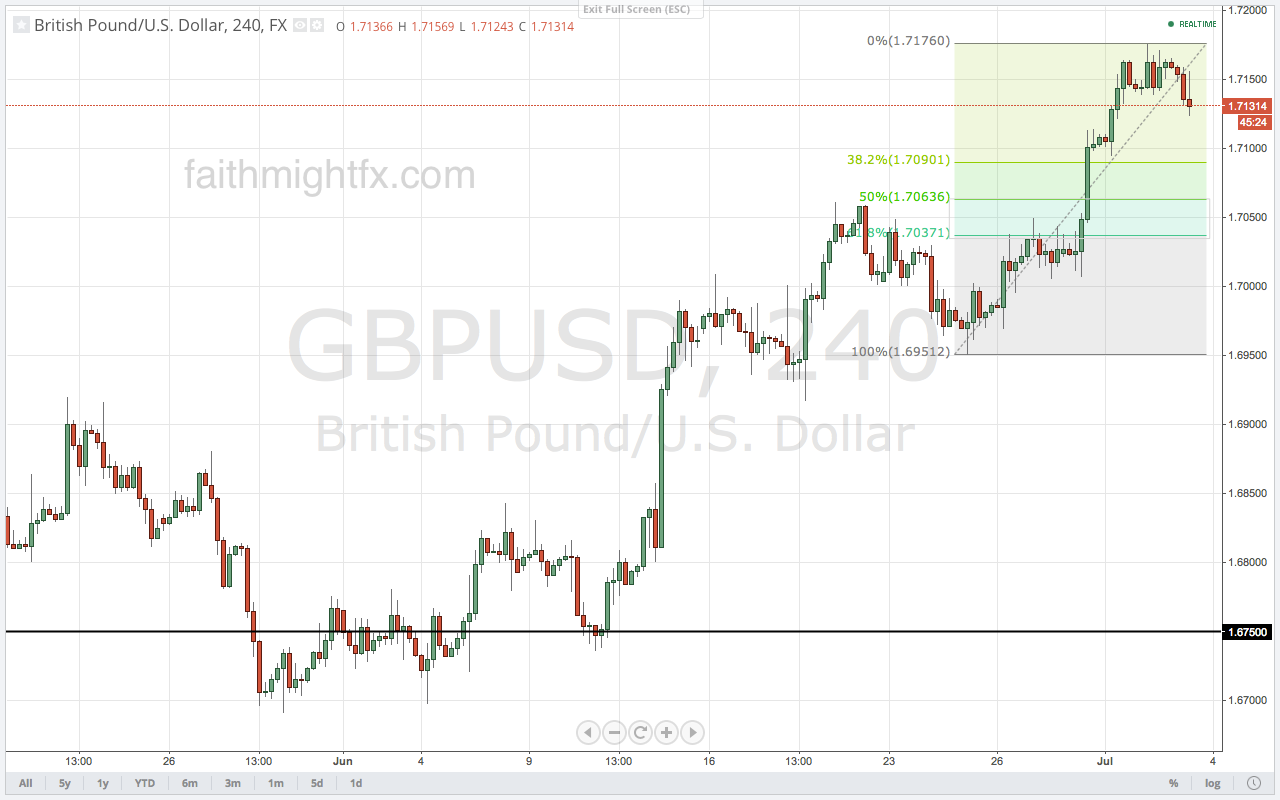

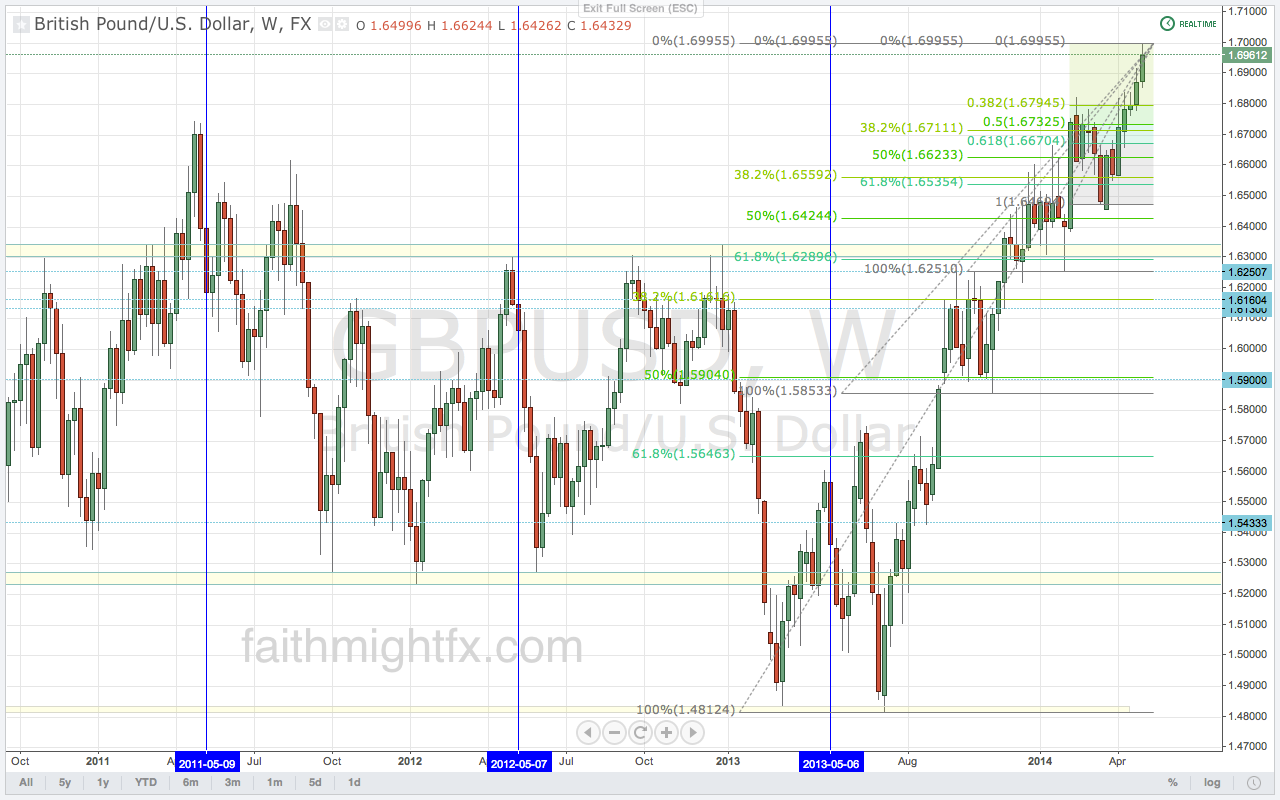

It’s nice when a trading session goes according to plan. Retracement levels were tested yesterday as sterling consolidates recent gains ahead of Thursday’s Bank of England announcement. We started the week with these charts. We staked out our levels. But it is not enough to make a plan. You have to have some conviction to put your orders on too. It doesn’t pay, if you don’t play. Position-sizing is a very underappreciated skill. It takes more discipline than you would imagine to establish a position in the market with the correct size. Too big a position and the risk may take you out before you can earn the reward. Too small a position and the reward just isn’t as satisfying for your account balance. I find that by scaling into a position, you can spread the market risk across multiple, smaller trades maximizing the best price the market is giving. Once we determine our position, the hardest part of executing any plan is the action of inaction – we wait.

We didn’t have to wait long. Thanks in part to lower-than-expected manufacturing and industrial production releases, GBP fell across the board yesterday. Days like yesterday, you don’t have to do anything. Just watch price. In fact, if you are planning each trade and trading each plan, you should experience more days where you are simply watching price move at the market’s will. When it’s too tempting to watch price action, leave the screens or risk trading carelessly.

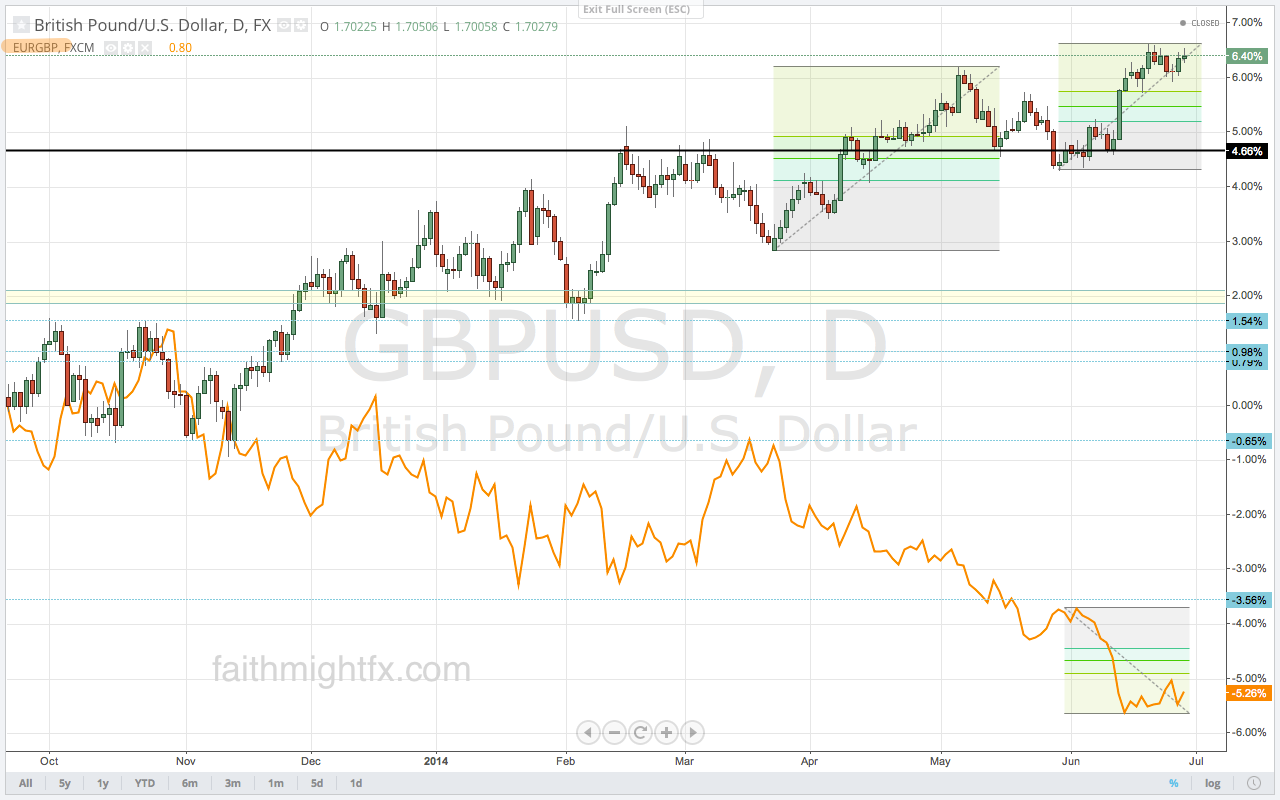

After yesterday, we are headed into FOMC with all the charts still in play. $GBPNZD breached its Fibonacci levels so only support at 1.9350 matters to the downside on more consolidation. All other charts ($GBPUSD, $EURGBP, $GBPJPY) stand. Markets will be light and choppy waiting for the 2pm EST release time. Be aware that some market participants will take advantage of lighter flows and size up their positions. When central banks come to the stage, it is the larger timeframes that really keep you focused on true supply and demand in the market.

don’t get chopped up in low liquidity wheeling and dealing … focus on the bigger picture

— 50 Pips (@50Pips) July 9, 2014

Game on. Trade what you see.

Read also:

- More Dips, Same Trend (FMFX)

- Healthy Dips Make for Healthy Trends (FMFX)