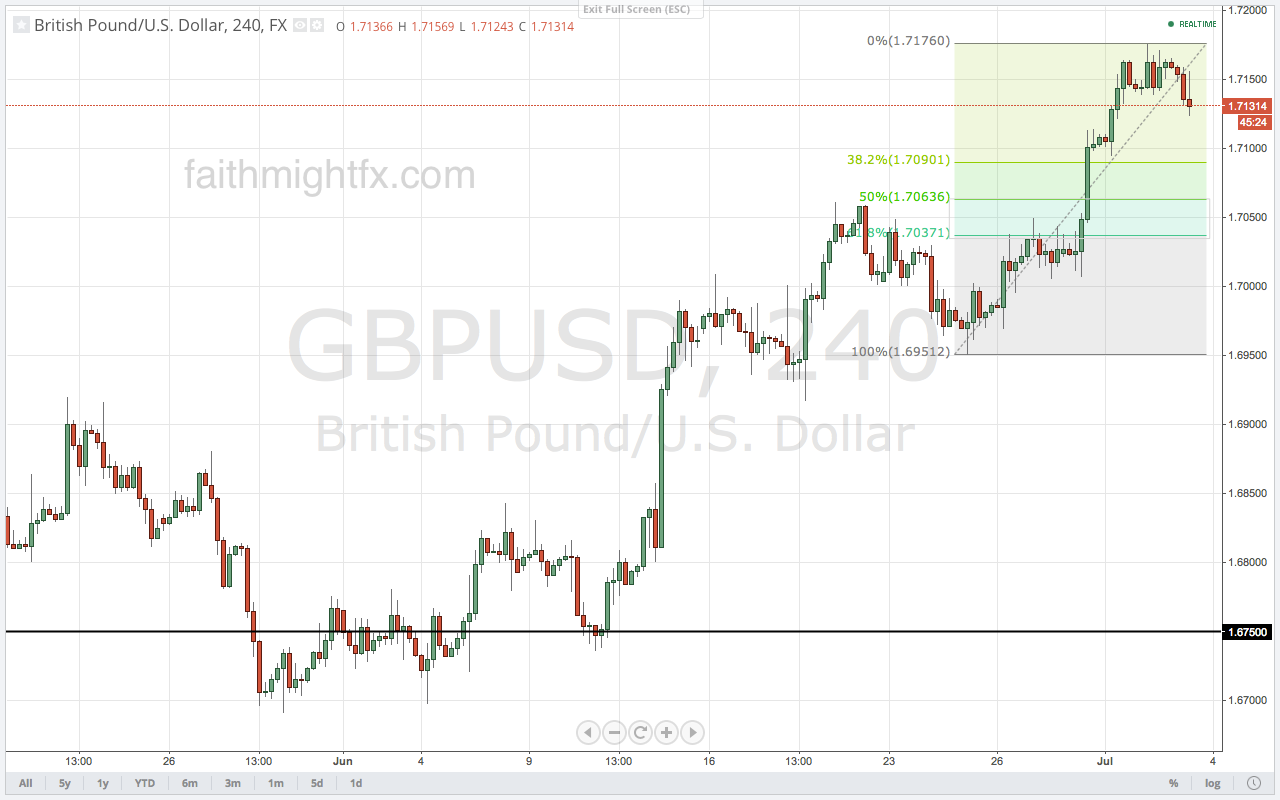

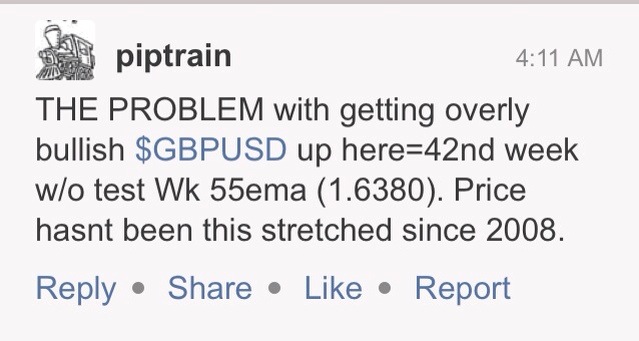

A scalper and swing trader could employ the same trading strategy (Fibs, pivots, support & resistance) but their styles will have very different outcomes. Figure out and trade your style. Most traders pick one. Some traders can trade both ways. Know what works for your personality and lifestyle. Then the hard part: trade thyself.