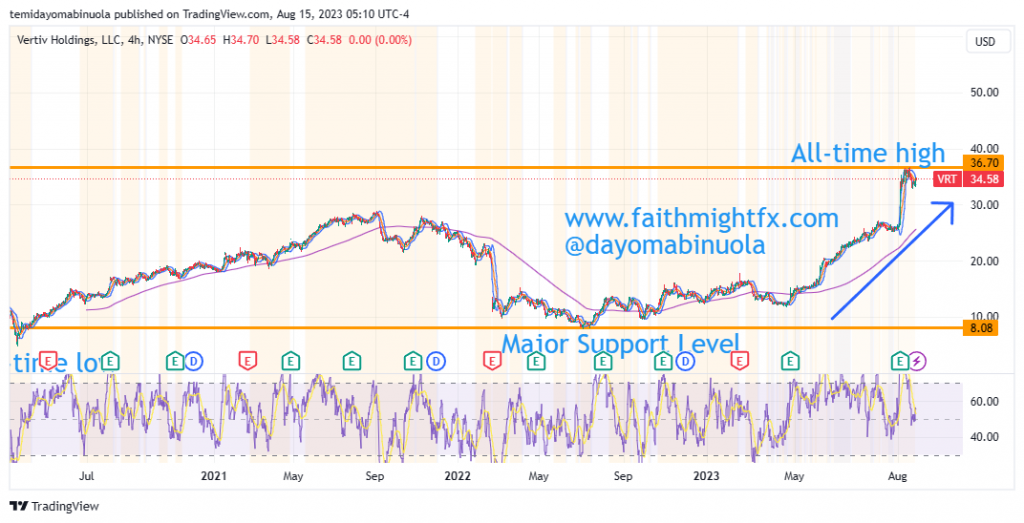

Vertiv is an American provider of equipment and services for data centers. Vertiv Holdings was formerly known as Emerson Network Power in 2016. As of now, Vertiv has a total staff strength of 27,000 globally. Vertiv Holdings had its IPO in July 2018 at $9.68. It is listed on NYSE as $VRT. On the monthly chart since its IPO, price ranged until December 2019 when a new high was reached at $12.43. Just like most stocks, $VRT dipped during the lockdown to an all-time low of $4.76.

As price bounced from the all-time low, a major rally occurred, which took price to $28.88 in September 2021. Despite the price fall of Vertiv in 2022, the company had a revenue of $5.6 billion. The value of Vertiv Holdings dropped as a result of material and freight inflation. It was $40 million worse than expected, and “foreign exchange, divestitures, and other” was $45 million worse than expected in 2022.

Since the beginning of this year, Vertiv Holdings has brought relief to investors as price rallied to break the previous high at $28.88. On the 2nd of August 2023, price of $VRT jumped to $33.01 from $26.51, which was the close of the previous day. The gap-up is yet to be corrected as price is currently consolidating despite general market trends in the last one month being bearish.

The all-time high stands at $36.73. This was reached on August 4, 2023. We foresee a breakout to the upside in the coming weeks leading to a new high which will replace the current all-time high.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.