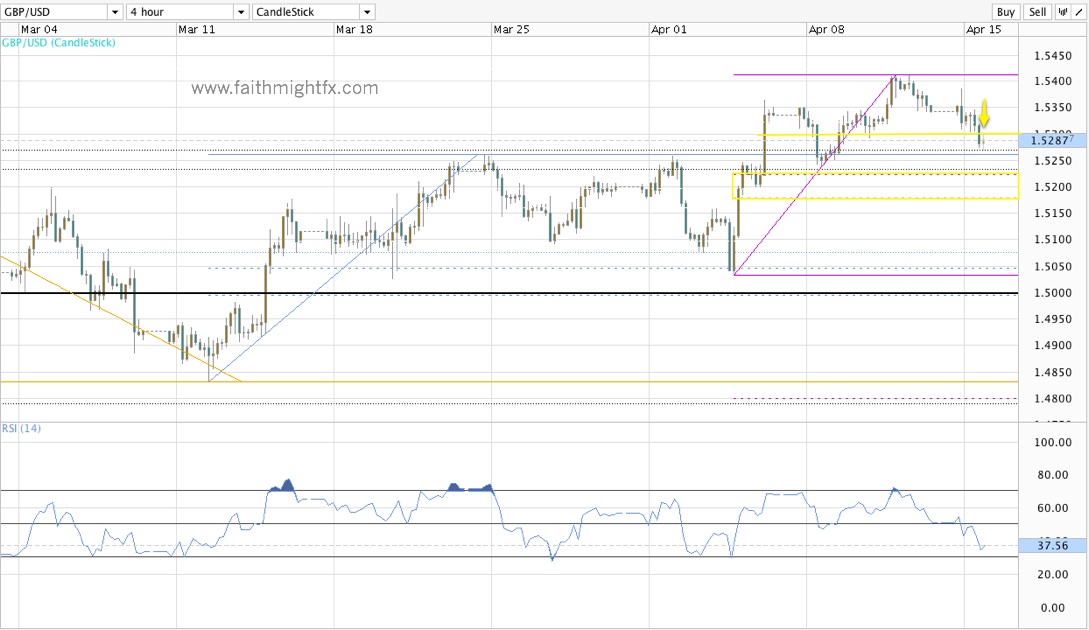

Today is the last day of the month and sterling has enjoyed April. $GPBPUSD closed last week at 2-month highs with a rally that finally took it above 1.55 to 1.5546. $GBPAUD rallied to new highs above the 1.50 major psychological level not visited since Feburary. $GBPCAD moved to spike highs at 1.5823. Needless to say, its been a breakout month. Despite the bullish price action, sterling is still very much correcting on long-term timeframes. All the aforementioned pairs are at or around the 50% Fibonacci levels on the weekly charts. And tomorrow is May. For the last 2 years, $GBPUSD has seen a tremendous sell-off in May. Being at new highs and technical levels sets sterling up for a fall more dramatic than its rally.

- GBP recovering, CHF falling, banks rising…we connect the dots (FxBriefs)

- UK retail sales show surprise fall (The Guardian)

- GBP/USD set to extend gains..? (FxBriefs)

- Sell in May and Go Away? (All Star Charts)

- the serious change in economists’ expectations for ECB rate decision (StockTwits) [CHART]

- Fitch cuts the Old Lady to AA+ (FxBriefs)

- Equally impressive move in GBP/JPY (Forex Live)

- Forex Outlook – Action Packed Week Ahead (BK Asset Management)