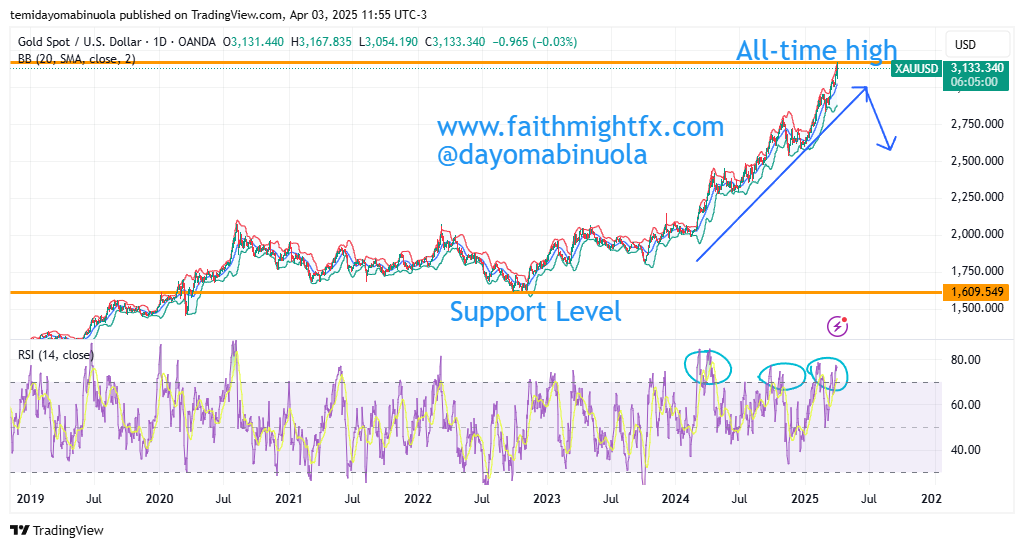

In early April 2025, gold prices reached an all-time high, surpassing $3,177 per ounce, marking an increase of over 18% since the beginning of the year. This surge is attributed to heightened investor demand for safe-haven assets amid economic uncertainties, including newly announced tariffs by the U.S. administration.

Central banks have significantly increased their gold reserves, purchasing over 1,000 metric tons annually since 2022, doubling the average of the previous decade? This trend is driven by efforts to diversify reserves away from the U.S. dollar due to geopolitical tensions and economic policies? Fears of stagflation, spurred by recent U.S. policies such as tariffs and spending cuts, have led investors to seek assets like gold?

The announcement of new tariffs by President Trump led to declines in global financial markets, with investors turning to gold, which surged to a record high of $3,170 per ounce.

Financial institutions have adjusted their gold price forecasts upward. ?Goldman Sachs forecasts an 8% rise, reaching $3,100 per ounce by the end of 2025? Morgan Stanley suggests prices could reach $3,400 per ounce within the year.

The current price of Gold is at $3,121. We might see the price of gold rally towards the high again at $3,170. While the stock market has been bad lately, gold is seen as a safe haven and this might push price to a new high in 2025.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get commodities in your portfolio? Schedule a meeting with us here

Leave a Reply