I love Facebook. I connect with my tribe there every day and it is fabulous. But I am completely over $FB, for a few reasons:

- People are leaving Facebook. While people are always leaving Facebook for one reason or another, the exodus never eclipsed the number of new people and businesses that signed up every day. Last quarter, Facebook reported a decline in users for the first time ever. And they warned that they expect that decline to continue. With 2 billion users on Facebook and a population of 7 billion on the Earth, how many more users can it really get at this point?

- History has shown that election season tends to be very lucrative for Facebook. But thanks to Cambridge Analytica, don’t be surprised if they see an actual decrease in revenue during this election cycle. If the market is surprised, it won’t be in a good way.

- I’ve been side eying $FB stock since the Cambridge Analytica fiasco anyway. But $FB hit $200 twice after that. So when the stock started to dip again, I knew there was real weakness. But thinking of all the mutual funds and hedge funds that hold this stock, I thought it would get back to $200 as they buy more shares on this dip too. With stock markets moving higher and higher all year despite trump and tariffs, I didn’t foresee rising interest rates to be the eventual catalyst for a decline in equity markets. I’m paying more attention to that as rates will go higher.

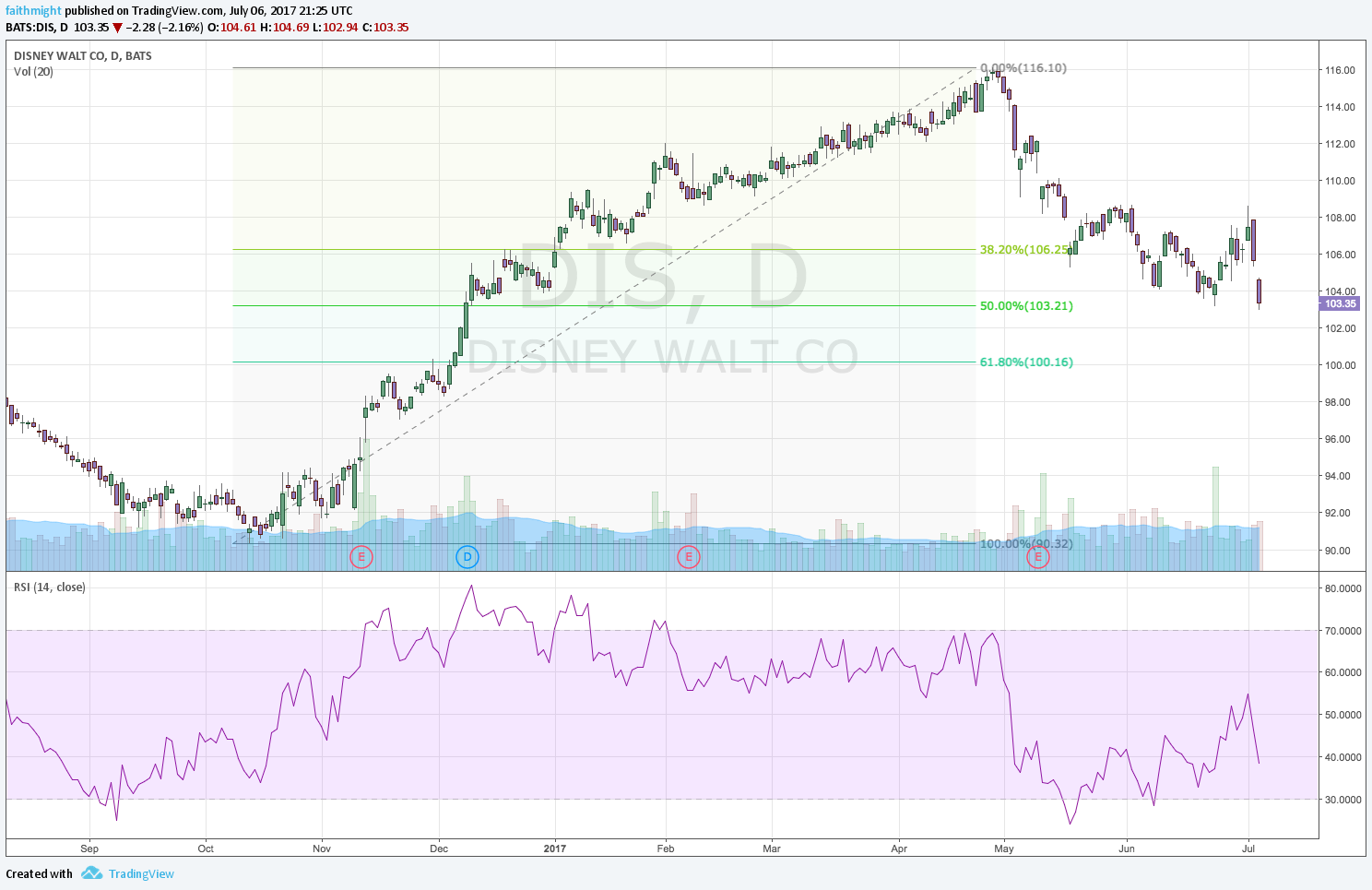

Read our work on $FB this year. We have been skeptical all year and current price action continues to confirm our sentiment. Before the earnings report was released yesterday, $FB made new lows for the year at $139.03. While this may be new lows, it is also a 38.2% Fibonacci retracement so the post-earnings bounce is a move we were watching for. The question is now the follow through higher, which is expected on a Fibonacci move. However, the aforementioned reasons could see a failed high before we see a new high.

There are ebbs and flows to every market. Trade what you see. Or learn with me. And invest with a pro. [sponsored]

Sources: What’s behind Wednesday’s market selloff?

(NPR)