You cant make someone change from being either a lefty in denial or a miserable pessimist (ukipers) that dont want a recovery. I for one will enjoy the upturn and reap the benefits with my company as I can already see. Must go work to do

The above quote is a comment on an article in the Telegraph yesterday that the UK economy is recovering at the fastest rate in the world. During the summer, the UK economy showed some great numbers from all sides of its economy. Construction and manufacturing were buzzing, consumers were spending and house prices were rising. From June through August, services PMI numbers surprised to the upside. Even construction and manufacturing had some very robust months which becoming a great sign of recovery as these sectors in particular suffered tremendously during the Great Recession.

[table id=2 /]

While this week’s PMI numbers may have missed expectations, these are some strong PMI numbers. All numbers are nicely above 50 indicating a very robust recovery in the UK. In fact, the September numbers were revised upward since 1st reported a month ago. It looks as though the fundamentals have come to reflect what price action has been telling us for the past few months.

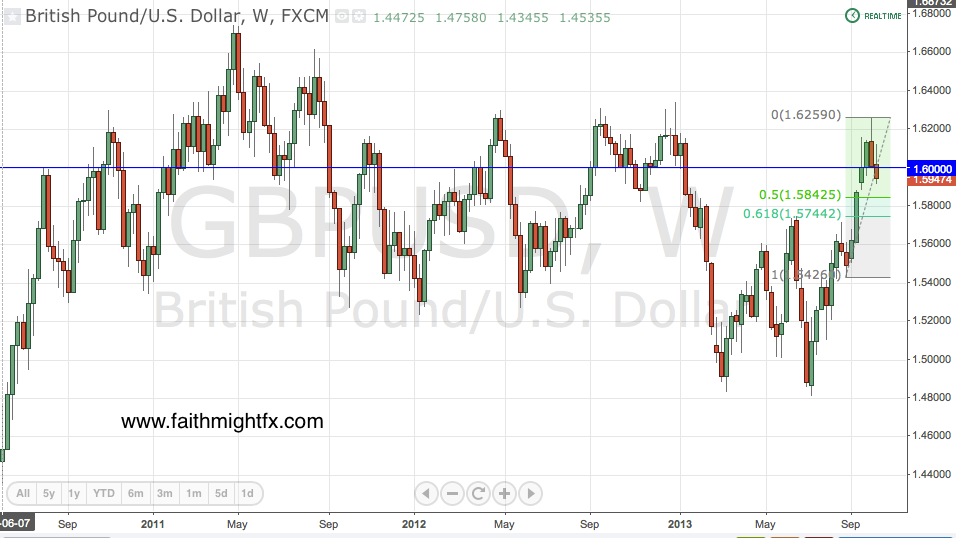

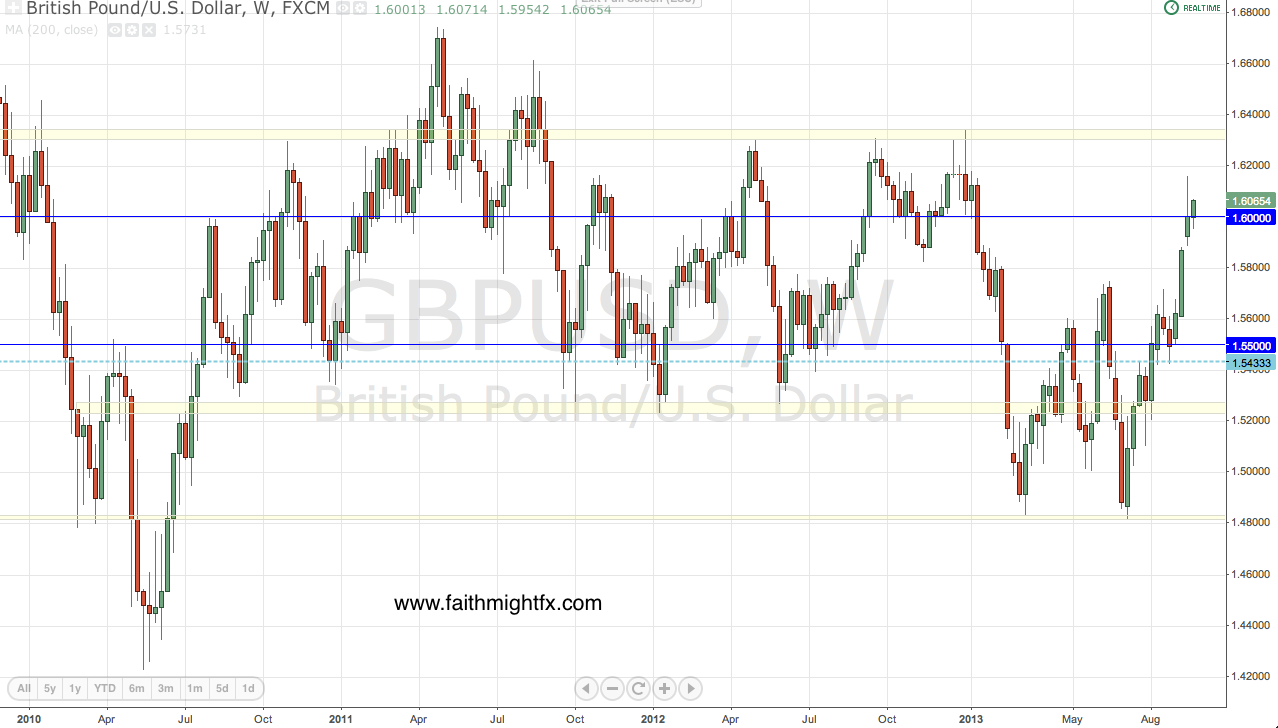

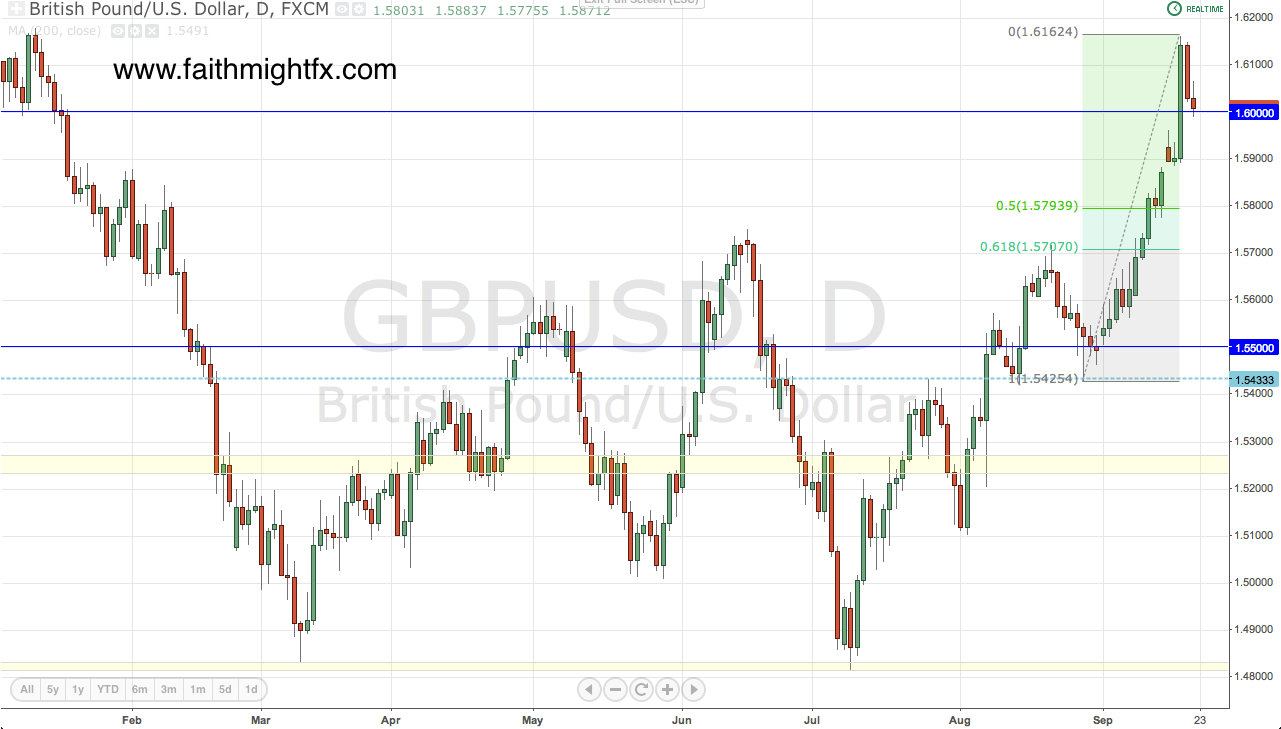

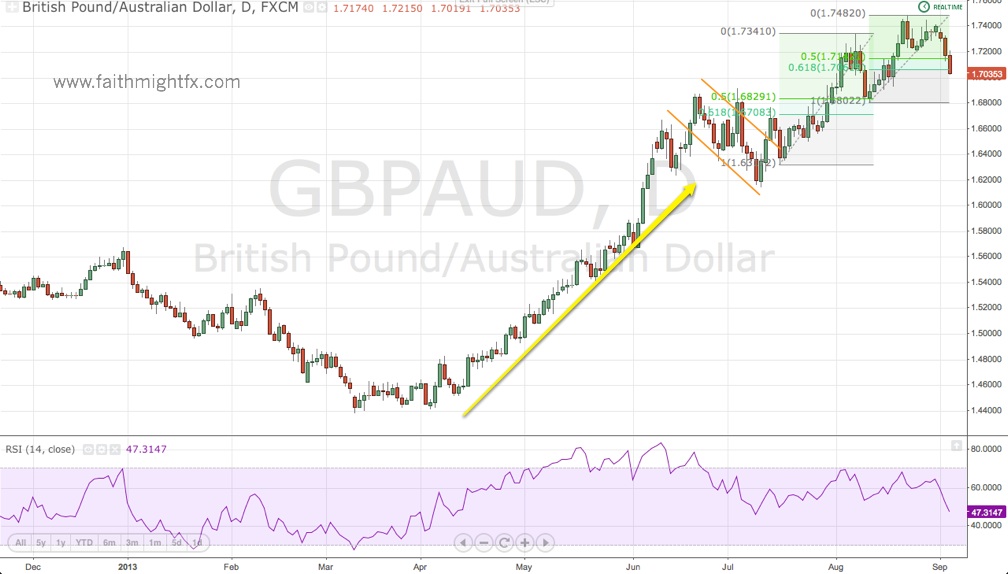

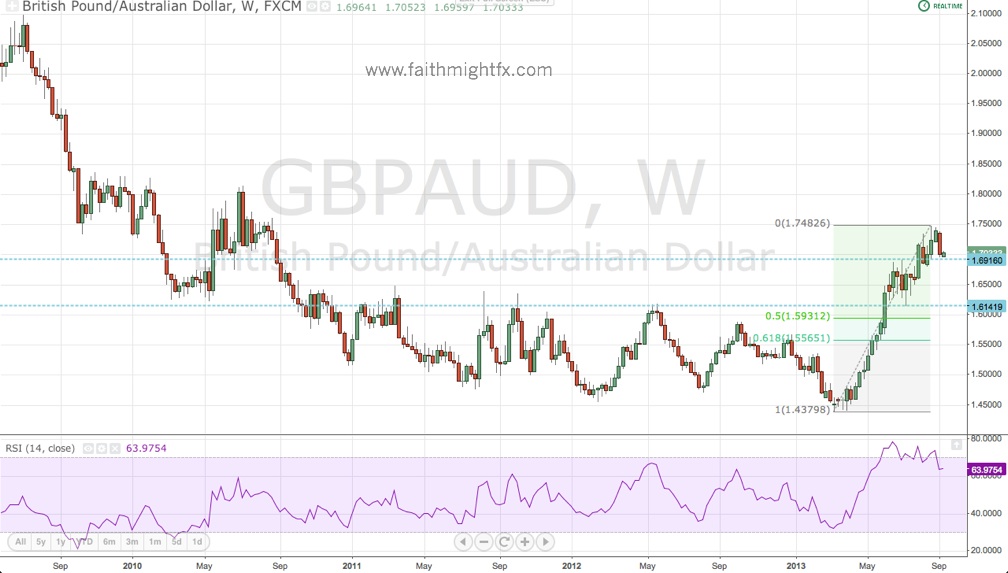

So why the selloff this week? $EURGBP has rallied close to 150 pips off the lows. $GBPUSD and $GBPAUD have both tumbled handsomely from their highs. It looks like a classic case of buy the rumor, sell the fact. The market is forward thinking and now that fundamentals support price action, bulls are taking profits.

Sterling is still very much bullish even at current levels in $GBPAUD, $GBPUSD and $EURGBP. However, these corrections have broken key support/resistance levels opening the door for a deeper correction into next week to match these tremendous GBP rallies.

Mentioned above:

UK economy growing at fastest rate in the developed world (Telegraph)

Global PMI Data (Avondale Asset Management)

Read also:

GBP/USD In Yet Another Correction (FMFX)

Australian Dollar Puts In a Bottom (FMFX)

Reality Bites (FMFX)

Respect the Zone (FMFX)