The top 9 moments of 2018 in FM Capital Group! We entered our 4th year of business this year, setting milestones all along the way.

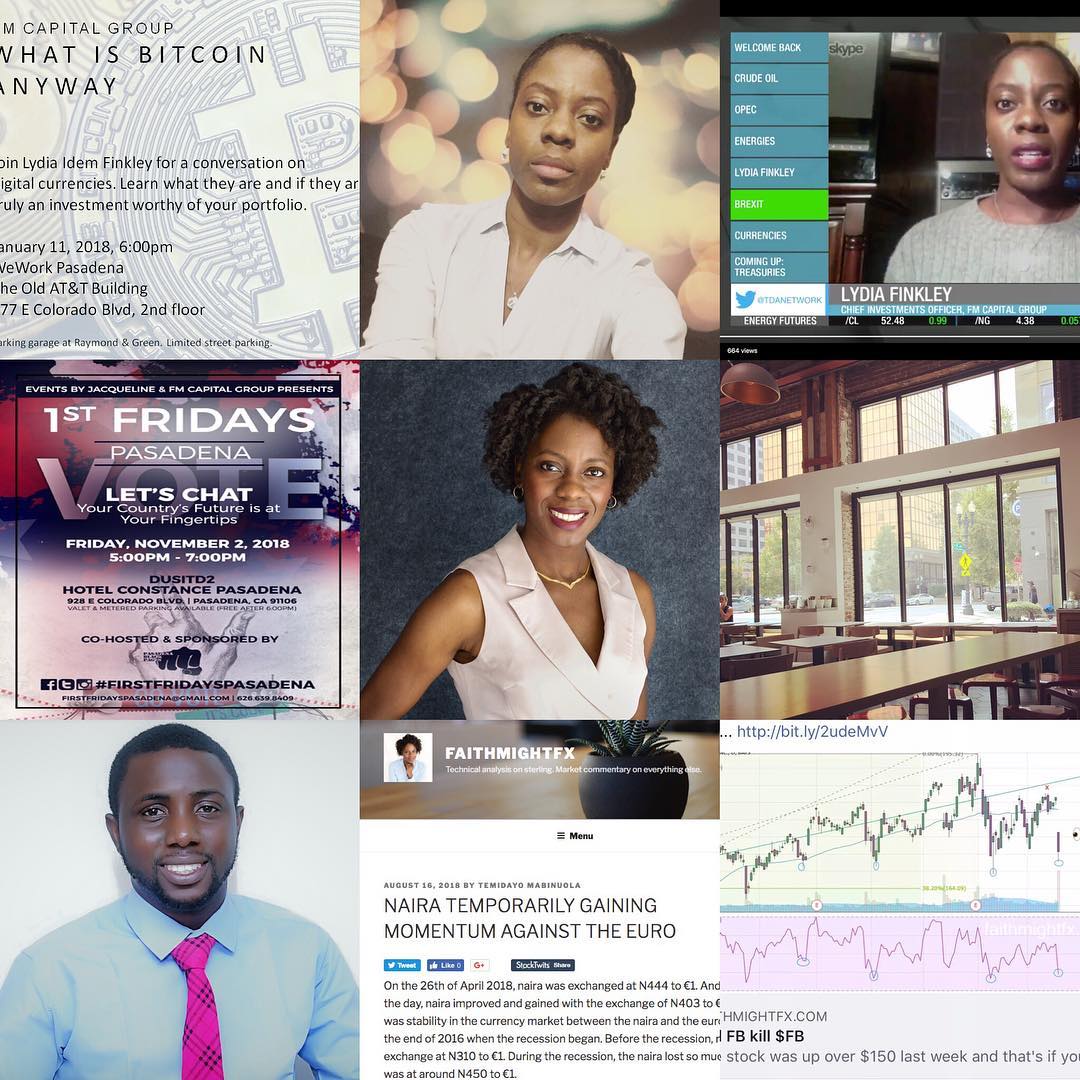

- Our first company event. It was small because I forgot to advertise it ????? lol but it was very well received.

- My first TV appearance! I was so nervous ?

- Fast forward to my last interview of the year and I did my absolute best work yet. I came a looooong way ?

- That first company event led to our infamous #1stfridayspasadena events. This last one was our largest turnout yet! ??

- New profile pic!! ?????

- I’m so pleased to announce that this year I sowed the seeds to raise a new venture capital fund that will make investments in Africa and Latin America. Stay tuned in 2019….

- Our first hire!

- Dayo’s first article for us and the first new author on the blog since I launched it 6 years ago.

- I have been blogging on the financial markets, and mostly the forex markets, for almost 10 years I am so pleased to announce that this body of work has culminated in a book deal! I was approached by my publisher earlier in December and I’m starting the work and journey to becoming an author. WOW! Stay tuned in 2019….

It’s been an amazing year. Cheers to 2019!?