Goldman Sachs’s share price reached an all-time high at $418.27 on the 12th of August, that’s about two weeks ago. This could have happened as a result of $GS’s deal with Fiserv. Towards the last week in July 2021, Goldman Sachs boosted the transaction banking business with the Fiserv tie-up. This innovation has attracted more than 250 clients, which was over $35billion in deposits and trillions of dollars in the system since June. The all-time high of $GS in June was at $392.71.

Just recently, Goldman Sachs demands proof of vaccine status for US office entry. This may not go well with some clients as there are many controversies around the administered vaccine. The return-to-work policy is accompanied by mandatory once-a-week testing for employees and enforced mask-wearing in shared office spaces to contain the rapid spread of the Delta variant in the US.

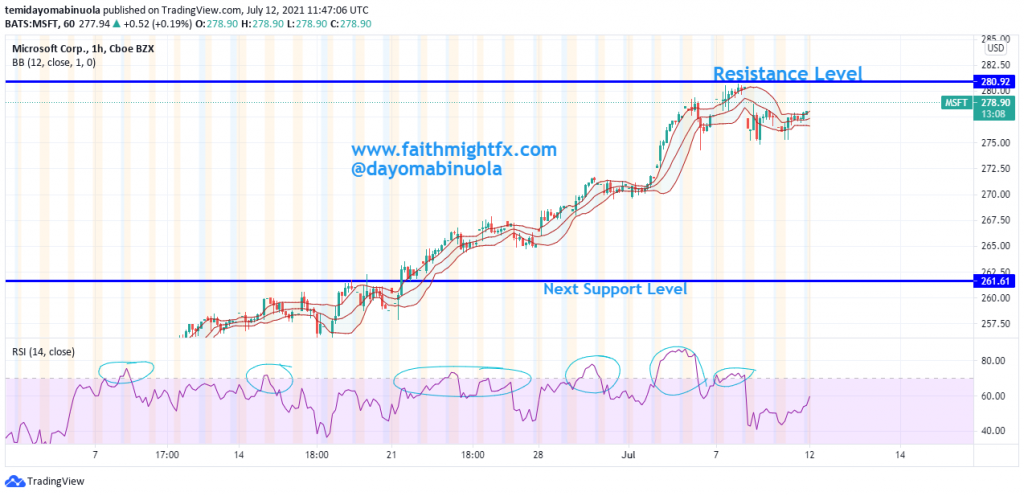

In August, $GS had the most recent all-time high at $418.27, after which the price began to fall, there was a retracement that brought the price to $416.69 just yesterday. Indications are showing of a possible reversal, which might be due to the new work policy in $GS, for the mandatory vaccine for both staff and visitors. A drop in price might occur, which might bring the price to $361.95. This might be unfavorable for $GS investors. The new work policy might not stand as there are rising cases of vaccinated persons contracting covid again. RSI has shown since May the price being overbought at three different instances.