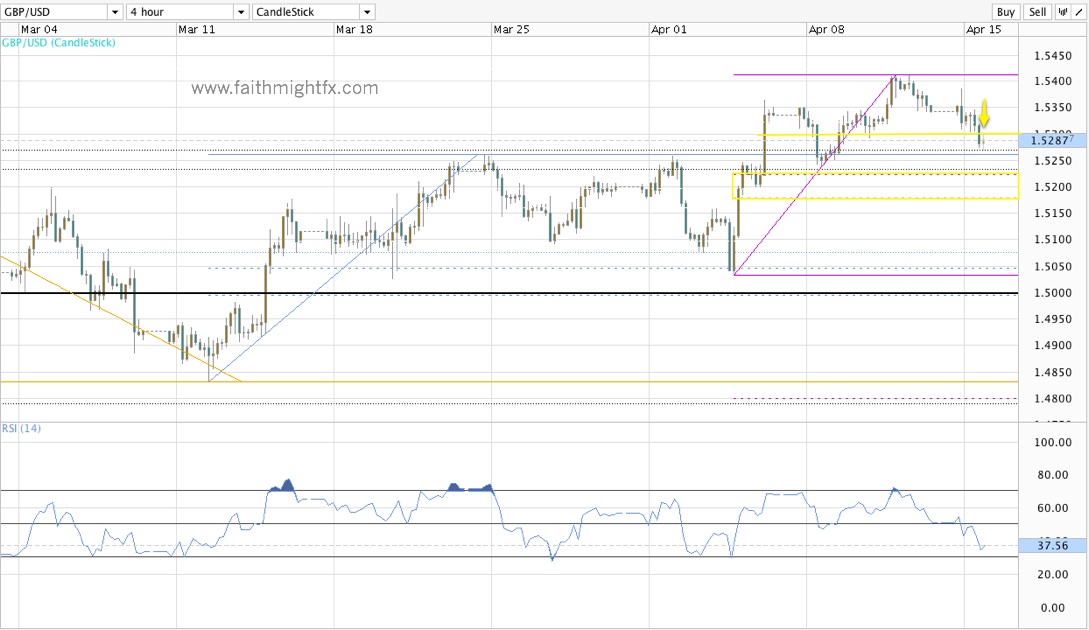

It’s the last week of the month. I’ve been playing this seasonality trend in cable since April. Admittedly, May has been a much better month for me. But, alas, the edge is almost over. $GBPUSD has put in a bottom at the end of May for the past 3 years. Why should this May be any different?

If cable does put in a bottom, it begins that process this week. 1.5000 is a great level to do it at. A failure to break below the 1.4830 lows after a perfect hold of the big 50% Fibonacci level at 1.5606 will be technical reason enough for many traders to get bullish $GBPUSD ahead of Carney’s inauguration.

Topping is a process.

— Christian Gagnon (@InEgo_) May 28, 2013

Today’s price action is huge. UK CBI retail sales released today was soft. It was a HUGE miss in the largest sector of the UK economy and GBP rallies. That is red flag for sellers; a signal not to be taken lightly. Price may take another stab at 1.50. The market may even break below it. But a strong GBP on bad news (and a weak USD on no news) is not lost on me today. I’m not looking to sell on this rally as I was weeks earlier. Watch how price behaves at lows. Bottoming is a process too. Will $GBPUSD bottom again this May?

Mentioned above:

- Seasonality in GBP/USD (FMFX)

- Sterling Digest: April tops, May bottoms (FMFX)

- Sterling Digest: April rallies bring May selloffs (FMFX)