NVIDIA is an American multinational technology company based in California, USA. The company designs graphics processing units. It was founded on the 5th of April, 1993 by Jensen Huang, Curtis Priem, Chris Malachowsky. As of 2022, NVIDIA made a yearly revenue of $26.91 billion. As of that same year, NVIDIA had a staff strength of 22,473.

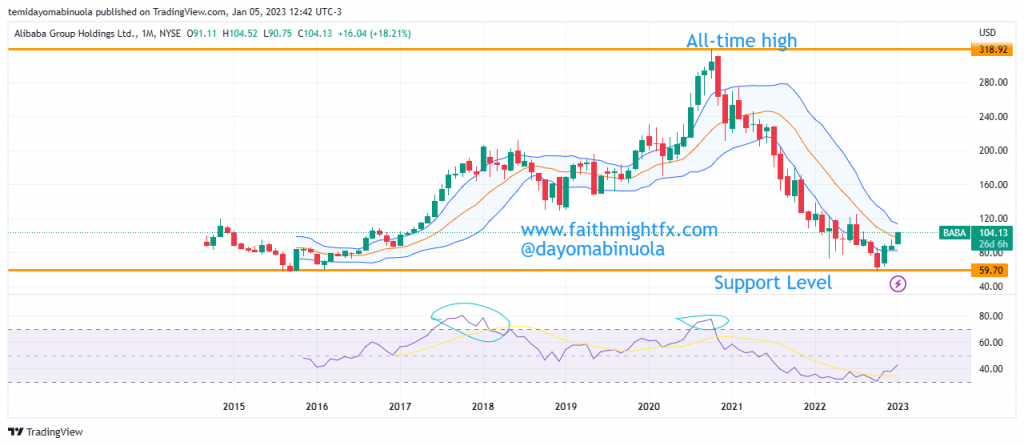

The lowest value of NVIDIA since August 2020 stands at 108.70, which also stands as the support level of 2022. The year 2022 was not a good year for NVIDIA investors as price opened at $298.12 and closed at $146.03 – a 39% loss. There seems to be relief as price began to rally after a bounce from support in the last quarter of 2022. 2023 opened at $147 and price has rallied to $191.93, a 30.5% increase in about a month. The last time price of $NVDA was at $191.93 was in August 2022, which was the previous resistance level.

We might be seeing the price of $NVDA reaching $200 per share in the coming weeks.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here