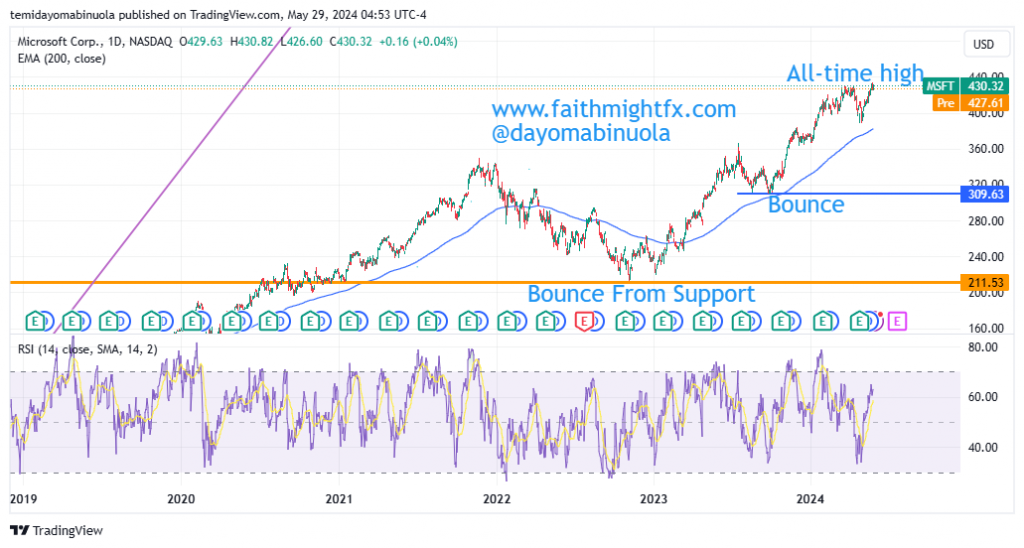

80% of the most valued companies in the world are in the United States, with Microsoft as the world’s number one valued company at $3.198 Trillion market capitalization. In the last one year, Microsoft has appreciated by 29.92%. After the March 2024 high at $430.80, price dipped to $388.17, which was the lowest price in April 2024. From the low in April, price has bounced to an all-time in May. The all-time high to $433.61 is just a little breakout from the previous high of March. The second most capitalized stock in the world is Apple at $2.913 Trillion., Microsoft remains the only company with a market capitalization of over $3 Trillion at the moment.

According to Microsoft latest financial reports the company’s current revenue (TTM) is $236.58 Billion. In 2022 the company made a revenue of $204.09 Billion, an increase over the year 2021 revenue that was $184.90 Billion. Also, according to Microsoft’s latest financial reports, the company’s current earnings (TTM) is $105.26Billion. In 2022 the company made earnings of $82.58 Billion an increase over its 2021 earnings that was $79.68 Billion.

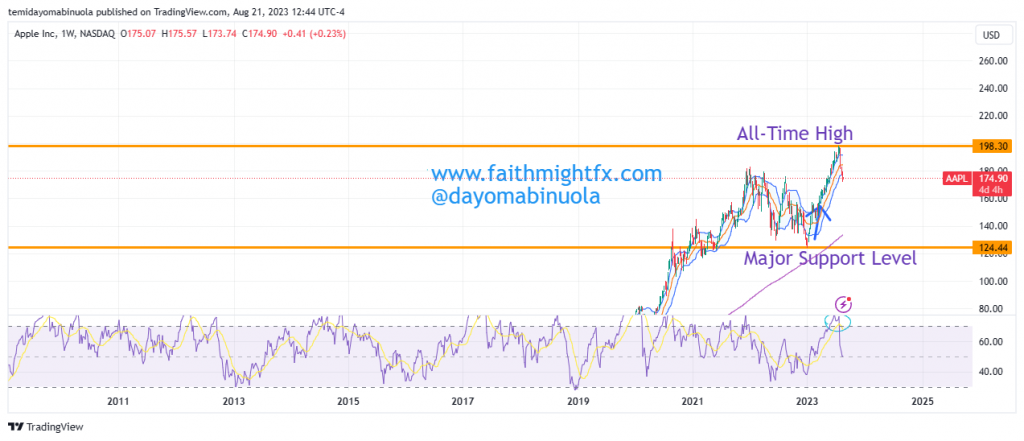

The current price of $MSFT is at $430.32. The Microsoft bulls have been in charge of the growth since the low in 2022. Despite many overbought positions on the RSI using the weekly chart, RSI has continued to reach new highs. The $MSFT will continue to see new highs in the coming weeks.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here