Microsoft reported earnings beat analyst expectations. The earnings per share came in above what analysts had forecast, rising 22.2% year over year. Revenue also surpassed analyst estimates, up 20.1% compared to the same quarter one year ago. Microsoft’s opening price at the beginning of 2022 was $335.87. The price has since fallen to $296.71, making it the worst monthly fall ever. That is an 11% decline since the beginning of the year.

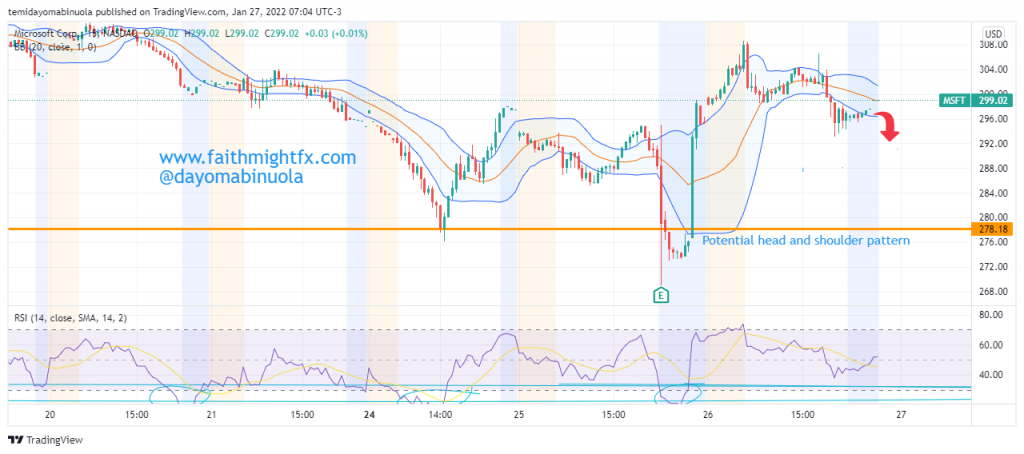

Furthermore , the company’s shares fell as much as 5% in post-market trading on Wednesday. Over the past year, Microsoft’s shares have made a return of 26.7%. The share price of $MSFT reached an all-time high at $349.69 in November 2021. Before the global market tanked a few days ago, the price had been ranging since that all-time was reached. The price of $MSFT reached $276.02 on the 24th of this month before a price correction. The last time price of Microsoft was at the $276.02 level per share was back in July.

The 15mins time frame is showing that an inverted head and should pattern is about to form, which, in the long run, leads to a massive bullish run. In the next few days, the price should fall to complete the head and shoulder. If this is completed, the price could reach $339.98. The market opened yesterday after a gap-up but closed on a bearish note. The global market has been very bad this week. The next rally might just be what investors have been waiting for since the holidays are over. The RSI daily chart already shows that the price has been oversold. This could be the indication the bulls are expecting.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here.