Nvidia Corporation is an American Multinational technology company founded in April 5, 1993. Nvidia Corporation is one of the largest developers of graphics processors and chipsets for personal computers and game consoles. Nvidia has a market cap of $1.118 Trillion as of October 2023. As of this year, Nvidia had a workforce strength of 26,196 and has made a revenue of $26.97 billion.

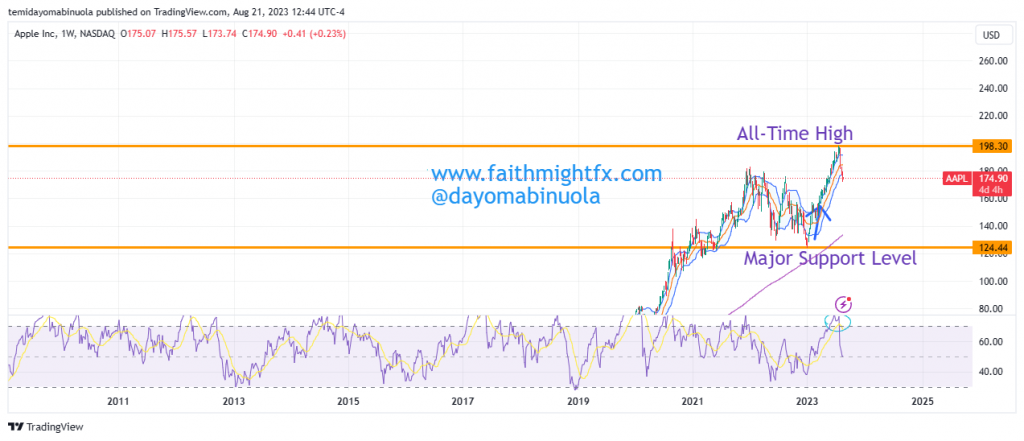

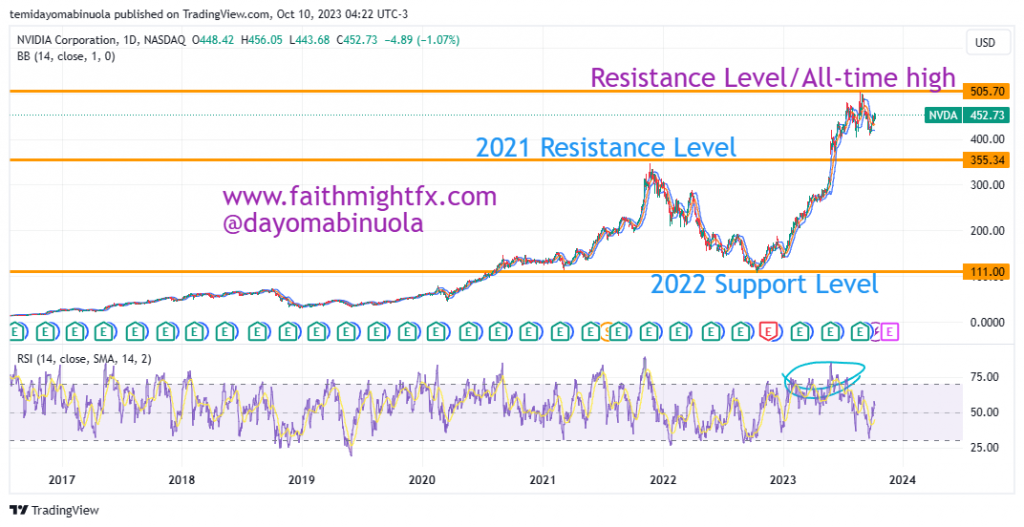

Unlike many other stocks, Nvidia investors enjoyed a smooth ride during the 2020 lockdown. Prior to 2020, the support level of Nvidia was at $28 per share in December 2018. The bulls picked up momentum and a rally began that would last between December 2018 and November 2021 when price peaked at $347.

A major fall in the price of Nvidia occurred after price hit $347. The reversal in price made price reach $103.61 in October 2022. That is to say, for the most part of 2022, the bears were in charge of the Nvidia stock. There was a bounce in November 2022. This bounce began from the 2022 low at $103.61 and continuously rallied until price broke the $347 high. An all-time high has been reached at $500 and this happened in August 2023. Recently, price corrected and fell to $410 in September as RSI has been overbought multiple times since January. In the coming weeks, we might see price rally back to $490.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.