In Q1 2025, Tesla experienced a significant 13% year-over-year decline in vehicle deliveries across major markets. Notably, sales in China dropped by 49%, and in Germany, they fell by 76%, even as the electric vehicle (EV) markets in these regions continued to expand.

The EV market is growing crowded, with major automakers and startups ramping up production. Chinese brands like BYD and NIO are gaining ground, especially in Asia, pressuring Tesla’s pricing and market share while raising concerns over shrinking margins.

Chinese automaker BYD outperformed Tesla in key metrics, surpassing it in vehicle sales and net income. BYD recorded a net income of $1.26 billion, compared to Tesla’s $934 million. With advancements in battery technology and competitive pricing, BYD has significantly reduced Tesla’s market share, especially in Asia.

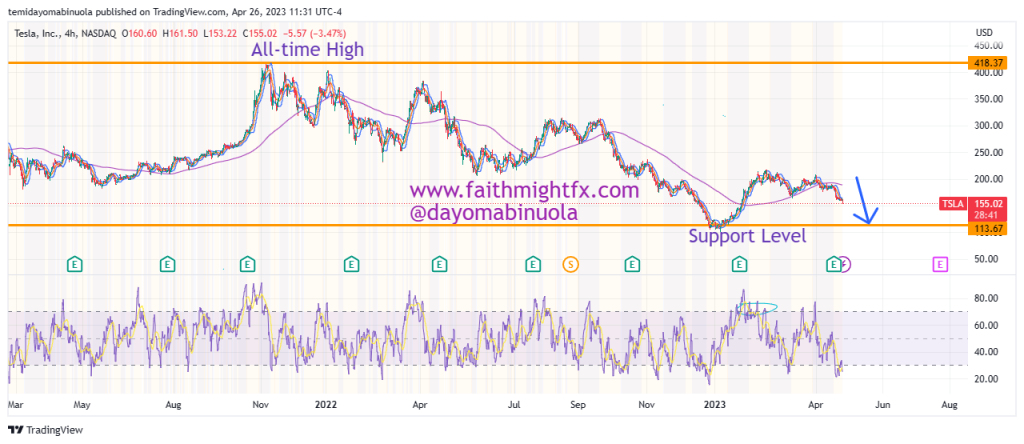

Tesla’s stock has declined by approximately 30% from its all-time high of $488.54 on December 18, 2024,

Though in May 2025, Tesla has been bullish with the price currently at $334.07 as of the time of publishing this article. RSI on the daily chart shows price has been overbought in December 2024 and also oversold in March 2025. TSLA has experienced a notable rebound in recent weeks, rising over 18% in May and approximately 40% since its first-quarter earnings report in April. As of May 14, 2025, the stock closed at $347.68, marking a 4.1% increase for the day. Price could fall to $212 in the coming weeks, as price has shown its been overbought multiple times on the 4hr-chart.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stock in your portfolio? Schedule a meeting with us here