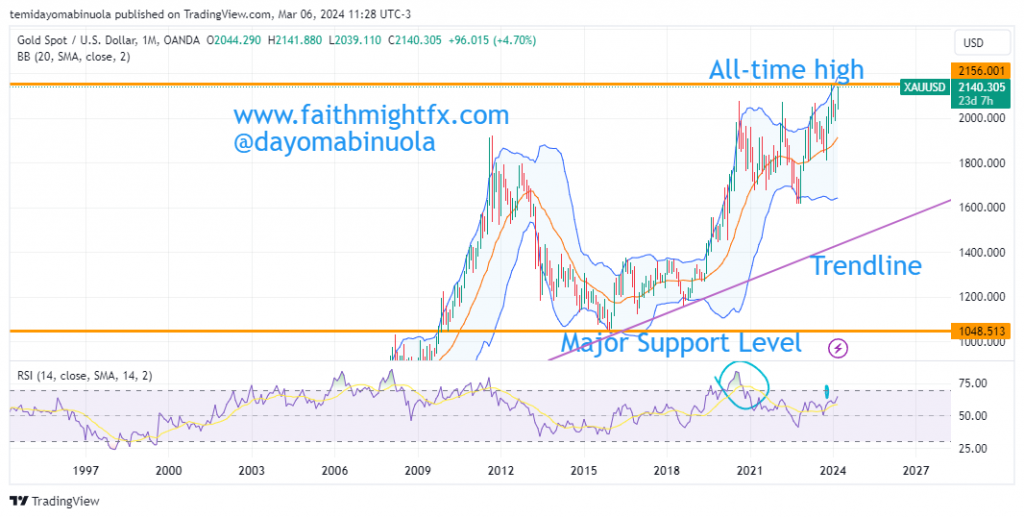

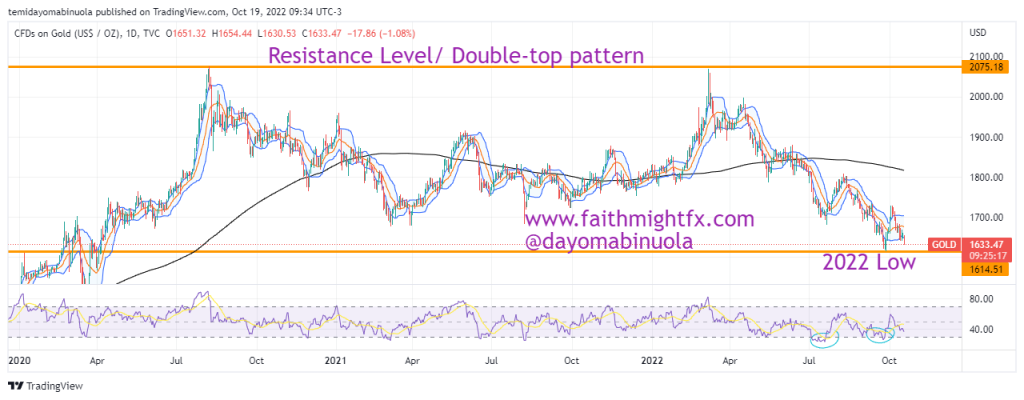

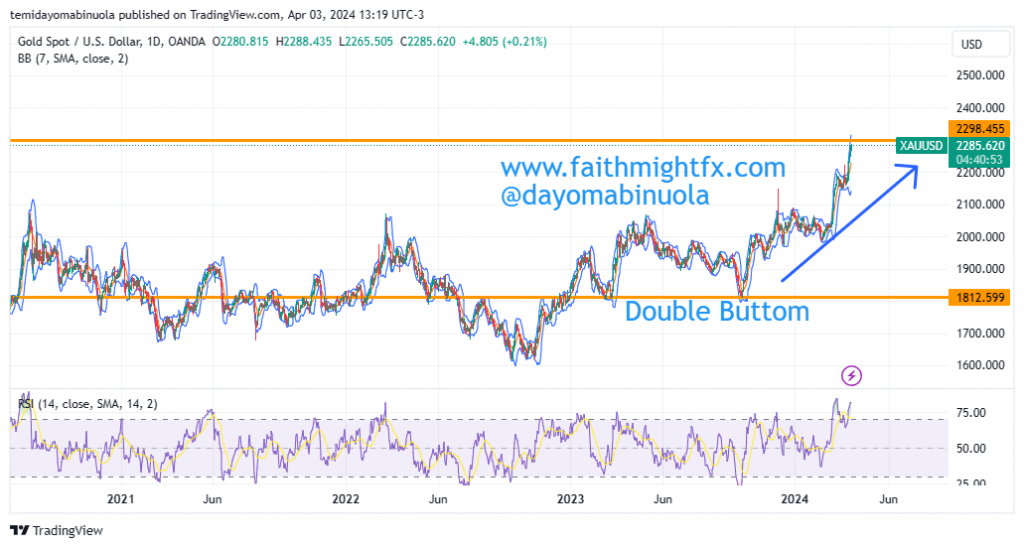

The year 2024 has been favourable for gold investors as the bulls have been able to push price high beyond the previous high of $2135. In December, the price of Gold made it to a high of $2194. After this high in December, Gold’s price retraced since the high of $2194 was reached.

On the daily chart, the price of gold has been overbought but the bulls have momentum for a continued bullish run. Despite the monthly chart shows that price has been overbought since August 2020, price of XAUUSD continues to rally. The current price of $XAUUSD is at $2284 as the bulls might push price beyond the all-time high of $2287, which will make price hit $2300 psychological level.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get commodities in your portfolio? Schedule a meeting with us here