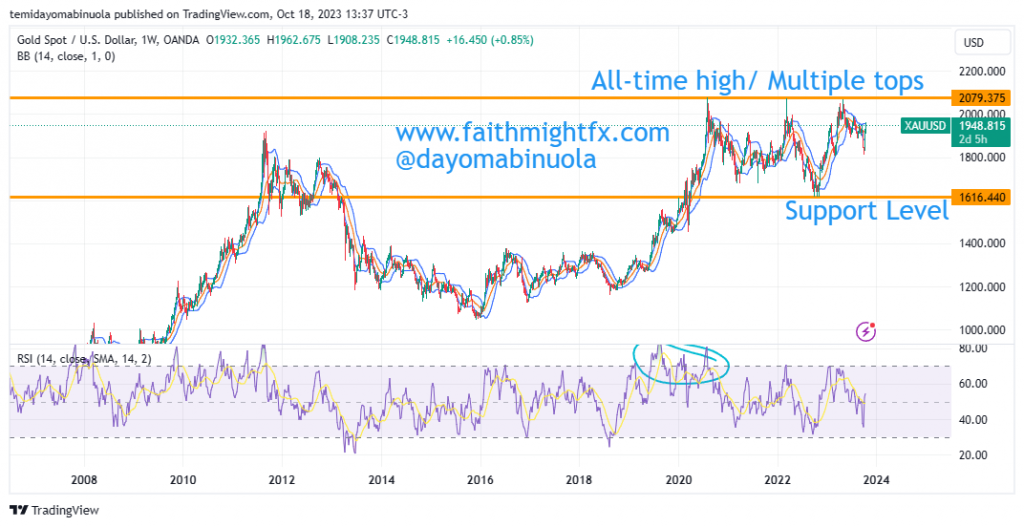

In October 2022, the price of gold fell to $1617 per ounce, after price had reached $2071 in March 2022. This price dip is one of the worst falls Gold has had since its been traded. A major support level was formed at $1617. There was consolidation for about 8 weeks before a bounce in the price of $XAUUSD started in November 2022. The bounce made the price of gold reach a previous resistance level of $2071 in May 2023. At different times in the past, in August 2020, March 2022 and May 2023, the price of Gold has maintained this resistance level at $2071.

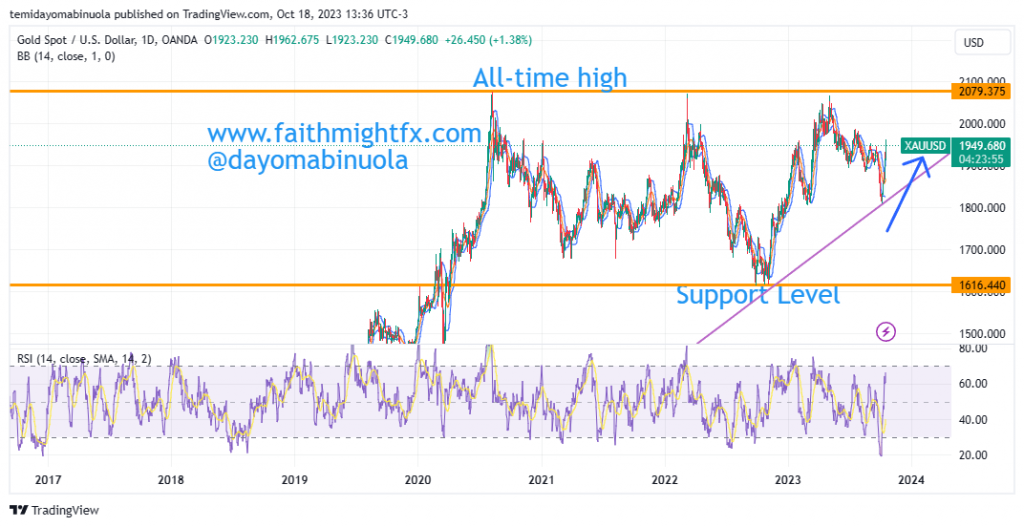

In the past three years, the price of Gold has been moving between $1617 and $2071. From the recent top in May 2023, price fell to a support level of $1810 in October 2023. The current price of Gold is at $1948. We might be seeing price rally to $1990 in the coming weeks, The RSI on the daily chart has shown that the price is oversold.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get commodities in your portfolio? Schedule a meeting with us here.