? I was back on the TD Ameritrade Network with the Futures with Ben Lichtenstein Show bright and early this morning ?? talking Bank of Canada, Brexit and the U.S. dollar. Ben always asks the tough questions providing a great interview of insights for viewers.

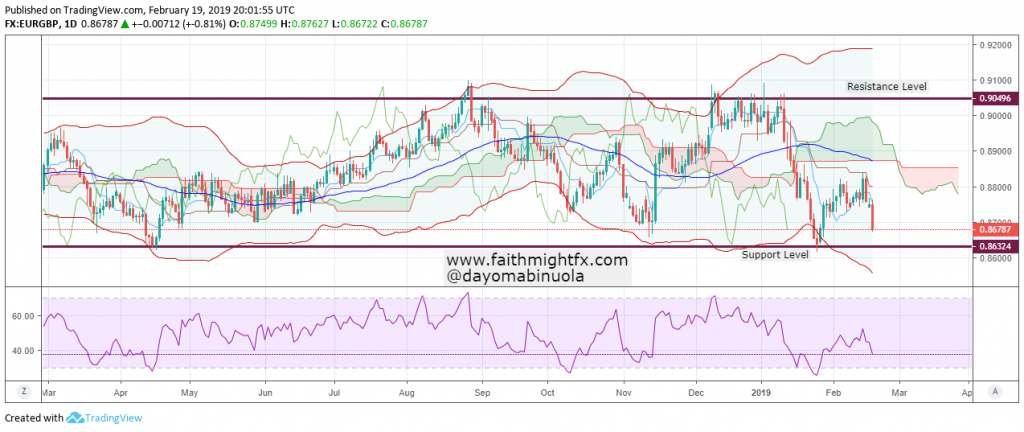

It looks like the Bank of Canada did, indeed, back down off their hawkish rhetoric as the Canadian dollar is weaker after the monetary policy announcment. The U.S. dollar is starting to react a bit to that poor U.S. trades number but the market will likely keep a muted reaction as it waits for the spotlight event of the week, the U.S. jobs number. Don’t forget about the Canadian jobs report released at the same time. Another weak economic report just may send the Canadian dollar over the cliff for good.

Watch my full segment below: